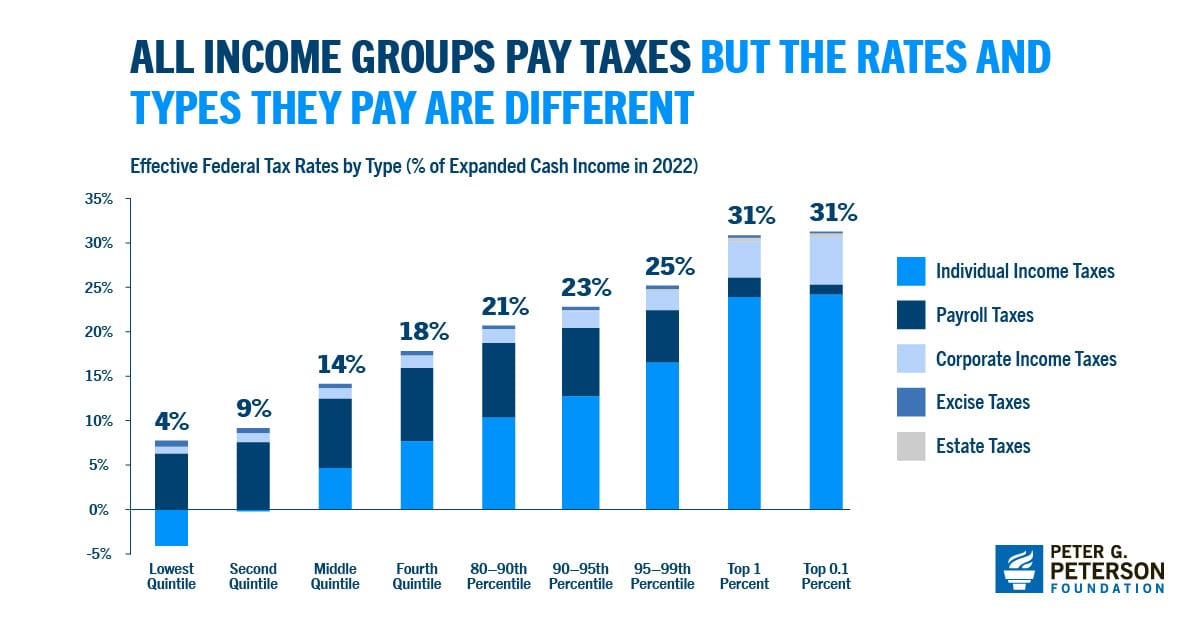

One issue that most lawmakers and voters agree on is that our tax system needs reform. It is confusing, complex, and favors some individuals and economic activities over others. Exactly how to improve the tax code, however, can be a hotly contested issue — which is further complicated by common misconceptions about how the current system works.

Many observers have called for simplifying the current tax code to reduce preferences and make it easier to understand. The Administration in its recent budget proposed tax reforms that would target higher-income taxpayers.

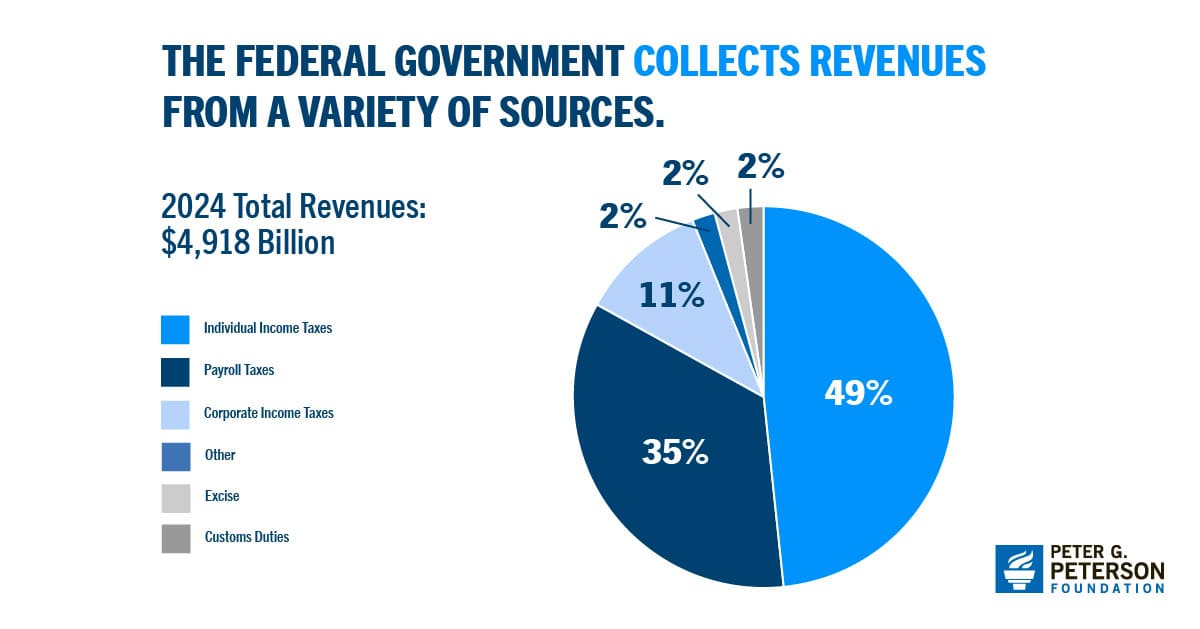

Before we can begin to assess the value of specific proposals, it helps to look at the big picture of how the system works. Check out the infographic below for an overview of the system and then test how much you have learned with our tax quiz.

Further Reading

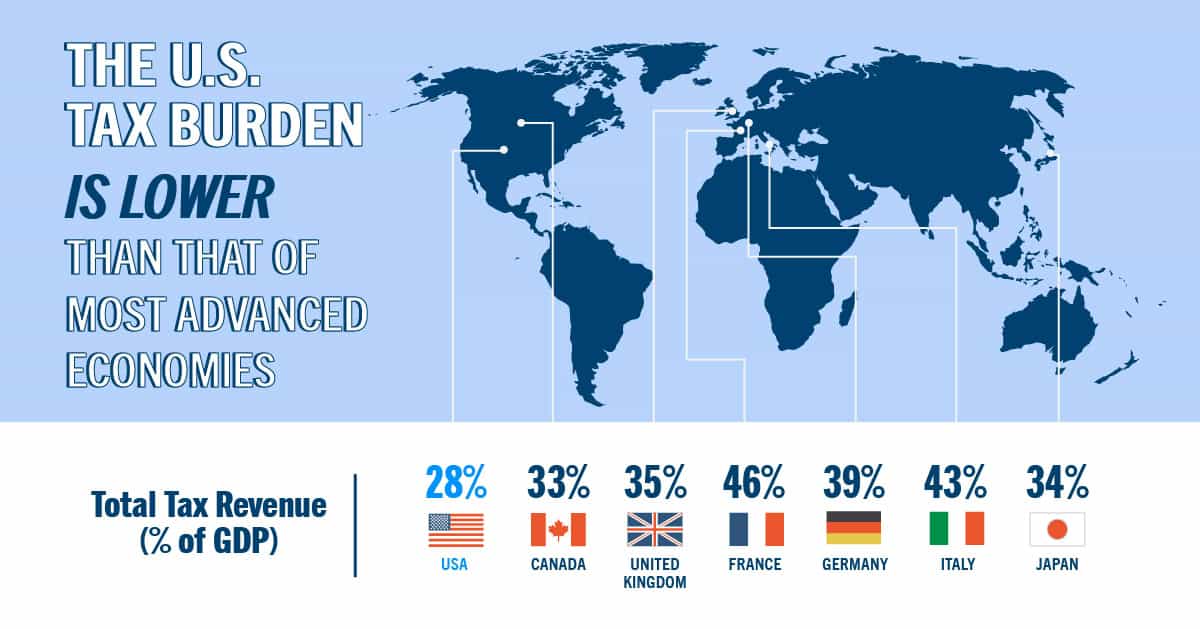

The United States Collects Less Tax Revenue Than Other G7 Countries

The U.S. collects less tax revenues compared with other G7 countries, and that lower level of revenues is a key driver of the national debt.

Energy Tax Policy Under the OBBBA

As part of the OBBBA, lawmakers rolled back existing energy tax incentives in order to partially offset the bill’s deficit impact.

What Are Refundable Tax Credits?

The cost of refundable tax credits has grown over the past several years, with the number and budgetary impact of the credits increasing.