Statement on CBO’s Updated Budget and Economic Outlook

NEW YORK — Today, the Congressional Budget Office released its Update to the Budget and Economic Outlook: 2015-2025, which projects that federal debt will rise to 77 percent of GDP in 2025, a historically high level of debt that threatens economic growth over the long term.

Beyond 2025, debt will rise sharply relative to GDP, and CBO warns that “such high and rising debt would have serious negative consequences both for the economy and for the federal budget.”

Michael A. Peterson, President and CEO of the Peter G. Peterson Foundation, commented today following the release:

“In today’s report, CBO reminds us once again that federal deficits will begin rising again soon, and that our long-term fiscal challenges put our economy at risk.

“Over the next decade, the U.S. will have historically high levels of debt, which will rise even more rapidly thereafter. And with all this debt comes staggering interest costs, which will total $5.2 trillion over the next 10 years, and become the third largest category in the federal budget by 2024.

“This unsustainable path threatens to restrain economic growth, crowd out public and private investment, and prevent widely shared economic opportunity across America. As the 2016 election season gets underway, these critical issues should be a key part of the conversation — candidates have a responsibility to tell voters about their plan for solving our nation’s long-term fiscal challenges and building a growing, thriving economy of the future.”

In today’s report, CBO outlined serious and negative consequences of high and rising debt, including:

- “When interest rates returned to more typical, higher levels, federal spending on interest payments would increase substantially.”

- “Because federal borrowing reduces national saving over time, the nation’s capital stock would ultimately be smaller, and productivity and total wages would be lower than they would be if the debt was smaller.”

- “Lawmakers would have less flexibility than otherwise to use tax and spending policies to respond to unexpected challenges.”

- “Continued growth in the debt might lead investors to doubt the government’s willingness or ability to pay its obligations, which would require the government to pay much higher interest rates on its borrowing.”

Further Reading

Energy Tax Policy Under the OBBBA

For more than a century, the government has used energy tax incentives (credits, deductions, exemptions, and refunds) as a tool to advance energy policy goals.…

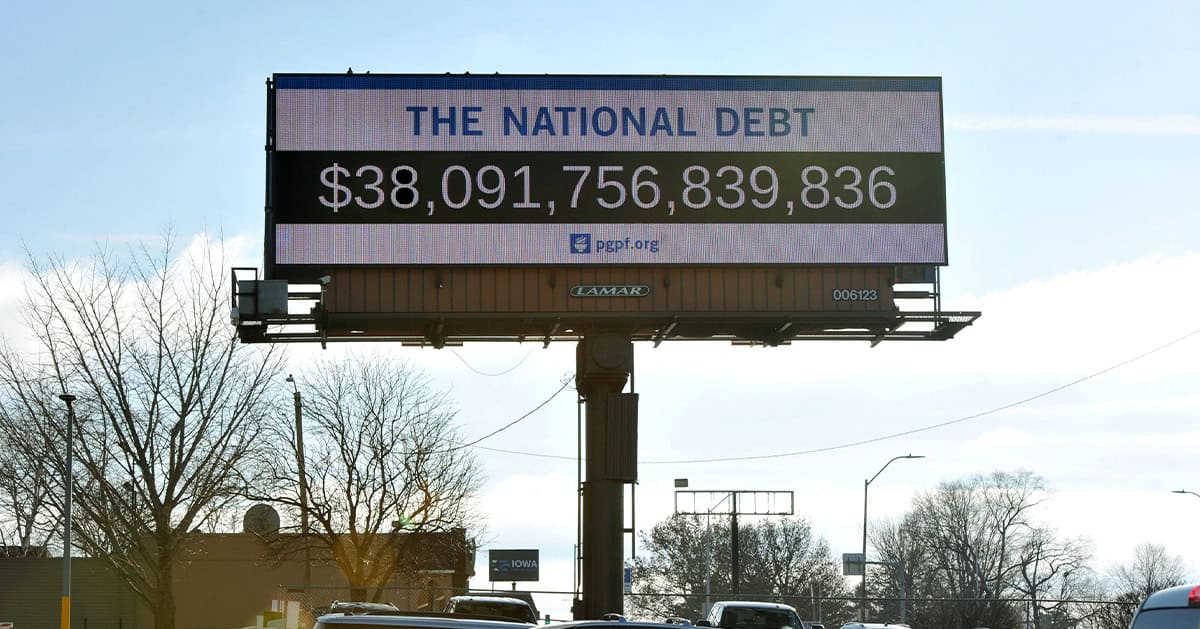

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

Lawmakers are Running Out of Time to Fix Social Security

Without reform, Social Security could be depleted as early as 2032, with automatic cuts for beneficiaries.