Here’s How Raising the Minimum Wage Would Affect Everything from Household Incomes to the National Debt

The federal minimum wage of $7.25 per hour has not changed since 2009, although many states have legislated higher amounts. Many economists and policymakers argue that because the minimum wage has not been raised in more than a decade, purchasing power for low-wage workers has declined significantly as their earnings have not kept pace with inflation.

In 2019, the Congressional Budget Office (CBO) examined how increasing the federal minimum wage would affect employment and family incomes. More recently, CBO examined how a specific proposal to raise the minimum wage to $15 per hour by 2025, the Raise the Wage Act of 2021, would affect the federal budget. Taken together, the reports provide an understanding of the effects of increasing the federal minimum wage.

Setting a higher minimum wage would affect family incomes in a variety of ways, including increasing earnings for most low-wage workers and lifting some families out of poverty. However, it would also lead to job losses and could reduce the income of business owners. In addition, a higher minimum wage would increase the federal budget deficit because of additional government spending on wages and some means-tested programs that would only be partially offset by reduced spending for other programs.

Here’s a quick guide on how raising the minimum wage would affect everything from salaries in service industries to the national debt.

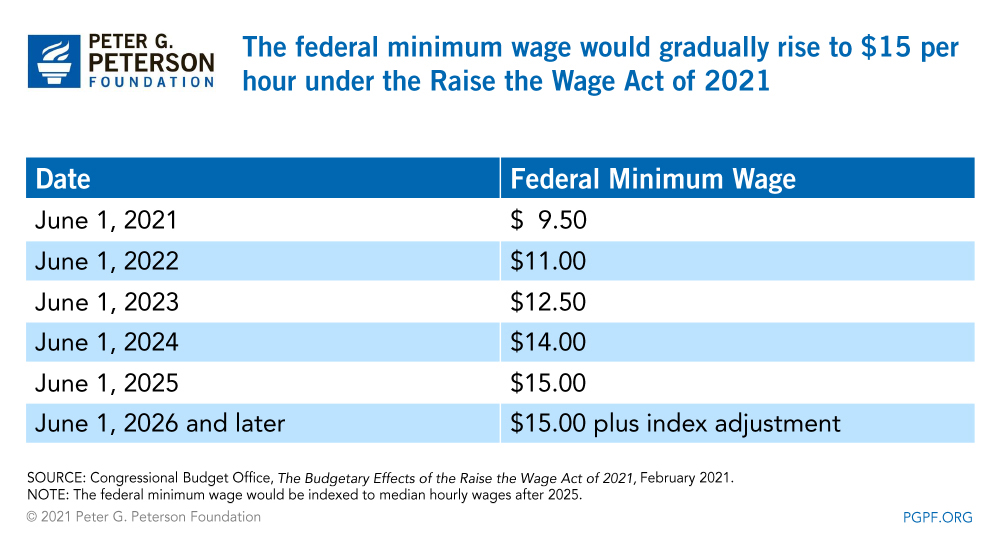

What Changes to the Minimum Wage are Lawmakers Proposing?

Under the proposal lawmakers are considering, starting in June 2021, the federal minimum wage would gradually increase until it reaches $15 per hour in June 2025. In subsequent years, the minimum would be adjusted based on the growth of median hourly wages in the economy. In addition, the legislation would mandate that all workers — including those that currently may earn below minimum wage such as tipped workers, employees under the age of 20, and certain workers with disabilities — be paid the minimum wage by 2027.

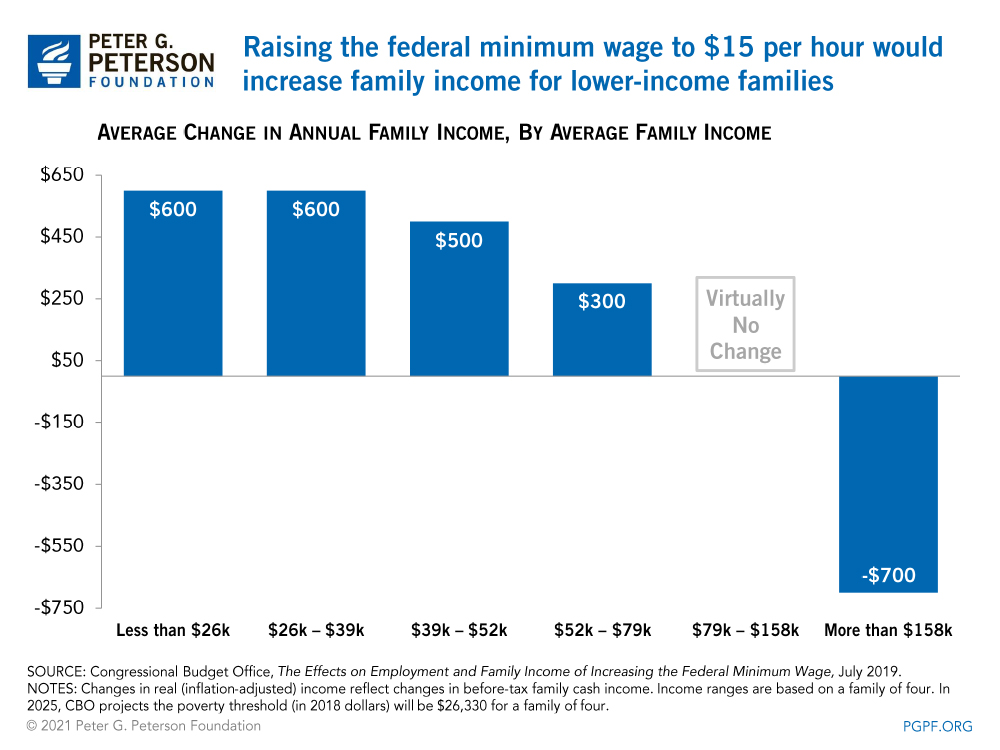

How Would Raising the Minimum Wage Affect Incomes?

Lifting the minimum wage to $15 per hour by 2025 would increase incomes for millions of families. CBO estimates that the increase would directly lift the wages of about 17 million workers who would otherwise earn an hourly rate of less than $15 and boost the wages of 10 million additional workers earning more than the proposed minimum. In 2019, CBO calculated that the annual income for a family living in poverty would increase by an average of $600 in 2025. The annual income for higher-income families — particularly those whose income is six times the poverty threshold or more — would decline by an average of $700 in 2025. That estimate accounts for reductions in income for business owners due to the higher costs of employing low-wage workers. More recently, CBO estimated that a $15 per hour minimum wage would move 0.9 million people out of poverty in 2025, on average.

Would Raising the Minimum Wage Cause Job Losses or Increase Prices?

CBO finds that in response to a minimum wage increase, some employers would reduce employment of low-wage workers or adopt technologies to replace such workers (such as self-checkout kiosks). In addition, business owners may respond to higher wages by passing on the added costs to consumers, which would lead to a drop in consumption and ultimately a decline in certain jobs. On average, CBO estimates that in 2025, employment would be reduced by 1.4 million workers.

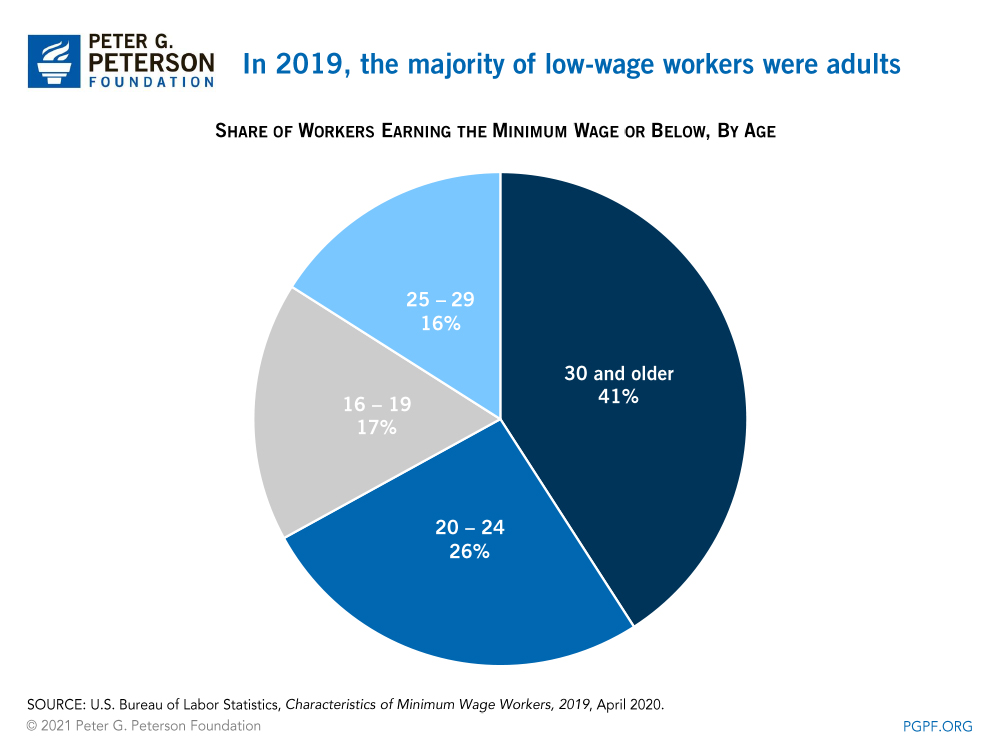

Who Would Benefit from an Increase to the Minimum Wage?

Raising the minimum wage would affect various types of workers. The majority of the 1.6 million workers who currently earn the minimum wage or less are adults. In 2019, the most recent data available, 41 percent of such workers were at least 30 years old according to the Bureau of Labor Statistics. In 2019, more than half of low-wage employees worked in the food industry. Other low-wage employees worked in transportation services, sales, and personal care occupations.

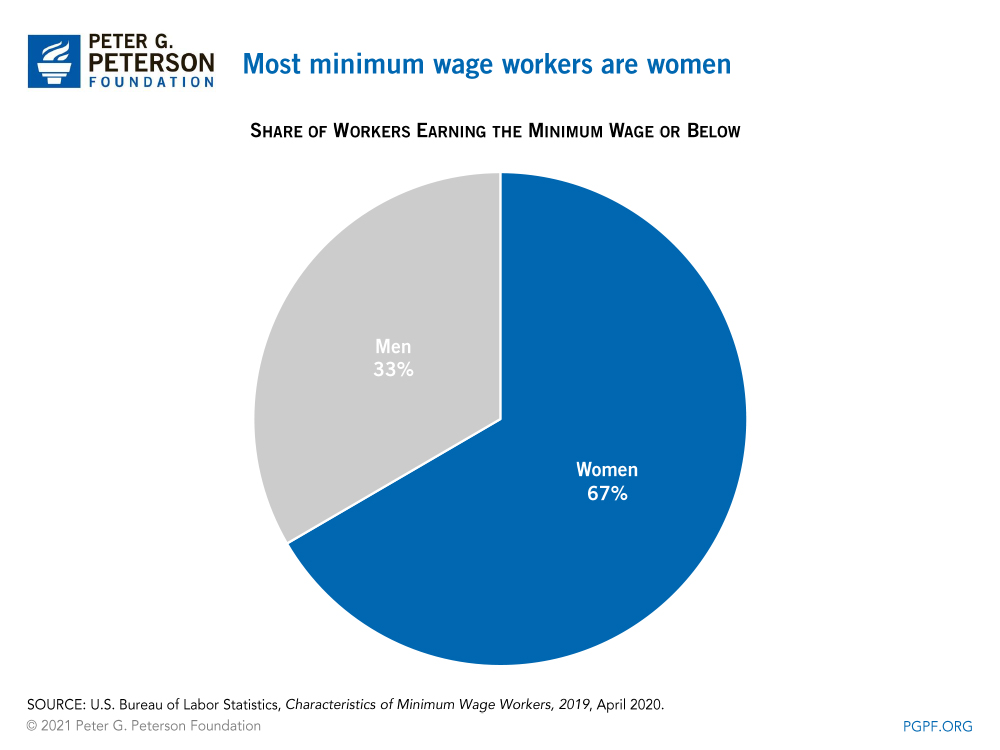

Increasing the federal minimum wage could narrow the gender pay gap. Research by the Economic Policy Institute suggests that when examining median wages per hour, a typical woman is paid 83 cents for every dollar a man is paid. In 2019, women represented 67 percent of workers earning $7.25 per hour or less.

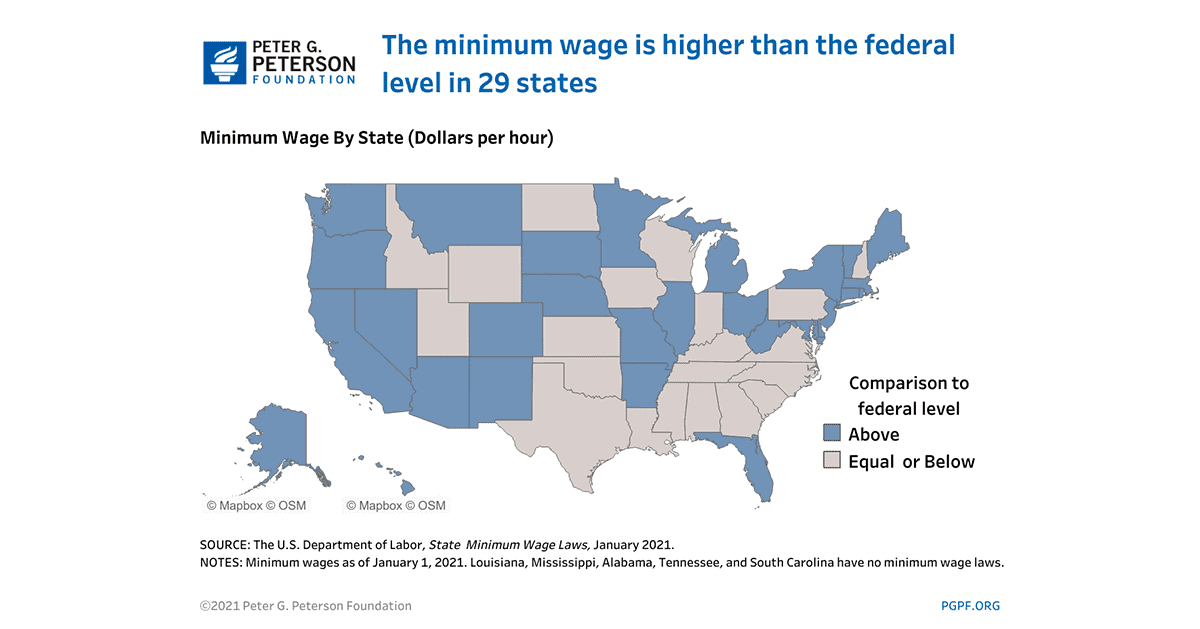

Will Raising the Federal Minimum Wage Affect States?

Currently, minimum wage laws exceed the federal minimum in 29 states; another 14 have minimums equal to the federal level. The rest have either no minimum or it falls below the federal level. Some jurisdictions including New York City, Washington DC, San Jose, San Francisco, and Seattle already have a minimum wage equal to or above the proposed $15 per hour. Some states are already planning increases in the minimum wage similar to that proposed in the Raise the Wage Act; California, Connecticut, Florida, Illinois, Maryland, Massachusetts, New Jersey, and Virginia have scheduled wage increases to $15 per hour by 2026.

How Would Raising the Minimum Wage Affect the Federal Budget?

As the higher minimum wage is phased in, the federal budget would reflect increased government spending partially offset by higher tax revenues.

How Would Raising the Minimum Wage Affect Government Spending?

CBO estimates that spending on government-funded healthcare programs such as Medicaid and Medicare, which pay for home healthcare and nursing care workers, would increase because of higher wages. In addition, spending for Medicaid and the Children’s Health Insurance Program would increase because enrollment by people who lose their job would outweigh the effect of disenrollment by people with higher income. Federal spending would also increase for marketplace subsidies to purchase healthcare as more workers become eligible to enroll.

In addition, workers who become jobless would qualify for unemployment compensation. A higher minimum wage would also drive increased spending for Social Security because initial benefits are tied to economy-wide average wages. In contrast, spending for nutrition programs including the Supplemental Nutrition Assistance Program would decline because additional family income would reduce the number of eligible beneficiaries and their benefit payments.

How Would Raising the Minimum Wage Affect Federal Revenues?

On net, CBO estimates that a higher minimum wage would boost revenues. Higher earnings would increase revenues from payroll and individual income taxes of low-wage workers. That increase would be partially offset by the decline in revenues attributable to higher costs for business owners and lower income for individuals who become jobless.

How Would Raising the Minimum Wage Affect the Federal Deficit?

Over the 2021–2031 period, raising the federal minimum wage to $15 by 2025, and indexing it to median wages thereafter, would increase the cumulative budget deficit by $54 billion according to CBO. In addition, a higher minimum wage would cause interest rates to be somewhat higher than they otherwise would be in the 2021–2031 period due to higher inflation; those interest costs would add another $16 billion to the 10-year budget deficit.

Photo by MangoStar_Studio/GettyImages

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.