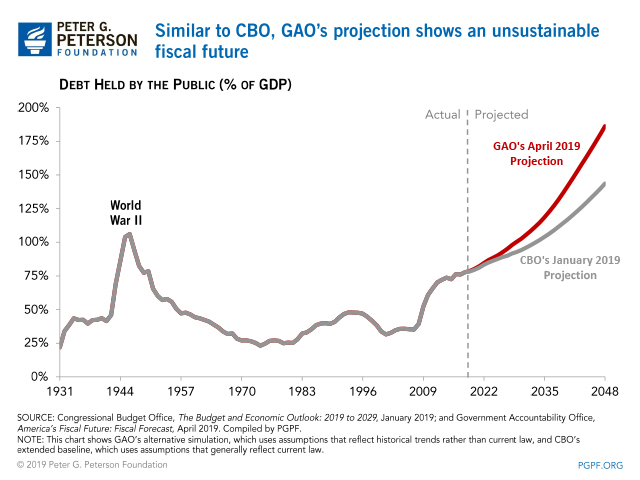

A new report released by the nonpartisan Government Accountability Office (GAO) shows federal debt on an unsustainable path. Debt held by the public would reach record levels relative to the size of the economy within the next two decades, and possibly as soon as 2032 — just 13 years from now. By 2048, GAO projects that debt held by the public would be almost twice the size of the economy.

GAO’s projection assumes the continuation of certain policies that are scheduled to expire under current law. The most recent projection from the Congressional Budget Office (CBO), by contrast, is based on the assumption that current laws will remain unchanged. For example, several major tax provisions that were enacted in 2017 as part of the Tax Cuts and Jobs Act are scheduled to expire at the end of 2025; GAO’s projection assumes that those provisions will be extended by lawmakers, while CBO assumes that they will be allowed to expire.

Spending Rises. GAO’s report highlights that federal spending would be driven by increases in healthcare programs and interest payments on the national debt. Both of those spending categories are projected to continue to grow faster than the economy over the next 30 years. By 2048, federal spending on healthcare would be equal to 8.6 percent of gross domestic product (GDP), up from 5.4 percent in 2018. Interest payments on the federal debt, which today are equal to 1.6 percent of GDP, would be 6.7 percent of GDP in 2048.

Inadequate Revenues. GAO’s revenue projections for 2019 through 2029 are based on CBO’s alternative revenue estimates, which assume that expiring tax provisions will be extended. After 2029, GAO assumes that revenues will remain constant at 17.4 percent of GDP — their 50-year historical average. Such levels of revenue are a contributor to GAO’s assertion that “absent policy changes, the government’s fiscal path is unsustainable.”

Interest costs surge. Net interest would grow substantially in the long term. In January, CBO projected that net interest payments would surpass the amount spent on non-defense discretionary spending in 2024 and on defense discretionary spending in 2025. GAO’s report adds to that picture by calculating that interest spending would exceed outlays for Medicare in 2042 and for Social Security in 2046. At that point, the government would be spending more on interest than on any single area of the budget.

GAO’s projections add yet another reliable voice raising legitimate concerns about our fiscal position. They join CBO and the Office of Management and Budget in projecting levels of debt that are unsustainable and that result from a fundamental, structural mismatch between spending and revenues. Much like CBO presents a number of policy options to reduce the deficit, GAO highlights actions to solve administrative issues that contribute to our fiscal challenges — such as minimizing improper payments and reducing the tax gap. GAO’s findings are the latest evidence that policymakers should work to manage our debt by making changes to revenues and spending that will improve our fiscal outlook, ensure that we can accommodate future challenges, and invest in the next generation.

Image credit: Getty Images

Further Reading

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.