‘Student Debt Smarter’ Launched to Help Students Considering College Loans

New Student Debt Affordability Calculator Empowers Students as They Pursue College and Career Goals

NEW YORK — The nonpartisan Peter G. Peterson Foundation today launched StudentDebtSmarter.org, a free resource to empower high school students with practical information and personalized insights about their higher education choices.

The digital hub features a unique Student Debt Affordability Calculator that will help millions of people make better-informed decisions about student loans. For the first time, this simple tool will help students, families and their guidance counselors understand and evaluate the financial implications of their decisions on how to pay for college.

The tool focuses on four key data points: the college they are considering; their desired field of study; the year they plan to enroll; and where they intend to live and work after graduation. The calculator allows people to compare options and results to gain greater perspective on which colleges, majors, career paths and locations best meet their personal goals and financial circumstances, and the overall affordability of their student loans once they begin working. The tool does not require personal information and will not sell users’ data to third parties.

StudentDebtSmarter.org also includes independent, expert resources to help students navigate the complex process of applying for financial aid, scholarships, and grants, as well nonpartisan resources for understanding the overall American student debt and economic landscape, and the related policy options.

The nonprofit Peterson Foundation, which promotes fiscal responsibility to secure a stronger economic future for the next generation, has partnered in this initiative with a range of respected experts. Sheila Bair, former Chair of the Federal Deposit Insurance Corporation, former college president, and leading national voice on student debt issues and college affordability, serves as Senior Advisor to the initiative. Other collaborators include The Institute for College Access & Success; Moody’s Analytics; the Bipartisan Policy Center; American Enterprise Institute; and Center for American Progress.

“For most young people, borrowing to pay for college will be their first significant interaction with debt, and it’s a critical set of decisions that they have to live with for years,” said Michael A. Peterson, CEO of the Peterson Foundation. “However, navigating the complex student debt lending system can be confusing and frustrating, and the lack of clarity can lead to poorly informed decision-making. Student Debt Smarter is designed to demystify the process, adding transparency and easy-to-understand resources to better inform young students on these important choices.”

“No matter the outcome of the current student loan forgiveness debate, new borrowers can use this unique resource to make smart decisions for their financial futures,” Bair said. “As a former college President, I have too often seen how students lack clear, simple and transparent information to borrow wisely to pay for college. The Student Debt Smarter tool will help families access the data they need to make sustainable decisions. There are many systemic challenges in higher education that need to be addressed, including cost, access, equity and skills-based learning. Student Debt Smarter addresses one key aspect of college education by empowering individual students with better information, clarity and understanding, putting them on the best path to achieve a brighter future.”

Approximately 43 million Americans held a total of $1.6 trillion in outstanding loans at the end of 2020, with an average debt balance of $42,150. Approximately one-in-five undergraduate borrowers default on their college loans over a three-year period.

The Affordability Calculator includes information about thousands of educational institutions, individual academic programs and geographic regions revealing a wide range of options and outcomes. The tool enables each student to learn and design the financial and educational structure that works best for them.

“Whether taking on student loans makes financial sense or could result in financial disaster depends on a range of factors,” said Mark Zandi, Chief Economist at Moody’s Analytics. “Student Debt Smarter accounts for these factors, and therefore helps students determine under what circumstances student loans will work for them.”

Individuals with college degrees generally achieve higher earnings and experience lower unemployment rates, and have improved odds of moving up the economic ladder. However, students often take out loans without fully understanding the consequences, which can set a young person on financially insecure path that makes reaching their goals more difficult. Smarter decisions will help more students reap the many benefits that can come from higher education, and enhance economic opportunity for the next generation.

“Prospective college students should have access to the information they need make more informed decisions about how to finance their higher education,” said Kevin Miller, Associate Director of Higher Education at the Bipartisan Policy Center. “By fostering sustainable student loan choices, this tool will help individual young borrowers as policymakers continue to pursue broader improvements to the system itself.”

# # #

Further Reading

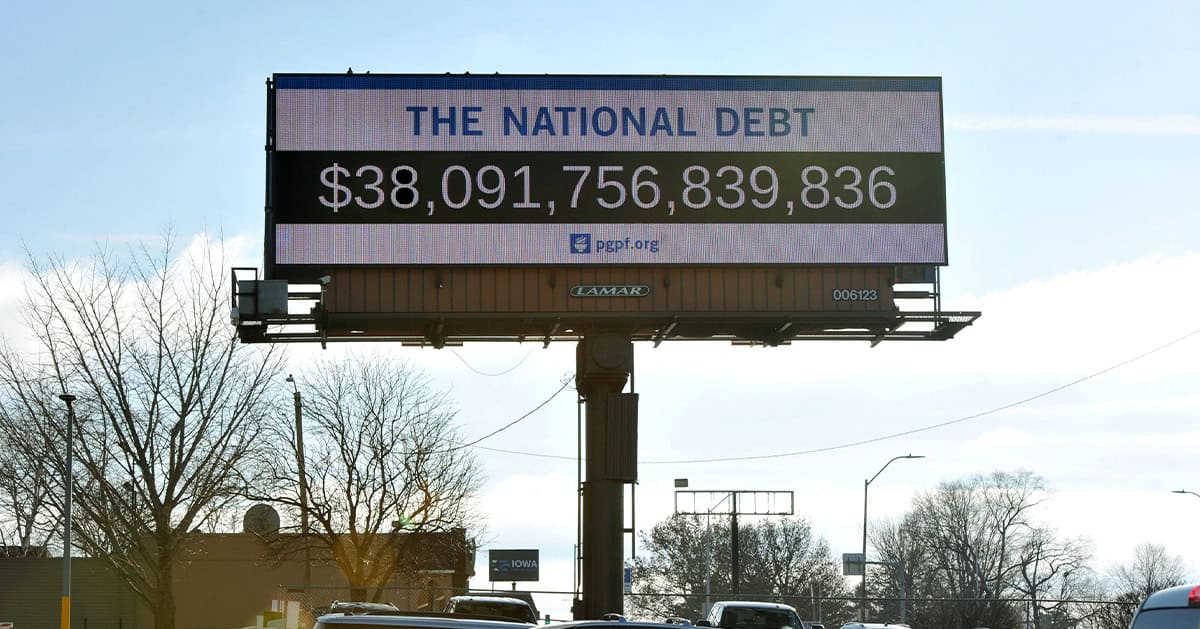

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

Lawmakers are Running Out of Time to Fix Social Security

Without reform, Social Security could be depleted as early as 2032, with automatic cuts for beneficiaries.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.