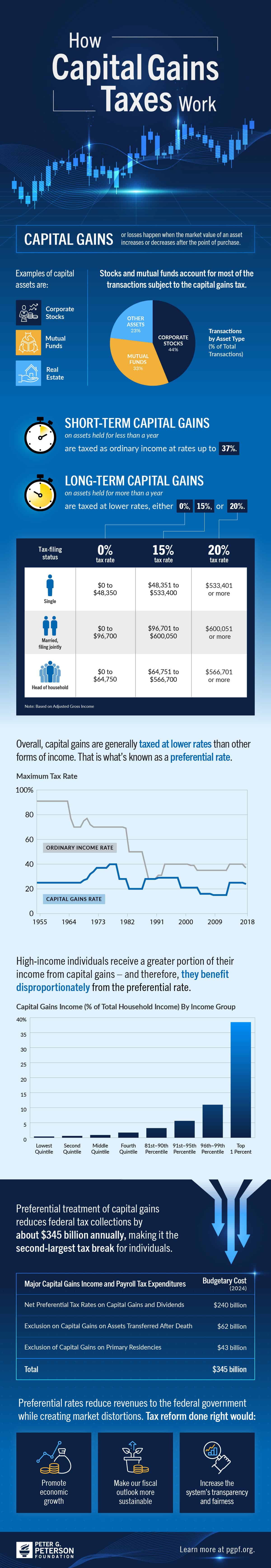

Capital gains are the profits received from the sale of a capital asset, such as stocks or real estate. The capital gains tax, which is a levy on said profits, is categorized as part of individual income tax revenues, but it is administered at a lower rate than ordinary income.

Proponents of increasing the capital gains tax argue that it could promote a more equitable tax system that treats different kinds of income more uniformly. They also note that it could raise additional revenues to help improve our fiscal outlook. However, advocates for reducing the capital gains tax argue that doing so may spur economic growth and promote entrepreneurship.

Preferential rates, like the capital gains tax, are one of many tax expenditures or “tax breaks” that provide financial assistance to specific activities and groups. Such expenditures reduce revenues to the federal government and create market distortions that damage economic growth and productivity. Many economists believe it would help the economy to eliminate some or all of those tax breaks to make the code more efficient and reduce the deficit. Tax reform is an opportunity to promote economic growth, make our fiscal outlook more sustainable, reduce the complexity and burden of compliance, and increase the system’s transparency and fairness.

The infographic below provides a basic overview of what kinds of assets and individuals are most affected by capital gains and how they work within our complicated tax system.

Further Reading

What Are Refundable Tax Credits?

The cost of refundable tax credits has grown over the past several years, with the number and budgetary impact of the credits increasing.

Understanding the New Senior Deduction in the One Big Beautiful Bill Act

The senior deduction adds complexity to the tax code, and fewer than half of seniors will benefit from it.

What Are Estate and Gift Taxes and How Do They Work?

Estate and gift taxes produce relatively lower revenue compared to other sources, but they generate a significant amount of attention, and even controversy.