Unemployment Insurance (UI) was a critical part of the federal government’s response to the recession caused by the coronavirus (COVID-19) pandemic. Both the massive increase in applicants for unemployment compensation and the temporary expansions to the program boosted federal spending to unprecedented levels early in the pandemic. Now, as the labor market continues to recover and as pandemic-related provisions have expired, federal outlays for UI are rapidly returning to previous levels.

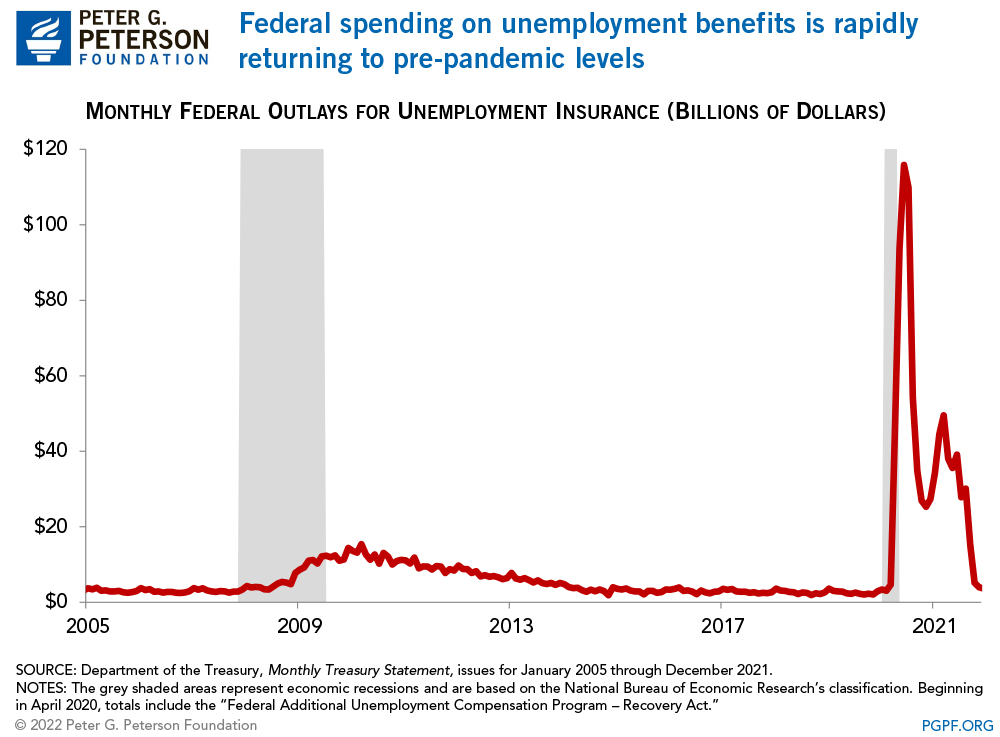

Through the unemployment insurance program, the government provides payments to workers who have been laid off from their jobs. Beneficiaries normally must meet certain eligibility criteria, such as actively seeking employment, though most states temporarily waived or changed the requirements during the pandemic. As a social safety net program that provides benefits to jobless individuals, the unemployment insurance program is designed to grow significantly during economic downturns. Such growth occurred during and immediately after the Great Recession, when federal outlays on unemployment benefits tripled from 2008 to 2010. Spending grew significantly faster when the coronavirus pandemic began — outlays for unemployment insurance were nearly 25 times larger at its peak in June 2020 than they were just three months prior.

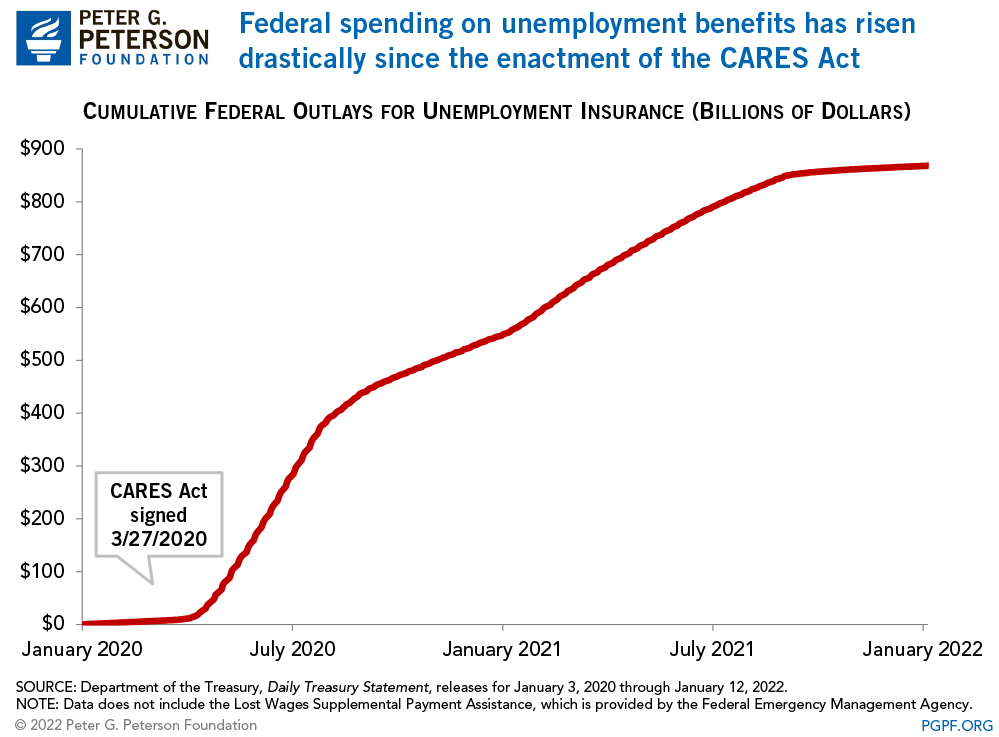

In addition to the rapid rise in the number of people filing for unemployment benefits, legislation enacted to provide economic relief also boosted spending. In particular, the Coronavirus, Aid, Relief, and Economic Security Act (CARES Act) provided states with the option to expand their unemployment programs by offering benefits to those who previously were not eligible, extending insurance payments beyond the regular 26 weeks, and providing an additional $600 in benefits per week through July 2020. The remaining provisions of the CARES Act expired at the end of last year but were restored in lower amounts by the Consolidated Appropriations Act and subsequently extended by the American Rescue Plan. The latest legislation added $300 to weekly benefits, continued the expanded eligibility for benefits, and extended payments through September 6, 2021.

Since the expiration of the COVID-related changes to UI, federal spending on the program has fallen significantly. Federal outlays on UI dropped by 88 percent over the past four months, from $30 billion in August to $4 billion in December. Even before then, outlays had been decreasing as several states withdrew from the enhanced programs before the September expiration and as states began to slowly reinstate work search requirements. Overall, the return to normal spending levels has been significantly quicker than it was after the Great Recession, when such spending took nearly five years to return to the pre-recession average of $3 billion.

Nevertheless, unemployment remains higher than pre-pandemic levels. Policymakers should work to understand how the program could effectively deliver necessary support to those in need in an efficient manner.

Image credit: Photo by Joe Raedle/Getty Images

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.