In December 2017, the Tax Cuts and Jobs Act (TCJA) was signed into law. This major piece of tax legislation included large-scale changes to both individual and corporate taxes, with significant implications for the federal budget and the overall economy.

Data released over the past several months are consistent with analyses of the law’s economic and budgetary effects that were released around the time of its enactment. Here is what we can say so far about the TCJA.

The TCJA Has Reduced Federal Revenues

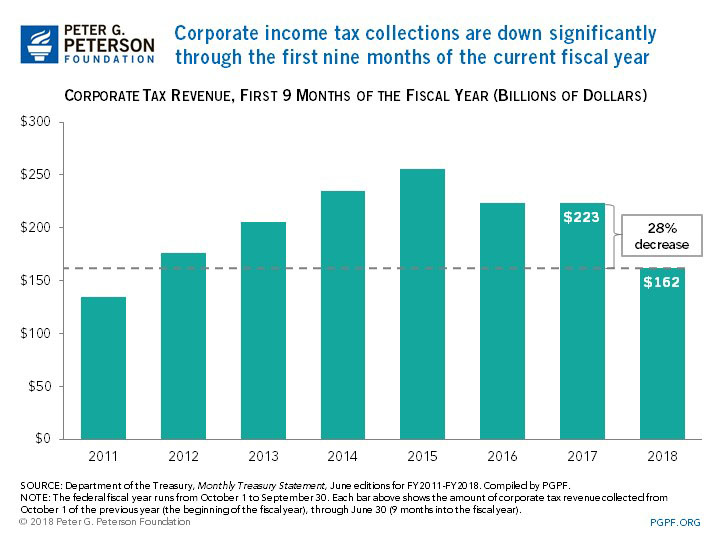

The TCJA reduced the corporate tax rate and made other changes to the corporate tax code; as a result, the amount of corporate income taxes collected so far in the current fiscal year has dropped relative to the previous year. According to the Department of the Treasury, corporate tax receipts during the first nine months of fiscal year 2018 fell by 28 percent — from $223 billion in 2017 to $162 billion this year.

The TCJA also reduced marginal tax rates on individual income, and the implementation of new withholding tables in February by the Internal Revenue Service has led to diminished tax collections from that source. According to the Congressional Budget Office (CBO), withholding rose by 1.9 percent in the first nine months of the year, from $1,800 billion to $1,833 billion. Without any change in law, withholding would normally grow at about the same rate as nominal GDP; however, the growth in withholding so far this fiscal year has been less than half of the rate of growth of the economy.

The TCJA’s Positive Economic Effects May Be Short-Lived

On July 27, the Commerce Department announced that the United States economy grew at an annual rate of 4.1 percent in the second quarter of 2018 – the fastest rate of growth since 2014. That aligned with the expectations of many economists, who anticipated a temporary boost in economic growth due to the tax cuts included in TCJA. However, in the longer-term, the TCJA’s economic benefits are likely to decline and the damaging fiscal consequences of the TCJA will exacerbate our nation's fiscal challenges.

An analysis published in June by the Tax Policy Center highlights those concerns:

TCJA will stimulate the economy in the near term. But, most models indicate that the long-term impact on GDP will be small. . . . It will make the distribution of after-tax income more unequal, raise federal debt, and impose burdens on future generations.

CBO’s April projections also point to a modest impact on economic growth from the TCJA. For both 2018 and 2019, CBO estimates that the TCJA will increase the rate of real GDP growth by 0.3 percentage points; however, by 2023, the TCJA would have essentially no effect on the rate of real GDP growth.

Several other organizations agree that the TCJA will increase GDP in the short term, before the effect diminishes. CBO identified eight other organizations that produced analyses of the final version of the TCJA and its longer term effects. Just one of those organizations, the Tax Foundation, projects that the TCJA’s boost to GDP will be larger in ten years than it is over the next five years.

The TCJA Took Our Debt Outlook from Bad to Worse

In CBO’s most recent baseline projections, the deficit would reach $1 trillion in 2020. The President’s Office of Management and Budget (OMB) recently updated its projections to show that the deficit could reach $1 trillion as early as next year. In both cases, the updated estimates represented a significant change from projections that didn’t fully incorporate recent legislation.

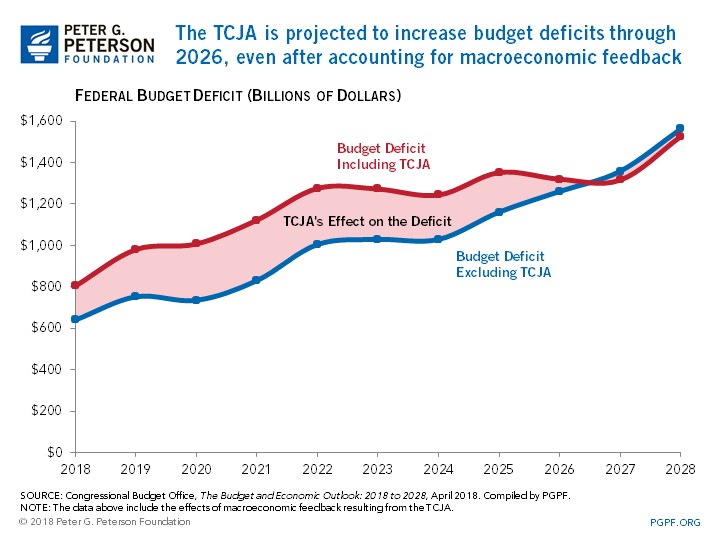

Those worsening budget deficit projections are in part a result of enactment of the TCJA. By CBO’s calculations, the deficit this year will be $164 billion larger because of the TCJA’s provisions. Over the 2018–2028 period, the cumulative deficit would be $1.9 trillion higher — $1.3 trillion from the direct effects of the legislation and $0.6 trillion from increased interest payments. Those totals include the effects on the economy of the provisions of the act and incorporate the assumption that the lower tax rates on individual income and other provisions expire as scheduled.

Looking Ahead

In the coming months and years, additional data will paint a clearer picture of the law’s economic effects and its impact on the federal budget. However, the general consensus among economists is that the long-term effects of the TCJA will be higher debt and little change to underlying economic growth. If that is the case, the recent positive economic effects will diminish while the increase in debt remains, thereby exacerbating our daunting fiscal outlook.

Image credit: Photo by Chip Somodevilla/Getty Images

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.