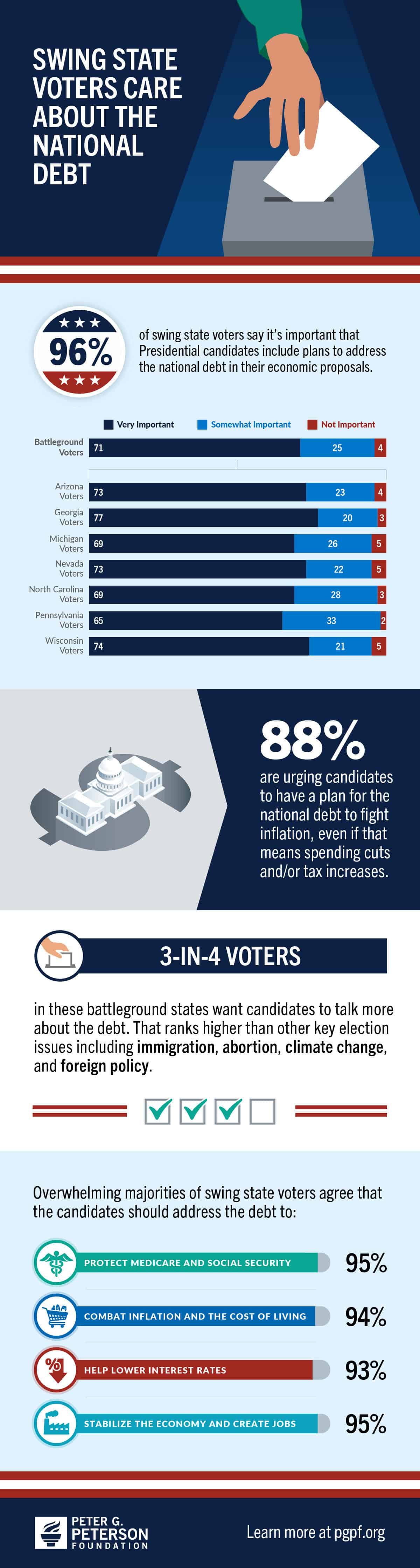

As we enter the final stretch of the 2024 election, Vice President Harris and former President Trump are tied across swing states – and new polling shows that the national debt is a critical issue for voters in these decisive states. More than 9-in-10 voters across seven key states — Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin — say it’s important for candidates to have a plan for the debt, including 95% of Harris voters, 97% of Trump voters and 95% of undecided voters.

Additionally, 3-in-4 voters in these battleground states say they want candidates to talk more about the debt and their plans to address it – outpacing the percentages of voters who say the same for other hot button election issues including immigration, abortion, climate change and foreign policy.

Thus far neither candidate has put forward a plan to address or $35 trillion national debt. A recent analysis from the Committee for a Responsible Federal Budget estimated that Harris’s campaign plan would increase the debt by $3.50 trillion through 2035, while President Trump’s plan would increase the debt by $7.50 trillion. But there’s still time for candidates to put forward plans, and there are many policy options to choose from.

Further Reading

What Types of Securities Does the Treasury Issue?

Let’s take a closer look at a few key characteristics of Treasury borrowing that can affect its budgetary cost.

Quarterly Treasury Refunding Statement: Borrowing Up Year Over Year

Key highlights from the most recent Quarterly Refunding include an increase in anticipated borrowing of $158 billion compared to the same period in the previous year.

Experts Identify Lessons from History for America Today

A distinguished group of experts to evaluate America’s current fiscal landscape with an historical perspective.