You are here

As Congress and the Administration begin to fill in the legislative details of their tax framework, the Tax Policy Center (TPC) has built on earlier work by calculating the cost of retaining certain tax expenditures in the code.

Key Takeaways: Reform that eliminates virtually all tax expenditures allows for rates to be lowered significantly; it can also preserve the amount of revenue projected under current law and maintain the distribution of tax burden across income groups. Retaining individual tax expenditures would require modestly higher rates than in the base scenario; combining provisions would have larger consequences than the sum of the individual effects.

Top Findings: Individual Income Tax

- Retaining tax expenditures for retirement; health; the state and local deduction; or the mortgage interest deduction requires individual rates to be adjusted upward to maintain revenue neutrality.

- The interactive effects of combining provisions would result in more people itemizing, and therefore require higher marginal rates to maintain revenue neutrality.

- The distributional effects of restoring tax expenditures vary. Restoring provisions for retirement or health alone would generally shift some tax burden from low- and middle-income taxpayers to those in the top 1 percent of earners. Restoring the mortgage interest deduction alone would shift some tax burden to the top 0.1 percent of earners. Restoring the state and local tax deduction alone would mostly benefit the top 5 percent.

The following table sets forth: current tax rates; rates under the Base Scenario (elimination of nearly all tax expenditures); and the effect on rates of adding back certain tax expenditures:

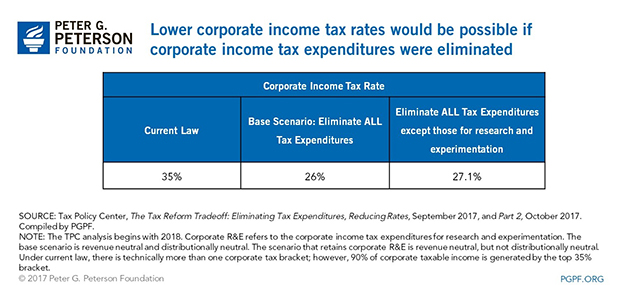

Top Findings: Corporate Income Tax

- Retaining corporate tax expenditures for research and experimentation would require the corporate rate to be adjusted upward by 1.1 percentage points to maintain revenue neutrality.

- Restoring only those tax expenditures would shift some tax burden to the top 0.1 percent.

- Tax Policy Center Analysis: The Tax Reform Tradeoff (Part 2)

- Peterson Foundation Principles for Tax Reform

Read more: