America’s national debt recently passed $30 trillion, and the Peterson Foundation’s Fiscal Confidence Index fell to a seven-year low, with 84% of voters saying that their level of concern about the national debt has increased over the last few years.

Our high and rising debt is “a big burden placed on current citizens, based on our past budgetary irresponsibility,” said Michael Peterson, CEO of the Peter G. Peterson Foundation, in a recent appearance on C-SPAN’s Washington Journal. “Today, we are spending $1 billion a day on interest. That is a lot of money. Over the next 10 years, it is $5.4 trillion on interest alone.”

Peterson highlighted the fact that the pandemic has accelerated our existing fiscal challenges. Although the six stimulus bills passed during the coronavirus pandemic added significantly to the national debt, the country was on an unsustainable fiscal path long before the pandemic. The key drivers of the debt include our aging demographics, our expensive healthcare system, growing interest on the national debt, and inadequate revenues.

Lawmakers can choose from many different solutions to reduce the debt, and 76% of voters think that addressing our debt should be one of their top three priorities.

"The only good thing about this problem is it is very solvable," Peterson said. "As opposed to trying to deal with Ukraine or climate change solutions which are difficult and involve international actors, we are in full control of our budget in Washington. . . It is just a matter of political will to implement them."

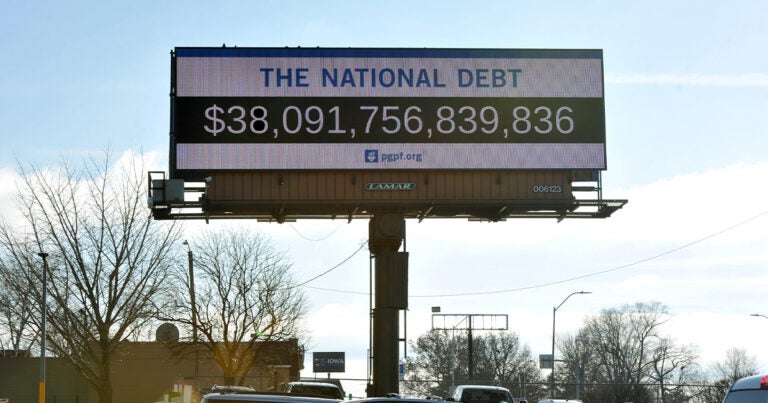

Image credit: Getty Images

Further Reading

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.