Statement by Chairman Pete Peterson on Agreement to Raise Debt Ceiling

“Today’s agreement to raise the debt ceiling has prevented a costly default in the short term, but our leaders must now get back to work to put America on a sustainable fiscal path for the long term.

“While this first stage of spending cuts represents a meaningful down payment to reduce our deficit, the measure of our county’s fiscal health will be whether we address the primary threat to our future: our long-term structural deficits. Our nation still needs a grand fiscal bargain to build investor and consumer confidence, which will help boost our weakened economy over the short and long term. Addressing our long-term debt and deficits must be priority number one for our leaders.

“The American people are counting on the Joint Committee announced today to agree on a bipartisan plan to improve our nation’s fiscal future. Many spending and revenue options are on the table to guide the second and most critical stage of this process. Building upon the work of the National Commission on Fiscal Responsibility and Reform, the “Gang of Six” and members of Congress over the past year, the Committee must harness the current consensus on the need to get our fiscal house in order and arrive at a comprehensive package which puts our country on a path to economic growth and fiscal sustainability.”

About the Peter G. Peterson Foundation

The Peter G. Peterson Foundation is a nonprofit, nonpartisan organization established by Pete Peterson – businessman, philanthropist, and former U.S. Secretary of Commerce. The Foundation is dedicated to increasing public awareness of the nature and urgency of key long-term fiscal challenges threatening America’s future and to accelerating action on them. To address these challenges successfully, we work to bring Americans together to find and implement sensible, long-term solutions that transcend age, party lines and ideological divides in order to achieve real results. To learn more, please visit www.PGPF.org.

Further Reading

Top 10 Reasons Why the National Debt Matters

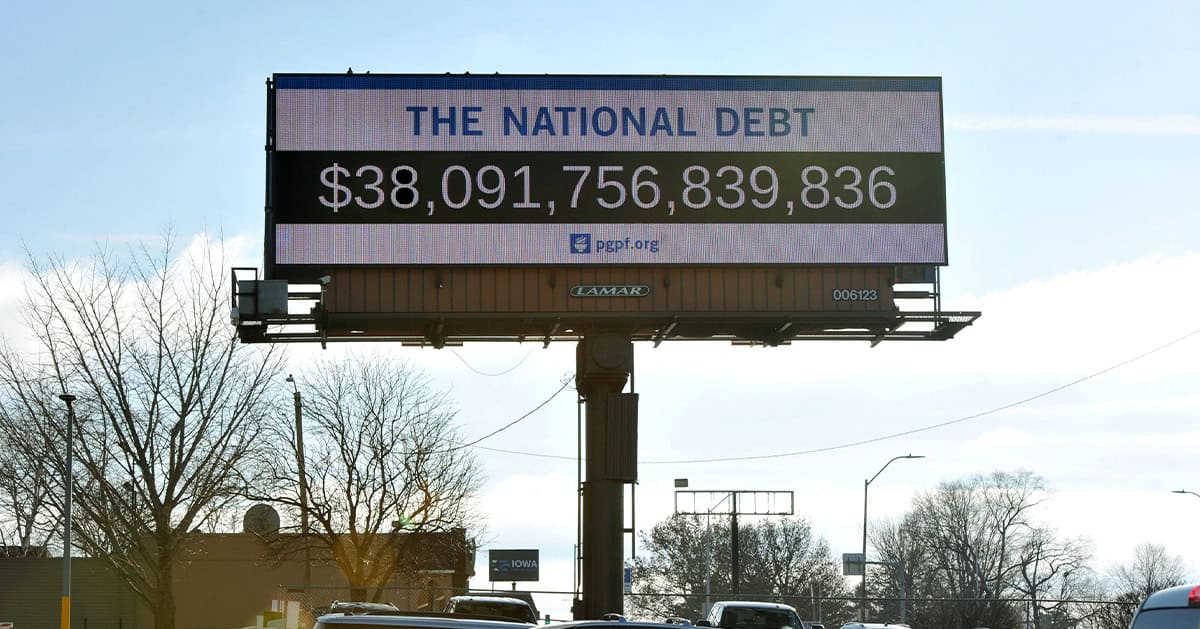

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

Lawmakers are Running Out of Time to Fix Social Security

Without reform, Social Security could be depleted as early as 2032, with automatic cuts for beneficiaries.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.