Budget Basics: Balanced Budget Amendment — Pros and Cons

What is a balanced budget amendment to the Constitution, and how would it work in practice?

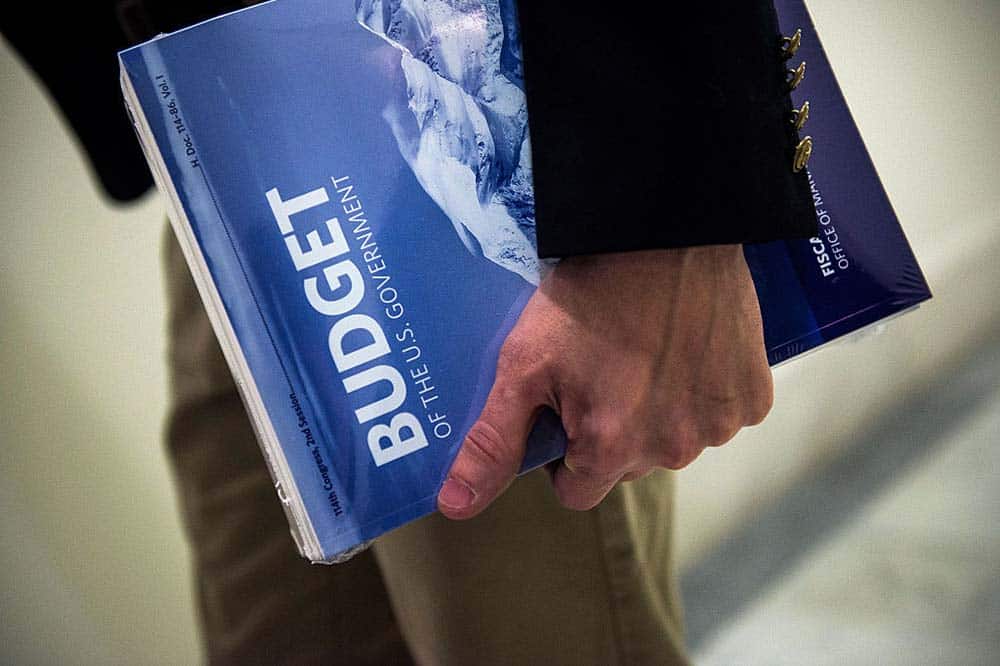

Read MoreThe Lame-Duck Congress and the 116th Congress Have Some Key Fiscal Issues on Their Agenda

There are a number of key fiscal issues not only facing the current Congress in coming weeks, but also awaiting the new Congress.

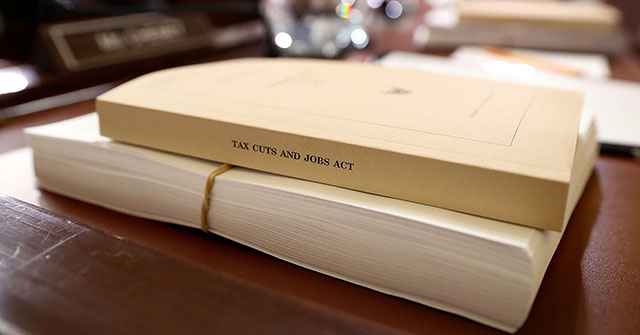

Read MoreFive Things That We Have Learned Since the Tax Cuts Were Enacted

Last year’s tax cuts have had significant implications for the federal budget, our economy, and every family and business in the country.

Read MoreBoth Parties Can Pick Up Late Support by Addressing the National Debt

Seven in ten voters say the record national debt will be an important factor in their vote in next week’s Midterm Elections.

Read MoreIt’s Rare for Revenue Growth to Be This Weak

Revenues in 2018 didn’t even keep up with inflation, much less growth in nominal gross domestic product.

Read MoreCorporate Tax Receipts Took an Unprecedented Drop This Year

Corporate tax receipts dropped by 31% in 2018 — an unprecedented decline during a time of economic growth. What’s responsible for the plunge?

Read MoreHow Will the Rising Cost of Prescription Drugs Affect Medicare?

Rising costs of prescription drugs and their effect on Medicare could have serious consequences on our healthcare system and our nation’s fiscal well-being.

Read MoreWith Election Looming, Congress Returns to Full Agenda

Members of the United States House of Representatives and Senate return to Washington to face a number of important policy decisions and deadlines.

Read MoreLast Year’s Tax Law Did Not Simplify the System — It Added More Tax Breaks

Last year’s tax legislation was a key opportunity to simplify the tax code, but the TCJA actually increased the number of tax breaks.

Read MoreHow Have Tax Cuts Affected the Economy and Debt? Here’s What We Know So Far

The general consensus among economists is that the long-term effects of the TCJA will be higher debt and little change to underlying economic growth.

Read More