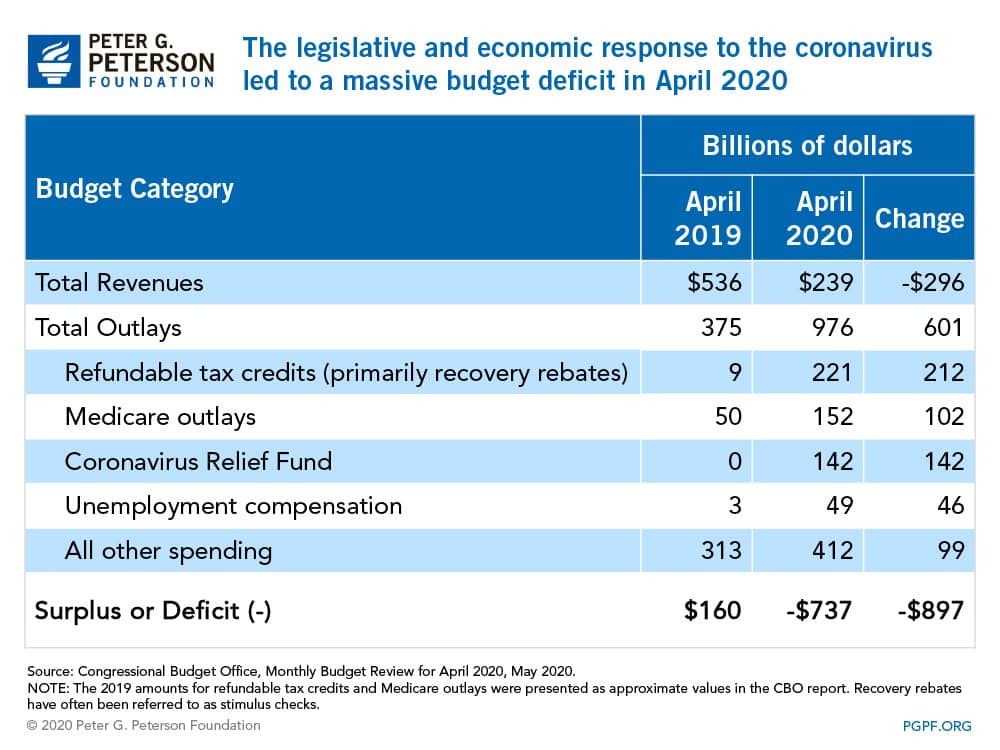

The federal government typically runs a budget surplus during the month of April as it collects final tax payments for the previous year. However, the effect of the coronavirus (COVID-19) pandemic — and the legislative response to it — has instead caused the deficit to balloon as the nation takes necessary measures to fight the pandemic. A large decrease in revenues and a large increase in spending have led the Congressional Budget Office to estimate a deficit of $737 billion in April 2020:

- Revenues were considerably lower. Last year, the government collected $536 billion during the month of April. This April, receipts were only $239 billion. That drop of 55 percent can be explained by a delay in tax-filing deadlines (the CARES Act delayed them from April 15 to July 15) and lower taxable wages resulting from reduced economic activity.

- Legislation to address COVID-19 has increased outlays. The four pieces of relief legislation enacted by lawmakers thus far have resulted in substantial increases in spending. Much of that spending is for new commitments that are specifically tailored to mitigate the economic damage caused by the pandemic. Such measures include recovery rebates (often referred to as stimulus checks) for individuals, the acceleration of certain Medicare Part A and Part B payments, grants to state and local governments, and expanded unemployment insurance benefits. All told, outlays in April 2020 were $976 billion, up from $375 billion in April 2019.

The effects of COVID-19 on the federal budget are summarized in the table below.

Image credit: Photo by Drew Angerer / Getty Images

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.