On August 1, 2023, Fitch Ratings, one of three major credit rating agencies, downgraded the U.S. long-term credit rating from its top mark of AAA to AA+, citing an “erosion of good governance” as one of the central reasons for that action. The debt ceiling crisis earlier this year and the current uncertainty surrounding a potential government shutdown are two high-profile examples of government dysfunction. Governance issues can harm the U.S. economy as well as decrease the country’s standing in financial markets, which has implications for interest costs and the nation’s fiscal sustainability.

The Erosion of Good Governance

In Fitch’s assessment, “there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters.” Specifically, the repeated debt-limit political standoffs have highlighted the country’s growing inability to handle fiscal matters. Just this year, on January 19, the United States hit its debt ceiling because lawmakers could not come to an agreement about raising it. Through the use of what is known as extraordinary measures, lawmakers were able to buy time until an agreement could be made over five months later to suspend the debt ceiling until January 1, 2025. If an agreement had not been reached and the Treasury were prevented from borrowing, a recession, a sharp rise in unemployment, disarray within financial markets, and lasting reputational damage to the U.S. were all possible, according to the Center for American Progress. In total, the debt ceiling has been raised or suspended 21 times just since 2001, and few have been without incident.

Fitch also took issue with the repeated use of last-minute resolutions in the appropriation process. Congress has not completed the full set of appropriations on time since FY97. Instead, the government relies on continuing resolutions (CRs) — temporary stopgaps used to avoid a partial shutdown and give lawmakers more time to pass the appropriation bills. Since FY98, lawmakers have passed 132 CRs.

If the appropriations are not enacted by the start of the fiscal year, or the CR elapses without another in place, some government activities would shut down. During the FY14 shutdown, the Congressional Research Service expressed concern that the episode marked the beginning of a series of future disruptions and that the pattern of brinksmanship could lead to “lasting effects on confidence and uncertainty.” In 2015, Fitch echoed that concern by noting that “sustained fiscal uncertainty could have a detrimental effect on the U.S. economy and lower market confidence in the authorities’ ability to deal with longer-term fiscal challenges.” Since then, the government has shut down two more times. S&P Global, another of the major credit agencies and the first to downgrade the United States, warns a shutdown would “highlight growing political dysfunction in the U.S., potentially posing further credit risk.” Moody’s Investors Service, the last major credit agency yet to downgrade the nation's credit, has warned that a shutdown would “underscore the weakness of US institutional and governance strength relative to other AAA-rated sovereigns."

The Potential Fiscal Impact of a Credit Downgrade

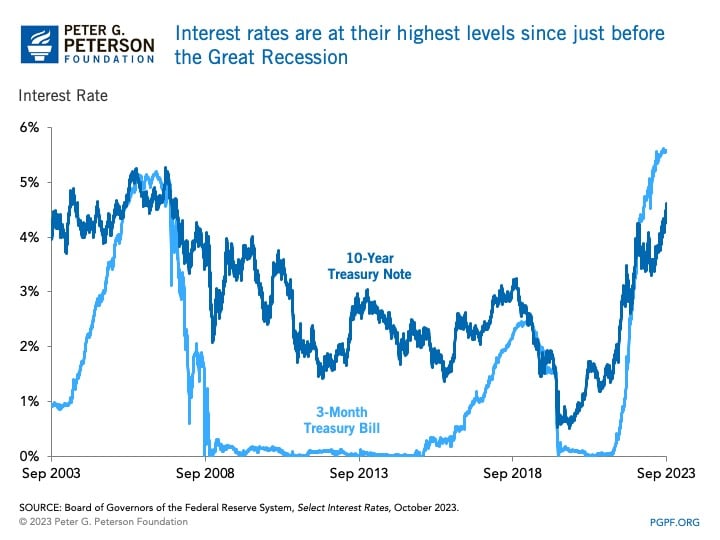

Lower credit ratings typically raise the country’s cost of borrowing and can contribute to a vicious cycle of rising interest costs that increase the country’s debt burden. Over the past few years, interest rates have increased dramatically and are now at a 16-year high of 4.7 percent. That, according to Manhattan Institute’s Brian Riedl, “is basically catastrophic for long-term federal deficits.”

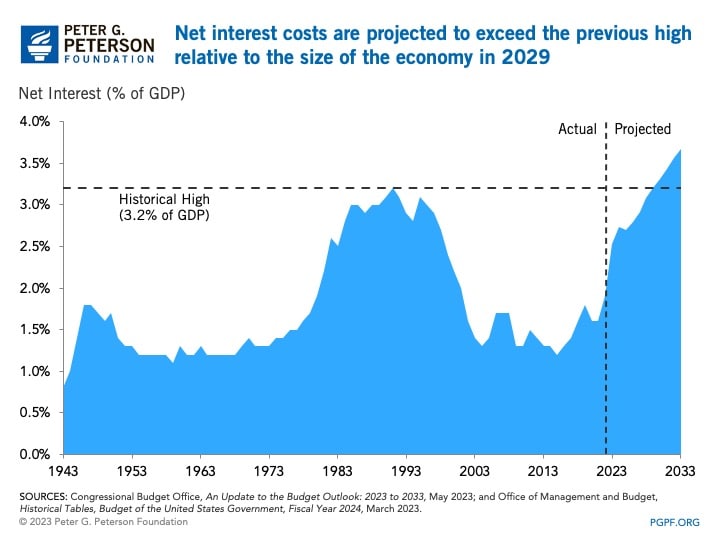

Previous low interest rates allowed the government to borrow more without increasing the interest payment burden relative to GDP — but that has changed. Between 2007 and 2020, interest costs averaged 1.5 percent of GDP. Such costs have been rising over the past couple of years, though, and are projected to exceed their historical high of 3.2 percent of GDP by 2029.

The U.S. fiscal outlook, already unsustainable, could worsen if the country’s credit is downgraded yet again, increasing rates and fueling higher than expected interest costs. If interest rates are sustained at 1 percentage point higher than expected, the White House estimates that would add $2.8 trillion to deficits through 2033.

Conclusion

The Fitch downgrade highlighted the nation's governance issues and fiscal challenges. Now, less than two months after the nation’s second-ever credit rating downgrade, policymakers have had to rely on yet another CR to temporarily continue government activities. There is still time to avoid a shutdown before November 17, and solutions are available to improve the country’s fiscal trajectory by returning to regular order and responsible budgeting.

Image credit: Getty Images/iStockphoto

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.