You are here

Can We Raise the Retirement Age and Protect Vulnerable Workers?

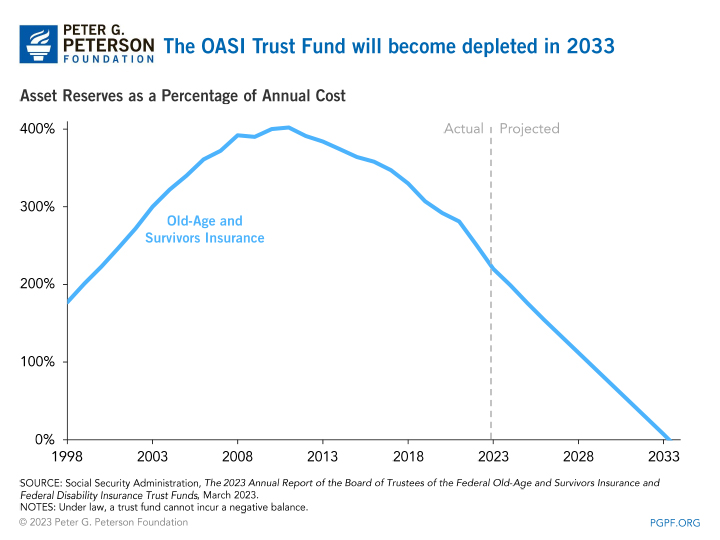

The Social Security Trustees estimate that the Old-Age and Survivors Insurance (OASI) Trust Fund will become depleted by 2033, at which point scheduled benefits would be reduced by 23 percent. Fortunately, policymakers have a menu of options available to them that can increase the solvency of the program and secure benefits for current retirees as well as for the next generation of workers. One group of policy options calls for raising the retirement age. Currently, the full retirement age (FRA) is set at 67 while the early eligibility age (EEA) is 62. However, there is debate over whether raising the retirement age would be equitable and continue to protect against poverty in old age.

What Are the Potential Benefits and Drawbacks of Raising the Retirement Age?

Raising the retirement age would delay depletion of the OASI Trust Fund by reducing the annual costs associated with the program. The Congressional Budget Office (CBO) calculates that incrementally raising the FRA to age 70 by 2048 would save $121 billion over the next 10 years, and savings would grow substantially in subsequent years. A higher retirement age could also encourage workers to work longer, thereby increasing the size of the labor force and promoting economic growth.

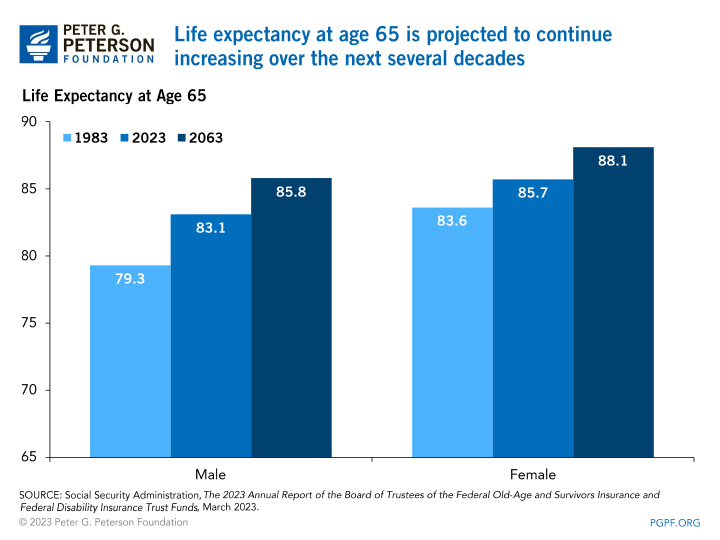

Raising the retirement age could also increase generational fairness in retirement. The FRA is now 67 years old, up from age 65 in 2000. Since 1983, when the legislation to increase that age was enacted, the life expectancy for males age 65 has increased by 3.8 years and that for females age 65 has increased by 2.1 years. Looking forward from 2023 to 2063, the Social Security Trustees project that life expectancy for males age 65 will increase by another 2.7 years, while over the same period, life expectancy for females age 65 will increase 2.4 years. Raising the retirement age would maintain the estimated number of years in retirement.

On the other hand, plans to raise the retirement age would reduce scheduled lifetime benefits under current law for all beneficiaries. Critics of such plans also argue that reductions in benefits would especially harm workers who would be unable to delay retirement due to physically demanding occupations, disability, or job loss. Such groups often depend on their benefits to remain out of poverty.

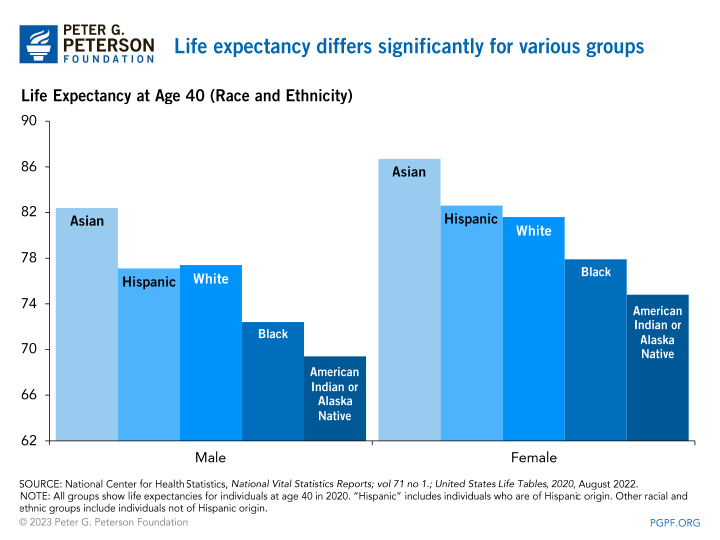

Further, historic gains in life expectancy have not been equally distributed among various socioeconomic groups. For example, in 2014 (the most recent year for which data is available), the life expectancy gap between the top 10 percent and bottom 10 percent of male earners was 12.2 years and for female earners that gap was 7.8 years. Gaps in life expectancy also exist among social groups. For example, a 40-year-old American Indian or Alaska Native would be expected to live 7.2 years less than the national average.

Policy Options That Shield Vulnerable Workers from Increases in the Retirement Age

Below are some options that would raise the retirement age while also attempting to mitigate some of the drawbacks associated with that type of reform. Generally, such options aim to protect workers who are economically vulnerable or those who are unable to delay retirement because they work in physically demanding occupations.

Occupation-Based Exemptions for Retirement Age

Allow workers in certain “hazardous or arduous” occupations to continue to retire at age 62, even if the normal retirement age is raised. The Social Security Administration (SSA) would specify a list of occupations and accompanying “minimum service requirements.” For example, an individual who has been employed as a construction worker for a minimum of 20 years of service could qualify. Currently, SSA does not require employers to report employees’ occupation, meaning the agency currently lacks necessary information to make determinations that would be required under this approach.

Years-of-Work Based Retirement Age

Sets a minimum number of working years before which an individual is eligible for benefits. Less educated workers often enter the labor force before more educated workers, meaning less educated workers — who often work in more physically demanding occupations — tend to work for more years. This policy is feasible to implement as SSA already collects the necessary data for implementation. However, the policy might not achieve its intended fairness for less educated workers with less job stability and women who tend to spend more time caregiving.

Lower Early Retirement Age for Workers with Lower Lifetime Earnings

Make a lower EEA available to workers with low average lifetime earnings. Rather than basing the EEA on simply age or number of years worked, the EEA could be indexed based on average monthly earnings. While increasing life expectancy is often cited as justification for raising the retirement age, gains in life expectancy are not equal among groups with differing levels of education, lifetime earnings, and wealth. Proponents of such an option claim that it would be effective because vulnerable workers and those with low life expectancy often have low lifetime earnings. However, the correlation between low lifetime earnings and low lifetime household income is weaker for secondary earners than for primary earners. For that reason, the policy would need to be paired with other options to prevent benefits from flowing to secondary earners with high lifetime household income due to a primary earner. The 2010 Bowles-Simpson Commission recommended pairing the policy with one similar to the option above, which would make assistance more targeted and avoid some of the weaknesses of just one approach.

Creation of a “Poverty Protection Benefit” (PPB)

Raise the EEA and FRA while creating a new PPB at age 62. Any “full-career” worker would be eligible to collect PPB benefits, meaning means testing or health examinations would not be necessary. Benefits would be equal to 100 percent of the poverty line at age 62 and increase for workers who are able to delay retirement. The plan is designed to protect low-income workers and workers who cannot delay retirement from poverty while incentivizing workers who can delay retirement to continue working in old age.

Conclusion

As the OASI Trust Fund continues to be depleted, it is becoming ever more important for lawmakers to intervene. The sooner that lawmakers act, the better their options will be to implement fair, gradual, and balanced reforms. Beyond raising the retirement age, there are many solutions to raise revenues or address benefits that can ensure that the program continues to adequately serve the millions of Americans who depend on it. Regardless of what approach lawmakers choose, Social Security reform is an opportunity for lawmakers to secure this critical program for the future, while addressing a key underlying driver of national debt.

Related: Social Security’s Funding Gap Is 1.3% of GDP — Here’s How We Can Close It

Image credit: Photo by Justin Sullivan/Getty Images