Lawmakers resolved the latest debt-limit standoff by enacting the Fiscal Responsibility Act of 2023 on June 3, 2023. The legislation suspends the debt limit through January 1, 2025 and implements caps on discretionary funding for fiscal years 2024 and 2025. It also includes other provisions related to discretionary programs and adjusts work requirements for certain income-support programs.

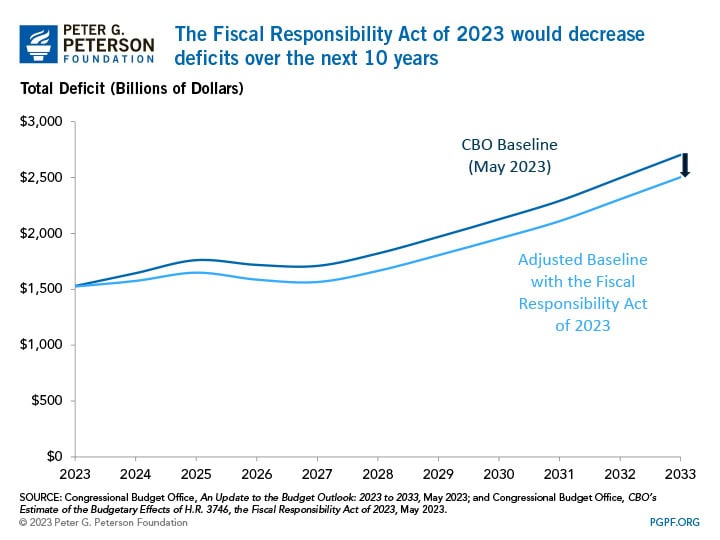

According to the Congressional Budget Office (CBO), those provisions will result in a $1.5 trillion decrease to the deficit over the next 10 years. Much of those savings stem from the imposition of caps — which limit the amount of discretionary spending — and the extrapolation of lower levels of funding for the next two years. CBO anticipates that such a reduction in deficits would reduce the amount of debt held by the public in 2033 from 119 percent of GDP to 115 percent.

Although CBO produced an estimate, there is not universal agreement on the magnitude of savings that will actually be generated from restrictions on discretionary spending, especially after the next two years when the caps expire. The Committee for a Responsible Budget, for example, estimates that depending on how appropriations play out over the next couple of years, the savings from the act could total between $250 billion and $2.1 trillion over the upcoming decade.

Regardless of the eventual total savings from the act, it is clear that the legislation makes only a small dent in the fiscal gap. Using CBO’s estimate of the effect of the act, deficits over the next decade will still total nearly $19 trillion and continue rising in the future. Without addressing the true drivers of the fiscal trajectory — spending on older Americans, rising healthcare costs, and insufficient revenues to cover promises that have been made — the country is still in a precarious position.

Image credit: Photo by Chip Somodevilla / Staff/Getty Images

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.