The federal government is projected to spend $10.6 trillion on interest payments on the national debt over the next decade, and a breach of the debt ceiling could significantly increase those costs. Unless policymakers take action, the federal government could default on its debt or other obligations in the coming months, thereby exacerbating uncertainty in financial markets. Such uncertainty has led to recent volatility of interest rates on short-term Treasury bills that are set to mature within the next month or two, when the debt ceiling is expected to be binding. That volatility indicates that investors are sensitive to that rapidly approaching date. In addition, economists are concerned that a default on U.S. debt, even if it’s short-lived, could have severe consequences on federal borrowing costs.

When Will the United States Breach the Debt Ceiling?

On January 19, 2023, the United States once again hit its debt ceiling, which is currently capped at $31.4 trillion. Around that time, the Treasury Department began implementing “extraordinary measures” to manage its cash flows in order to stave off default. While those accounting maneuvers helped buy the federal government some time, the “X date” — the time when the federal government can no longer fully meet its obligations — is fast approaching because commitments for federal spending vastly exceed revenues to cover them.

Estimates for the X date range from June to September of this year. However, the Treasury and other observers have warned that there is a greater risk that the U.S. government will reach the X date by early June due to lower-than-anticipated tax receipts from April payments.

How Is the X Date Affecting Interest Rates on Treasury Bills?

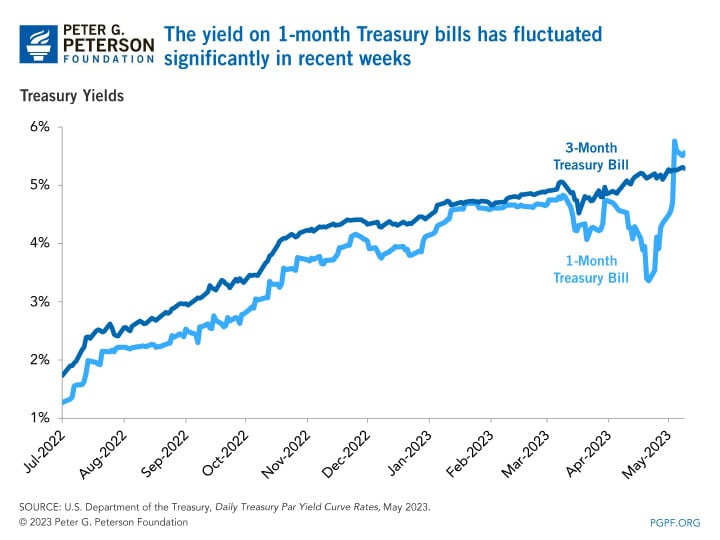

While short-term interest rates have been rising in concert with increases in the Fed Funds rate over the past several months, some of those rates have fluctuated in recent weeks as investors have started to shift their behavior in response to the anticipation of the X date. Most notably, investors have favored Treasury securities that mature before the likely debt ceiling deadline, while demanding higher rates for Treasury bills that would mature around the anticipated X date to compensate for higher risk.

For example, yields on one-month Treasury bills that mature before the anticipated X date plummeted in recent weeks, reflecting heavier demand for those securities as investors did not expect any interruptions on the repayment of those assets. The yield on such securities dropped from 4.74 percent for bills issued on March 31, 2023, to 3.36 percent for bills issued on April 21, 2023. At the same time, yields on three-month Treasury bills that mature throughout the summer — when the X date is expected to occur — continued to climb from 4.85 percent to 5.14 percent over that time. That led to the largest-ever spread between one-month and three-month Treasury yields.

That gap began to close in the days following April 21, however, as uncertainty around the X date intensified. On May 1, the Department of the Treasury announced that the U.S. government may run out of funds by early June — meaning newly issued 1-month Treasury bills faced a higher risk of maturing after the X date. In the days following that announcement, the yield on such securities climbed rapidly — rising from 4.35 percent prior to the Treasury’s announcement, to 5.76 percent by May 4.

Any Breach of the Debt Ceiling Could Increase Interest Payments on the National Debt and Severely Damage the Economy

Short-term fluctuations in interest rates likely will have a negligible impact on the federal government’s total borrowing costs. However, if the debt ceiling is not lifted, higher rates could become a permanent fixture of federal borrowing. U.S. Treasury securities are seen by many investors as a risk-free investment, as they are backed by the full faith and credit of the U.S. government. In fact, some economists have estimated that the interest rate on U.S. Treasury securities is 0.25 percentage points lower, on average, than other sovereign securities because of that backing. According to the Brookings Institution, the creditworthiness of the U.S. government translates to about $50 billion in interest cost savings this year and around $750 billion over the next decade. However, a breach of the debt ceiling may forfeit at least part of that advantage — pushing interest payments up even higher.

Furthermore, a default on U.S. debt would inflict significant damage on the U.S. economy and on American households. An analysis by Moody’s Analytics found that even a short-term breach of the federal debt limit could reduce gross domestic product, result in the loss of 2 million jobs, and wipe out trillions of dollars in U.S. household wealth. A prolonged breach of the debt ceiling would likely amplify those effects.

Conclusion

As the debt ceiling deadline approaches, lawmakers should work together to find a solution that avoids damaging the creditworthiness of the United States and helps build a stronger, more sustainable fiscal foundation for the future. The good news is that there are plenty of options available.

Image credit: Photo by Kevin Dietsch/Staff

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.