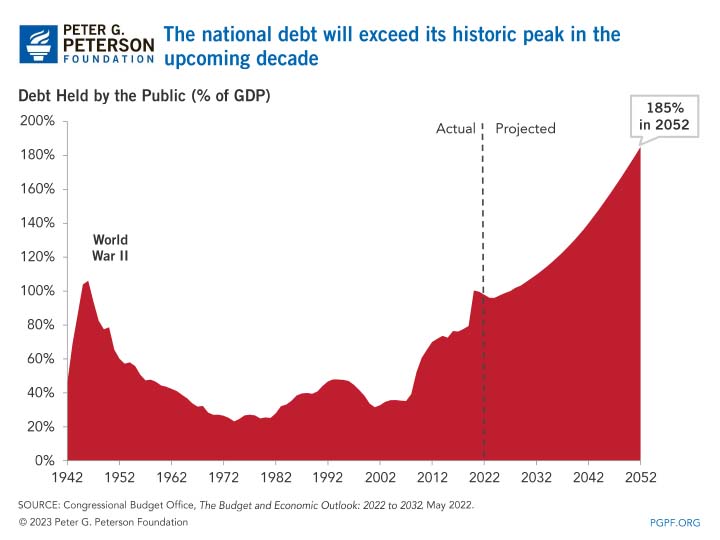

With debt already the size of the entire U.S. economy and on a course to grow to be twice as large, there’s no question that America’s fiscal outlook is daunting. The good news is that there are plenty of ways to reverse course; the nonpartisan Congressional Budget Office (CBO) recently released 76 options to put us on a more sustainable fiscal path.

In two volumes, CBO offers 17 options that would significantly reduce the debt and 59 smaller options, including provisions affecting both the spending and revenue sides of the budget. CBO defines large reductions as either reducing the deficit from 2023 to 2032 by more than $300 billion or, in the case of Social Security options, have a large effect in later decades.

Of the solutions to reduce spending, the options include:

- Changes to Medicaid. CBO addresses two solutions directed toward Medicaid reform. The first is to establish caps on federal spending for Medicaid. Almost all federal funding for the program is open-ended under current law, but if there were overall caps and per-enrollee caps on how much the federal government contributes to each state’s program, the deficit over the next 10 years would be reduced by an estimated $501 billion to $871 billion. Similarly, if federal Medicaid matching rates were reduced, it could save the federal government $68 billion to $667 billion over the next decade depending on the extent of such a decrease.

- Changes to Medicare.One option to reduce the deficit is to address premiums paid for physician and other outpatient services (known as Medicare Part B). Many enrollees pay about 25 percent of expected costs per enrollee, although some higher-income participants pay a higher rate. Increasing the typical contribution and freezing the income thresholds for additional contributions would reduce the deficit by $448 billion over the next 10 years. CBO also estimates that adjusting some of the benchmarks that determine pricing for the Medicare Advantage program would save $392 billion over a decade.

- Changes to Social Security. One option CBO estimates is to set Social Security benefits to a flat amount, which would essentially change the way in which benefits are calculated. The primary insurance amount (PIA) is a key determinant of a worker’s initial benefit, and the option CBO analyzes is to make the PIA the same for all retired or disabled workers. Because the amount would no longer depend on past earnings, workers with high lifetime earnings would see reductions in their benefits, whereas some workers with low lifetime earnings would receive larger benefits than scheduled under current law. Setting that flat amount to 125 percent of the federal poverty guidelines would save the government an estimated $593 billion from 2023 — 2032. Another option would be to reduce Social Security benefits for high earners. That would change the threshold at which PIA factors change, and adding a bend point at the 50th percentile of earners would lead to a reduction of $184 billion over the decade.

- Reduce spending on other programs. Reductions for income security programs, such as the Supplemental Nutrition Assistance Program, the Supplemental Security Income program, and refundable portions of the earned income and child tax credits could amount to $327 billion over the next 10 years. Furthermore, means-testing VA disability compensation would reduce government spending by $253 billion. Another approach would trim discretionary spending. CBO estimates that reducing manpower and implementing other changes to the Department of Defense’s budget would save $995 billion over the next 10 years; reductions in nondefense programs could save the government $332 billion.

CBO also offers 7 large solutions to boost revenues, which include the following:

- Impose a new tax on consumption. A consumption tax generally applies to spending on goods and services. Such taxes include value-added taxes (VATs), retail sales taxes, and excise taxes. More than 160 countries have broad-based VATs, but currently, the United States does not have a broad consumption-based tax at the federal level. The average VAT rate for OECD countries was 19.3 percent in 2020; applying a 5 percent VAT rate to a broad base in the United States would bring in $3 trillion from 2023 — 2032.

- Impose a new payroll tax. Current payroll taxes are tied directly to social insurance programs, such as Social Security and Medicare. CBO evaluates a new payroll tax that would not make any changes to existing payroll taxes, but rather impose a new one that would not be used to finance specific programs. Creating a new payroll tax of 2 percent on earnings, paid by employees, would reduce the federal deficit by nearly $2.3 trillion over the next 10 years.

- Eliminate or limit itemized deductions. When filing for taxes, taxpayers can choose a standard deduction or itemize and deduct certain expenses. Taxpayers benefit from itemizing when the value of deductions exceeds the amount of the standard deduction. CBO finds that if the government were to eliminate itemized deductions entirely, it would decrease the deficit by $2.5 trillion from 2023 – 2032.

There’s no doubt America’s fiscal problems are serious and significant, but CBO’s assortment of options offers lawmakers a deep playbook of spending and revenue changes that would put us on a better path.

Building a sustainable fiscal future will help ensure economic growth and prosperity in the decades to come, and our leaders should take advantage of the many viable options to reduce deficits and improve our outlook for the next generation.

Image credit: Getty Images/Stock Photo

Further Reading

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.

Quarterly Treasury Refunding Statement: Borrowing Up Year Over Year

Key highlights from the most recent Quarterly Refunding include an increase in anticipated borrowing of $158 billion compared to the same period in the previous year.