Interest Is Skyrocketing, and the National Debt Will Reach an All-Time High in Just 5 years

Today, the Congressional Budget Office (CBO) updated their budget projections, showing that rising interest payments and the structural mismatch between spending and revenues continue to fuel the nation’s unsustainable fiscal outlook. Below are some of the key takeaways from CBO’s report:

1. The national debt would reach its highest point in history within the next decade. In 2022, debt held by the public was 97 percent of gross domestic product (GDP). However, by 2028, the structural mismatch between spending and revenues, as well as the nation’s rising interest payments, will cause federal debt to rise above the nation’s historic high of 106 percent, which was reached just after World War II. CBO projects that debt will continue rising, reaching 119 percent of GDP by 2033 and climbing to 195 percent by 2053.

2. Deficits would rise over the decade. Annual budget deficits are projected to rise over the next 10 years, climbing from $1.6 trillion in 2024 to $2.9 trillion in 2033 — with spending exceeding revenues by 40 percent in that year. Relative to the size of the economy, CBO projects that the nation’s budgetary shortfall will climb from 5.8 percent of GDP in 2024 to 7.3 percent in 2033.

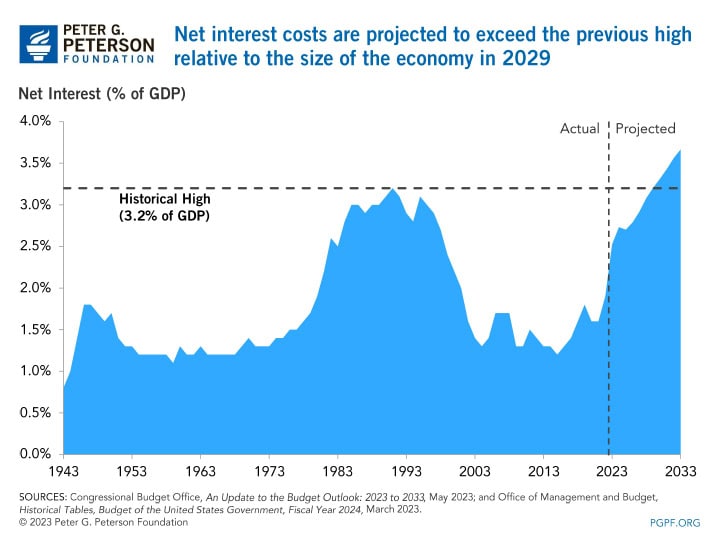

3. Interest costs would nearly triple in the next decade. The Federal Reserve has increased interest rates ten times since early 2022 to combat high inflation — which has contributed to the significant increase in the federal government’s cost of borrowing. In CBO’s projections, such costs would rise from $476 billion in 2022 to $1.4 trillion in 2033. Over the upcoming decade, CBO projects that net interest payments will total $10.6 trillion; relative to the size of the economy, net interest would grow from 1.9 percent last year to 3.7 percent in 2033. In 2029, the ratio of interest to GDP would total 3.2 percent, the highest recorded since 1940 (the first year for which such data are reported).

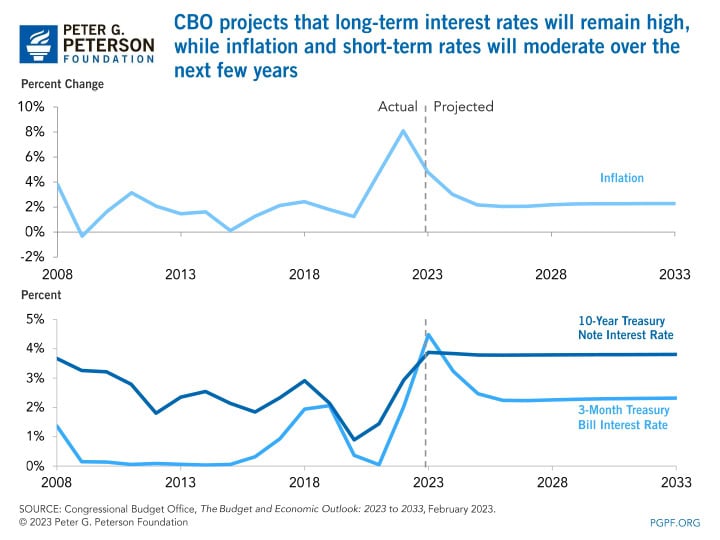

4. CBO anticipates that long-term interest rates will remain near current levels throughout the next decade. CBO did not update their economic projections in the May 2023 report; however, they note that interest rates in the beginning of this year have been higher than they previously expected. The rapid growth in interest payments last year and this year is primarily due to rising interest rates and high inflation. At the beginning of 2022, the interest rate on 3-month Treasury bills (an indicator for short-term rates) were about 0.3 percent while the rate for 10-year securities were 1.9 percent. As the Federal Reserve increased rates and carried out other measures to combat high inflation, interest rates on Treasury securities rose as well. At the end of 2022, such rates rose to 4.1 percent and 3.8 percent, respectively. While CBO projects that short-term interest rates will fall to 2.5 percent by 2025 and average around 2.3 percent throughout 2033, the agency anticipates that long-term rates will remain around the current level of 3.8 percent from 2024 to 2033.

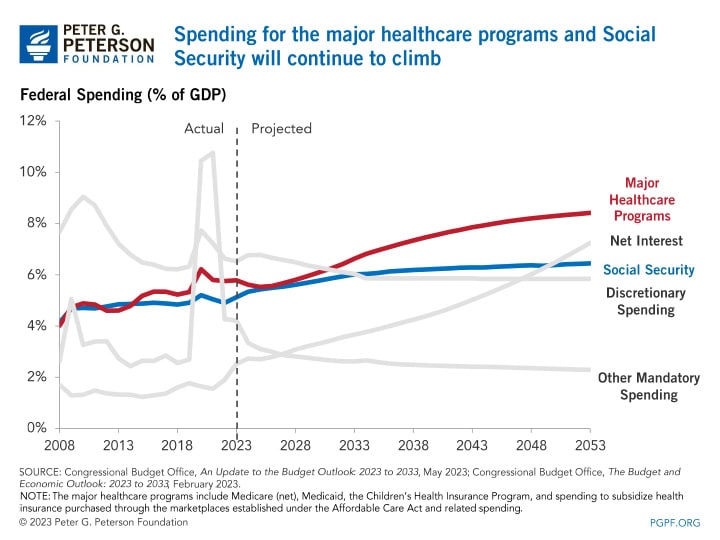

5. Social Security and Medicare are key factors in spending growth. Driven by an aging population and rising healthcare costs, federal spending on such major healthcare programs (Medicare, Medicaid, premium tax credits and related spending, and the Children’s Health Insurance Program) will increase from 5.8 percent of GDP in 2023 to 6.9 percent in 2033, climbing even further in the following years to 8.4 percent by 2053. Spending for Social Security will also rise over that period, from 5.1 percent of GDP in 2023 to 6.0 percent in 2033, reaching 6.4 percent by 2053.

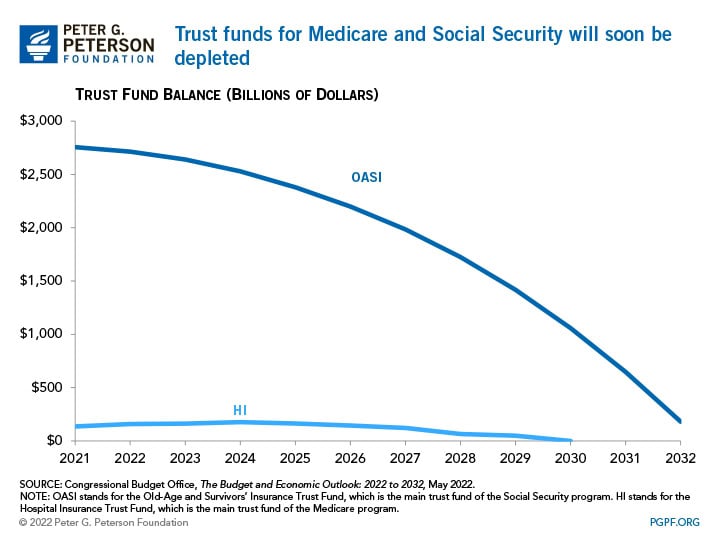

6. Trust funds for both Social Security and Medicare would become depleted within the next decade or shortly thereafter. CBO projects that the balance of Social Security’s Old-Age and Survivors’ Insurance (OASI) Trust Fund will be depleted in 2032. In addition, CBO projects that Medicare’s Hospital Insurance (HI) Trust Fund will be depleted shortly after the end of the 10-year period in 2033. The Highway Trust Fund is projected to be depleted in 2028.

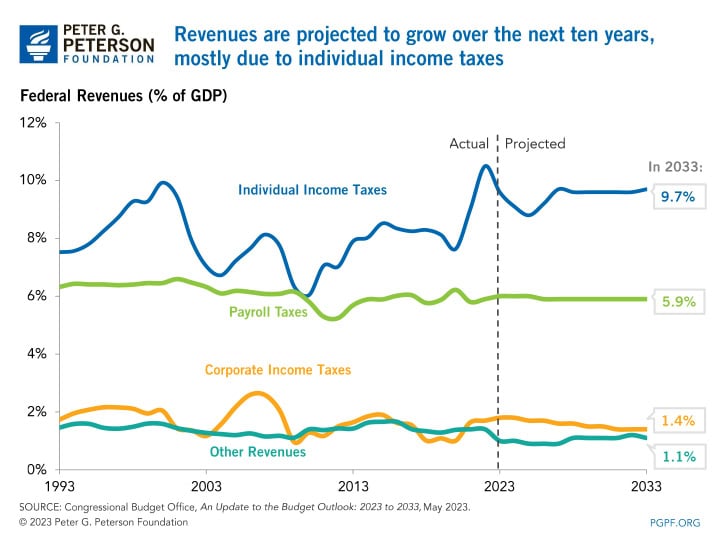

7. Revenues won’t keep pace with the growth in outlays. Relative to the size of the economy, federal revenues are projected to dip over the next couple of years, dropping from 19.6 percent of GDP in 2022 to 17.4 percent in 2025. CBO anticipates that such receipts will climb slightly in the following years, averaging 18.1 percent of GDP from 2026 to 2033, in part because of the expiration of certain individual income tax provisions in December 2025.

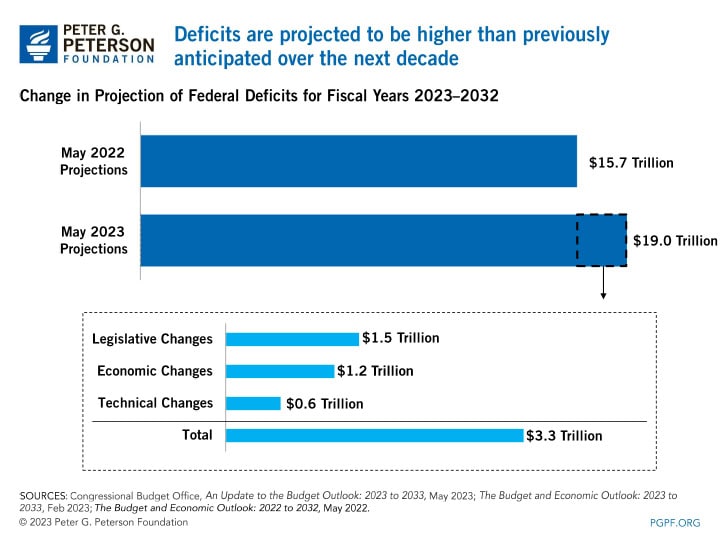

8. The fiscal outlook remains daunting. In May 2022, CBO projected that deficits from 2023 to 2032 would total $15.7 trillion. In the latest report, CBO projects a cumulative deficit of $19.0 trillion over that period. The increase over the past year is primarily due to economic factors, such as higher interest rates, as well as legislation that increased spending for veterans and appropriations for both defense and nondefense programs.

CBO’s report once again shows that the nation’s fiscal trajectory is on an unsustainable path. The structural mismatch between federal spending and revenues, along with the recent rise in interest rates and therefore federal borrowing costs, will pose challenges for the federal budget, our economy and our future if left unaddressed.

Image credit: Photo by Douglas Sacha/Getty Images

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.