What Is Inflation and Why Does It Matter?

Here’s an overview of inflation, why it matters, and how it’s managed.

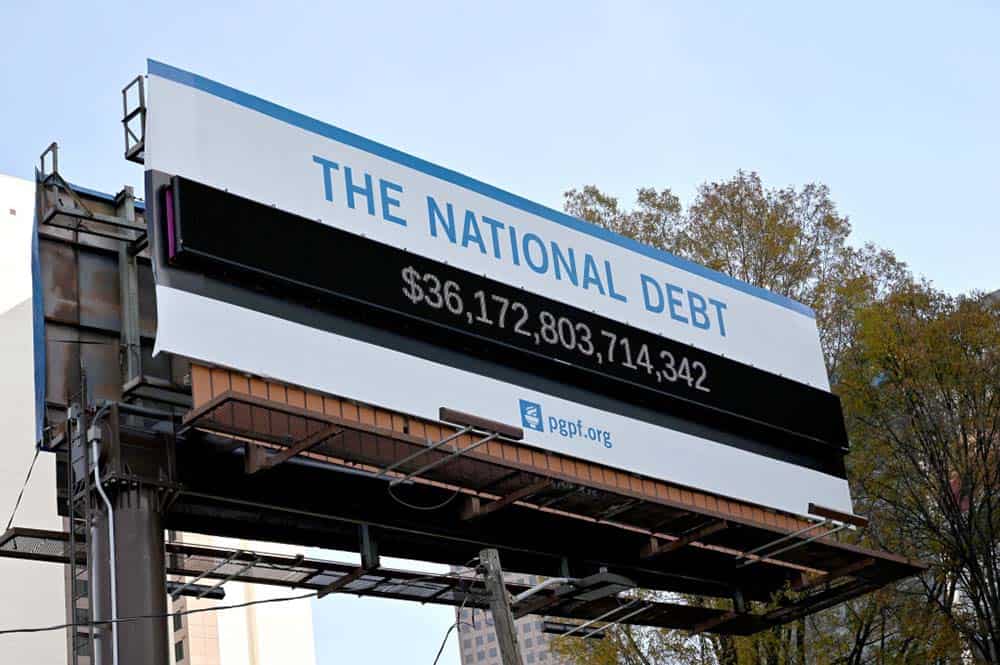

Read MoreHow Much Is the National Debt? What Are the Different Measures Used?

There are three widely used measures of federal debt. What are the important differences between these measurements?

Read MoreWhat Is the Primary Deficit?

The primary deficit is the difference between government revenues and spending, excluding interest payments. Learn more about the U.S. primary deficit.

Read MoreWhat Are Automatic Stabilizers and How Do They Affect the Federal Budget?

To better respond to business cycle fluctuations, many important programs in the federal budget automatically adjust spending based on economic conditions.

Read MoreThree Key Things to Know about CHIP

The Children’s Health Insurance Program is a key piece of the social safety net. Let’s take a look at what CHIP is, how it is financed, and who benefits from it.

Read MoreSocial Security Reform: Should We Raise the Retirement Age?

Many policymakers have called for the full retirement age to be gradually raised and ultimately pegged to average life expectancy.

Read MoreWhat Is Stepped-Up Basis on Capital Gains and How Does It Affect the Federal Budget?

The step-up in basis is a provision in tax law that relates to how assets — such as stocks, bonds, or real estate — are valued and taxed after their owner passes away.

Read MoreHow Much Government Spending Goes to Children?

Interest costs on the national debt are expected to rapidly outstrip spending on children in coming years.

Read MoreThe Share of Americans Without Health Insurance in 2023 Remained Low

In 2023, 26 million people were uninsured. While that represents a significant portion of the population, the uninsured rate remained at one of its lowest levels in history.

Read MoreBudget Basics: Medicaid

This budget explainer describes what Medicaid is, how it is financed, and who benefits from it.

Read More