Statement from Michael Peterson on Fiscal Cliff Agreement

“The agreement to avert the fiscal cliff is a necessary step to protect the fragile economic recovery in the short term. But the agreement obviously does not address the fundamental fiscal challenges that our nation faces.

The goal of any sustainable fiscal policy must be to stabilize the debt as a share of the economy and put it on a downward path. Until we have a plan that stabilizes our federal debt, uncertainty and lack of confidence will continue to be a drag on our current economy and threaten our future prosperity.

The fiscal cliff was a significant missed opportunity to put the nation on a sustainable fiscal path. The President and Congress must continue to work toward a comprehensive fiscal plan that addresses the major drivers of our deficits and stabilizes the debt for the long term.

There is no shortage of fiscal policy options that can stabilize the debt over the long term, while protecting the fragile recovery and the most vulnerable in our society. The sooner we agree on a sustainable bipartisan fiscal plan, the better.”

Further Reading

Energy Tax Policy Under the OBBBA

For more than a century, the government has used energy tax incentives (credits, deductions, exemptions, and refunds) as a tool to advance energy policy goals.…

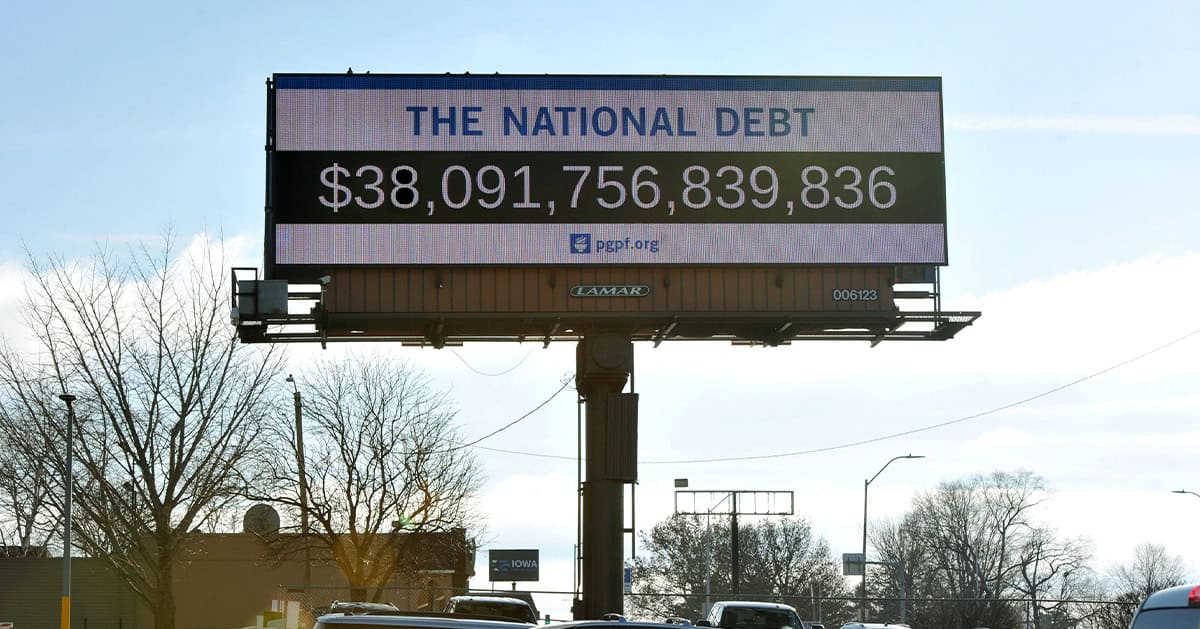

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

Lawmakers are Running Out of Time to Fix Social Security

Without reform, Social Security could be depleted as early as 2032, with automatic cuts for beneficiaries.