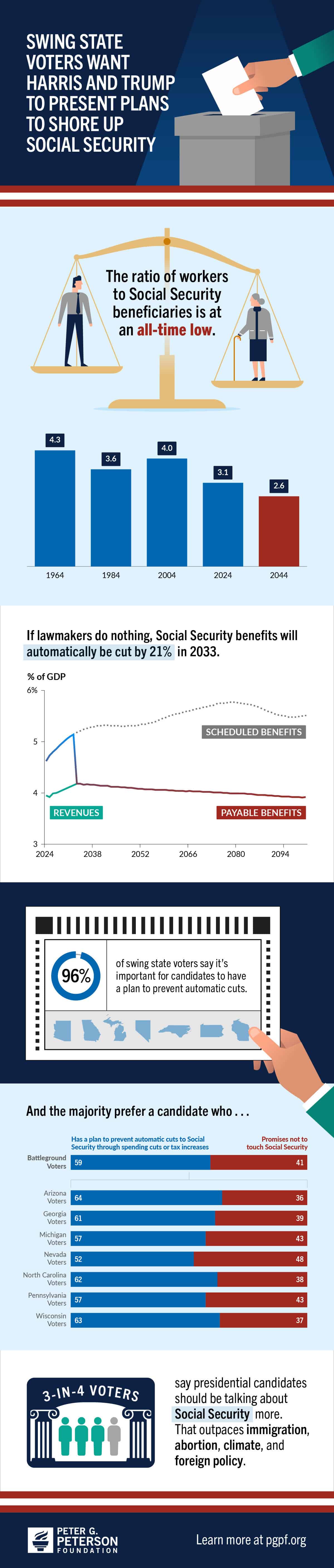

Swing State Voters Want Harris and Trump to Give Detailed Plans for Shoring Up Social Security

Despite decades of warnings, the depletion date for Social Security’s retirement trust fund is rapidly approaching. Unless lawmakers take action, Social Security’s trust fund will be depleted by 2033 – at which point benefits would be cut by 21 percent, automatically. These cuts would be devastating for the millions of seniors who rely on Social Security for a major share of their income.

The vast majority of voters (96%) in seven key battleground states — Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin —say it’s important for the presidential candidates to have a plan to prevent automatic cuts to Social Security, according to new polling. So far neither Vice President Harris nor former President Trump has put forward a plan to shore up Social Security – but there are many policy options to choose from, with strong support from swing state voters:

- 60% of voters favor increasing Social Security taxes

- 63% of voters favor a combination of tax increases and benefit adjustments

- 75% of voters favor increasing taxes and reducing benefits for higher-income Americans

- 52% of voters favor having the retirement age gradually raised for those under 50

Further Reading

Budget Basics: How Does Social Security Work?

Social Security is the largest single program in the federal budget and typically makes up one-fifth of total federal spending.

Budget Basics: Unemployment Insurance Explained

The Unemployment Insurance program is a key counter-cyclical tool to help stabilize the economy and speed recovery during downturns or crises.

Can We Raise the Retirement Age and Protect Vulnerable Workers?

Some policy options aim to protect economically vulnerable workers or those who are unable to delay retirement because they work in physically demanding occupations.