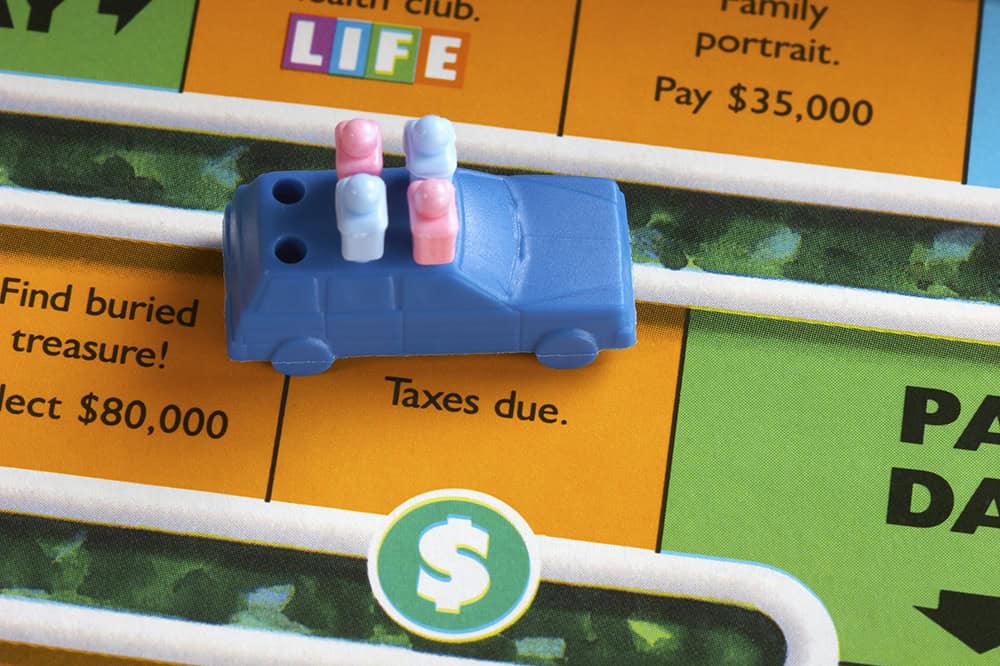

Quiz: How Much Do You Know About the U.S. Tax System?

The lengthy and complex United States tax code can be difficult to understand. Take our quiz to see how much you really know.

Read MoreNo Tax on Social Security Would Weaken Both Social Security and Medicare

Republicans in Congress are considering several new tax cuts that would reduce federal revenues by trillions of dollars over the next decade.

Read MoreThe United States Spends More on Defense than the Next 9 Countries Combined

Defense spending by the United States accounted for nearly 40 percent of military expenditures by countries around the world.

Read MoreSocial Security Reform: Options to Adjust Benefits

A well-designed benefit reduction policy would improve the equitability by better balancing the payouts between low- and high-income earners, say proponents.

Read MoreHow Much Can the Administration Really Save by Cutting Down on Improper Payments?

Cutting down on improper payments could increase program efficiency, bolster Americans’ confidence in their government, and safeguard taxpayer dollars.

Read MoreHow Do States Pay for Medicaid?

Medicaid’s role in state budgets is unique, since the program acts as both an expenditure and the largest source of federal support in state budgets.

Read MoreInfographic: How the U.S. Tax System Works

One issue that most lawmakers and voters agree on is that our tax system needs reform.

Read MoreHow Does Government Healthcare Spending Differ From Private Insurance?

Government insurance programs, such as Medicare and Medicaid, made up 45 percent, or $1.9 trillion, of national healthcare spending.

Read MoreHow Do Quantitative Easing and Tightening Affect the Federal Budget?

The Federal Reserve plays an important role in stabilizing the country’s economy.

Read MoreA Bipartisan Roadmap for Social Security Reform

Lawmakers are running out of time before automatic reductions to benefits are activated; the Brookings Institution plan is a valuable contribution to the policy discussion.

Read More