A new report, prepared by Macroeconomic Advisers for the Peter G. Peterson Foundation, finds that while our national debt is on a dangerously unsustainable path, gradual fiscal restraint can be paired with monetary accommodation to achieve significant macroeconomic benefits.

The analysis demonstrates clearly that there are pathways to solving our long-term fiscal challenges without jeopardizing economic growth. By making gradual changes to federal spending and revenue, lawmakers can not only stabilize our fiscal outlook, but provide long-run economic benefits for American families (in terms of real GNP growth) without inflicting undue damage on the U.S. economy in the near term.

Top-level findings include:

- Under current, unsustainable fiscal policies, U.S. federal deficits and debt will increase dramatically by 2045, putting upward pressure on interest rates and undermining our standard of living by “crowding out” private investments.

- These outcomes can be prevented by a gradual fiscal restraint that maintains, or even reduces, federal debt relative to the size of the economy.

- If such fiscal restraint is gradual enough, there is sufficient “monetary space” for the Federal Reserve, by lowering interest rates, to keep the economy close to full employment, growing at “trend,” with inflation close to the Fed’s 2% objective.

- The macroeconomic benefits of this mix of fiscal and monetary policy are substantial.

- If the ratio of debt to GDP were maintained at its current level, real per capita GNP would grow, on average, about 0.2 percentage points — or about 10% — faster per year through 2045.

- By 2045, the level of real per capita GNP would be 5.4% higher or, for a family of 4, slightly more than $18,000 per year at 2017 prices.

- The analysis suggests that the cumulative amount of any fiscal restraint is what matters; the mix of restraint between spending cuts and revenue increases is of minor importance.

- Another key finding of the analysis is that on our current fiscal path, U.S. trade deficits and our indebtedness to foreigners necessarily will rise along with federal deficits and debt, implying a gradual transfer of wealth and income to the rest of the world. However, if we apply gradual fiscal restraint,

the trade deficit will be 3.3% of GDP in 2045 compared to 4.4% of GDP in baseline. This represents a decrease of 25%.

About Macroeconomic Advisers

Macroeconomic Advisers is a leading independent research firm focused on the U.S. economic outlook and macroeconomic policy. The firm combines rigorous analytical methods with an unmatched understanding of how monetary and fiscal policies are conducted, offering unbiased and thoughtful analysis of where the U.S. economy is headed, and why. To learn more, please visit www.macroadvisers.com.

About the Peter G. Peterson Foundation

The Peter G. Peterson Foundation is a nonprofit, nonpartisan organization that is dedicated to increasing public awareness of the nature and urgency of key fiscal challenges threatening America's future, and to accelerating action on them. To address these challenges successfully, we work to bring Americans together to find and implement sensible, long-term solutions that transcend age, party lines and ideological divides in order to achieve real results. To learn more, please visit www.pgpf.org.

Further Reading

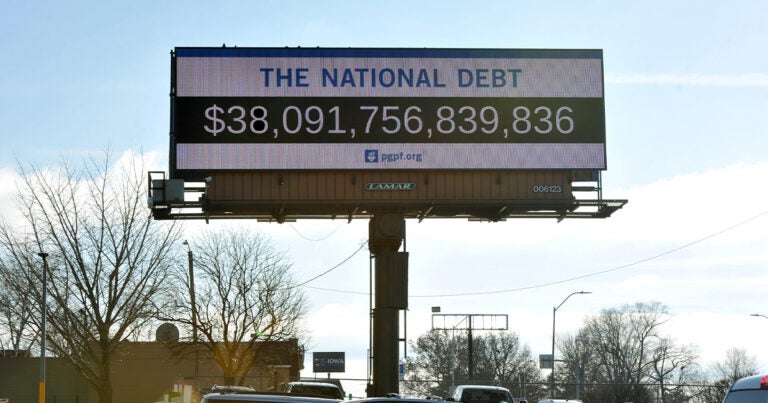

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.