The Congressional Budget Office (CBO) now expects interest rates over the next two years to be higher than previously anticipated, according to new data released on December 15. The agency also anticipates that economic growth will be slower over the next few quarters. Forecasts for other major economic indicators, such as unemployment and inflation, were also revised to reflect new expectations.

Changes to Interest Rate Projections

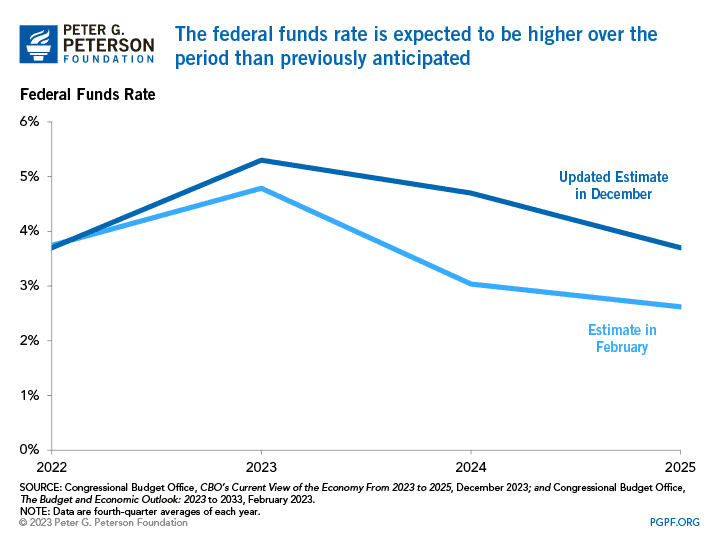

In CBO’s last full set of economic projections, which were released in February, the organization estimated that interest rates on the federal funds rate would rise to a fourth-quarter average of 4.8 percent in 2023 before falling to 2.6 percent by mid-2025.

However, the Federal Reserve increased the target federal funds rate by more than CBO anticipated in order to address inflationary pressures and higher-than-expected economic growth during the year. In the December report, CBO estimates that the federal funds rate will average 5.3 percent in the fourth quarter of 2023 before falling to 3.7 percent by the end of 2025.

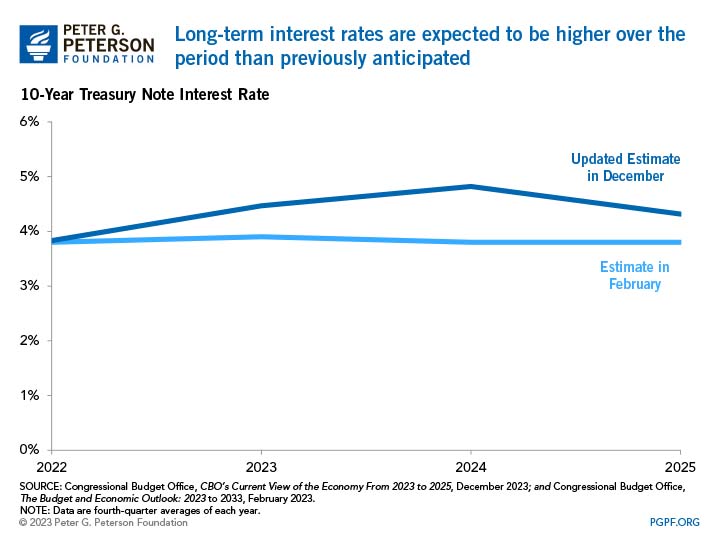

In February, CBO estimated that the interest rate on 10-year Treasury notes would average 3.9 percent during the fourth quarter of 2023. The 10-year rate was expected to remain at around that level through 2025. CBO now expects 10-year Treasury notes to average 4.5 percent in the fourth quarter of 2023 and rise a little further next year, before falling to 4.3 percent in 2025.

Changes to Economic Growth and Other Projections

In its February forecast, CBO projected that real (inflation-adjusted) gross domestic product (GDP) would grow by 0.1 percent from the fourth quarter of 2022 to the fourth quarter of 2023. That forecast assumed that the economy would quickly rebound, though, to 2.5 percent during mid-2024 and early 2025 before reaching 2.6 percent by the end of 2025.

In CBO’s updated projections, real GDP growth in 2023 is expected to be 2.5 percent, significantly higher than the expectation for the year in February. However, CBO now anticipates that economic growth will slow to 1.5 percent in 2024 and rebound to 2.2 percent by the end of 2025.

CBO revised its February projections for unemployment in the fourth quarter of 2023 downwards from 5.1 to 3.9 percent to reflect the faster-than-expected economic growth this year. The unemployment rate is expected to remain below the previous fourth-quarter average estimates of 4.8 and 4.6 percent through 2024 and 2025, respectively, at around 4.4 percent.

Consistent with previous estimates, inflation as measured by the Personal Consumption Expenditures price index is expected to slow in 2024. CBO revised inflation expectations for 2023 downwards by half a percentage point (from 3.3 to 2.9 percent) and expects that the Fed will be close to its 2 percent target by the end of next year.

How Changes in Economic Indicators Influence the Federal Budget

Fiscal health and economic strength are closely related, and CBO’s revised economic projections draw attention to the fiscal challenge in the United States.

As interest rates rise, so does government spending. Higher interest rates make it more expensive for the government to borrow money to fund its obligations. That leads to accumulation of more debt and the potential for crowding out investment in other government priorities to pay increasing interest costs. Unfortunately, interest is already the fastest-growing area of the government budget, and increases in interest rates only intensify that trend.

When expectations for GDP growth decrease, so do anticipated government revenues. CBO’s forecast for lower economic growth over the next couple of years means that revenues are likely to be lower than CBO previously projected as well.

CBO already projects that deficits will exceed $1.5 trillion this year and beyond. Higher interest rates and lower economic growth imply that deficits could be even larger. It is essential that policymakers prioritize solutions to solve the fiscal challenge and establish a sustainable path for the United States.

Image credit: Alex Wong/Getty Images

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.