Statement from Peterson Foundation on Proposed Budget Deal

NEW YORK — Michael A. Peterson, President and COO of the Peter G. Peterson Foundation, released the following statement this evening as the budget conference committee reached a bipartisan budget agreement:

“This bipartisan deal looks like a good step, but it doesn’t address the real drivers of our long-term debt. We should all welcome our lawmakers coming together on a budget agreement that would end the recent cycle of governing by crisis. But make no mistake — we still have a lot more to do to put our nation on a sustainable fiscal path. I’m hopeful that this agreement will lay the foundation for future bipartisan collaboration to stabilize our national debt for the long term.”

Further Reading

The United States Collects Less Tax Revenue Than Other G7 Countries

The U.S. collects less tax revenues compared with other G7 countries, and that lower level of revenues is a key driver of the national debt.

Energy Tax Policy Under the OBBBA

As part of the OBBBA, lawmakers rolled back existing energy tax incentives in order to partially offset the bill’s deficit impact.

Top 10 Reasons Why the National Debt Matters

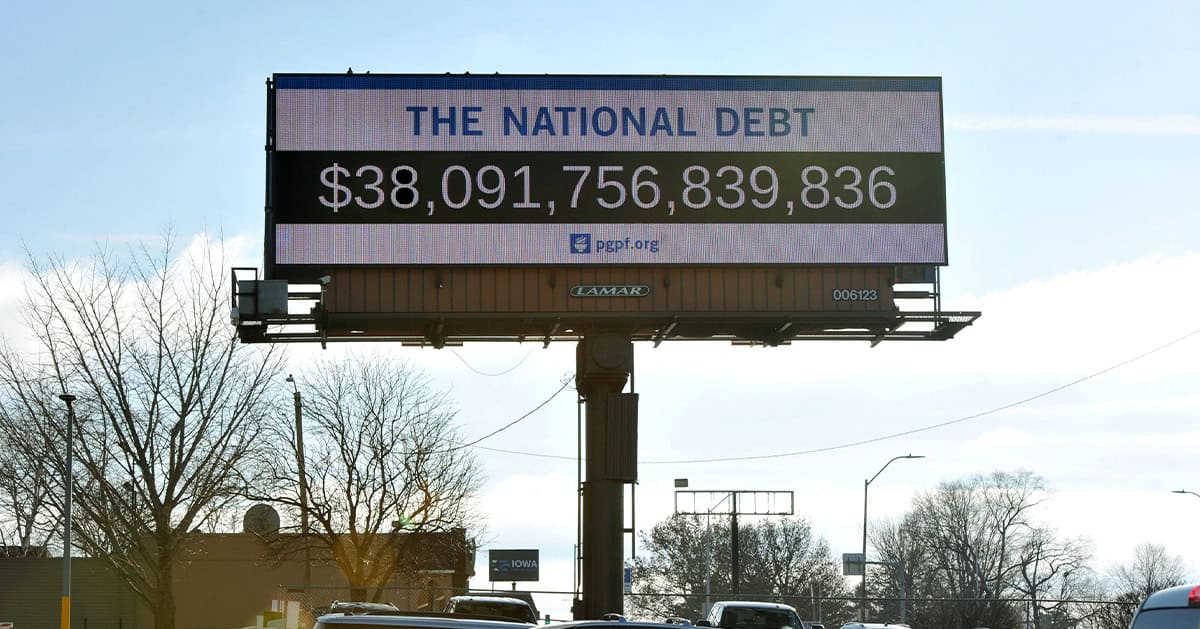

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.