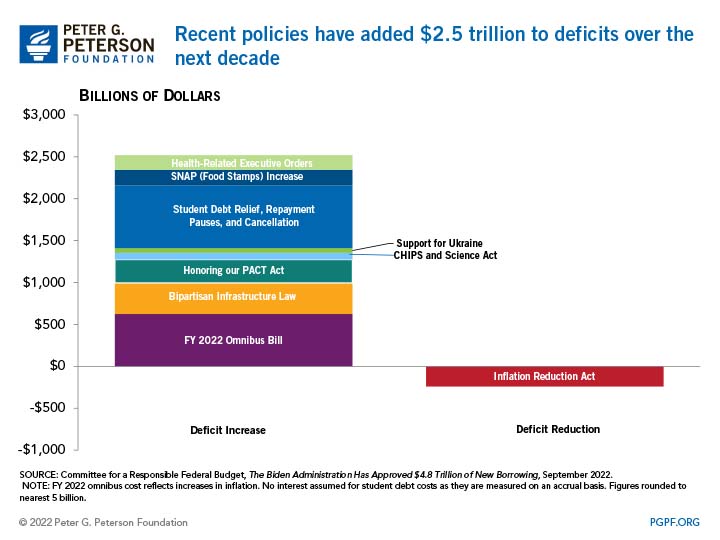

These Eight Decisions by Lawmakers in the Last Two Years Will Add $2.3 Trillion to the National Debt

Just eight actions over the past two years will add an estimated $2.3 trillion to deficits between 2021 and 2031. A recent report by the Committee for a Responsible Federal Budget outlines these decisions, which were included in six pieces of enacted legislation and two executive actions.

1. Health-Related Executive Actions ($175 Billion)

Health-related executive orders addressed three areas with an estimated total cost of $175 billion over ten years, if all the rules are finalized:

- A change in pharmaceutical pricing in Medicare Part D that would require pharmaceutical benefit managers to reflect pharmacy cost savings in consumer prices

- Adjustment to a rule used to implement the Affordable Care Act that would allow more families to be eligible for subsidies

- Revisions to the Medicaid enrollment process, which include standardizing eligibility and enrolment qualifications, limiting renewals to once per year, and giving applicants 30 days to respond to information requests

2. Student Debt Relief ($750 billion)

The cost of the Administration’s policies on student debt relief included the postponement of student debt payments, up to $20,000 federal student debt forgiveness for millions of borrowers, and a new income-based repayment plan. However, those actions are currently awaiting Supreme Court review.

3. FY2022 Consolidated Appropriations Act ($625 billion)

Discretionary budget for 2022 was 6 percent above the amount provided for 2021. If that additional amount is continued over the next decade, it would generate an additional $625 billion in outlays.

4. Bipartisan Infrastructure Law ($370 billion)

The Infrastructure Investment and Jobs Act was a $370 billion package of funding for investments in various transportation infrastructure such as roads and bridges, in addition to areas such as broadband, power, and water.

5. The Honoring Our Pact Act ($280 billion)

The Honoring Our Pact Act expanded veteran health and disability benefits for those diagnosed with health conditions related to exposure to toxic waste in the line of duty. The Congressional Budget Office estimates that the act will add costs of $280 billion over the next decade.

6. The CHIPS and Science Act ($80 billion)

The CHIPS and Science Act contains $80 billion in spending to expand the semi-conductor manufacturing industry and increase funding for the Advanced Manufacturing Investment Tax Credit (which provides a tax credit worth 25% of the investment facilities make in manufacturing semiconductors or semiconductor manufacturing equipment), as well as investments in general innovation and research.

7. Increase in SNAP Payments ($185 billion)

The U.S. Department of Agriculture revised its Thrifty Food Plan, which is used to calculate Supplemental Nutrition Assistance Program (SNAP) benefits; those revisions resulted in a 21 percent increase in the reference plan’s cost, thereby boosting spending over the 10-year period by $185 billion.

8. Support for Ukraine ($55 billion)

Since the onset of the war in Ukraine in February 2022, the Congress has approved $55 billion in spending to support military and humanitarian aid.

With gross federal debt recently reaching $31 trillion it is more important now than ever for our policy makers to redirect their focus to more sustainable spending and borrowing practices. Looking ahead, our debt is projected to grow rapidly due to a structural mismatch between spending and revenue. The good news is that there are many available options for lawmakers to decrease spending, increase revenues, or a combination of both in order to close that gap and put our nation on a stronger fiscal and economic path. With continued inflation and a looming risk of recession, it’s more important than ever for our leaders to make fiscally responsible decisions.

Image credit: Melina Mara-Pool/Getty Images/iStockphoto

Further Reading

The Fed Held Its Target Range After Reducing the Short-Term Rate Three Meetings in a Row

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

How Does the United States’ Fiscal Position Compare to Other Countries’?

The United States is in a poor fiscal condition compared to the rest of the world, according to the OECD.

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.