The Provider Relief Fund, administered by the Department of Health and Human Services, distributes payments to hospitals and other healthcare providers on the front lines of the coronavirus response. On March 27, 2020, $100 billion was allocated to the fund as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the third and largest phase of legislation designed to lessen the economic impact of the coronavirus (COVID-19) pandemic. One month later, lawmakers allocated an additional $75 billion to the fund in the Paycheck Protection Program and Healthcare Enhancement Act, thereby bringing the total amount allocated to the Provider Relief Fund to $175 billion.

To date, HHS has allocated $147 billion of that amount in the following ways:

- $59 billion in targeted distributions to providers in: high-impact COVID-19 areas ($22 billion); safety net hospitals that disproportionately provide for the most vulnerable citizens ($15 billion); healthcare providers in rural areas ($11 billion); skilled nursing facilities such as nursing homes and long-term care facilities ($10 billion); and tribal hospitals, clinics, and urban health centers ($500 million).

- $50 billion in “Phase 1 General Distribution” to Medicare providers who bill Medicare fee-for-service. The funds are allocated in proportion to providers’ share of 2018 patient revenue.

- $18 billion in “Phase 2 General Distribution” to state Medicaid, CHIP, dental care providers, and certain Medicare providers that have not yet received a payment from the initial $50 billion General Distribution.

- $20 billion in “Phase 3 General Distribution” to providers that have already received Provider Relief Fund payments, as well as those that were previously ineligible, for financial losses and additional operating expenses caused by the coronavirus.

Of those allocations, $96 billion has been disbursed through October 30, 2020. The map below shows the amounts that healthcare providers in each state have received so far from such disbursements.

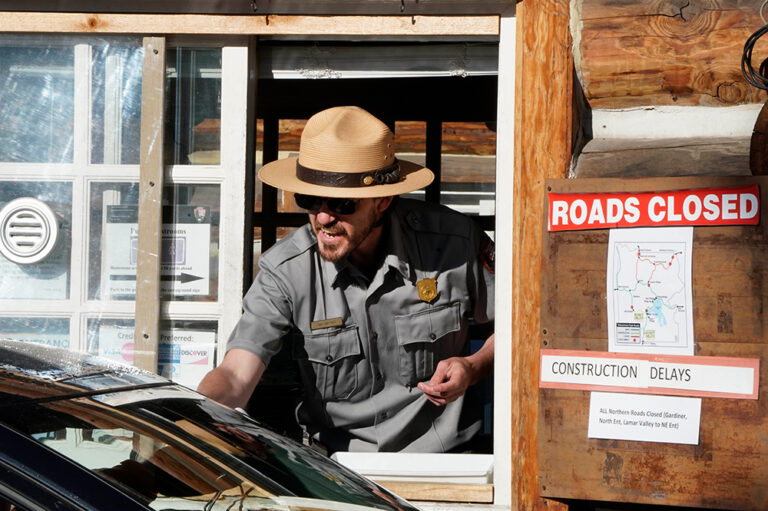

Image credit: Photo by Spencer Platt/Getty Images

Further Reading

How Much Do We Spend on the Federal Workforce?

Here, we examine the federal government’s expenditure on its workforce, the evolution of its size over time, and the opportunities for budget savings.

The One Big Beautiful Bill Act Is the Most Expensive Reconciliation Package in Recent History

The legislative package will be the most expensive reconciliation bill in a quarter of a century and will add trillions of dollars to the U.S. debt.

Lifting the Debt Ceiling Has Been Paired with Budget Reform in the Past

Earlier this year, the United States once again hit its debt ceiling, which is currently capped at $36.1 trillion.