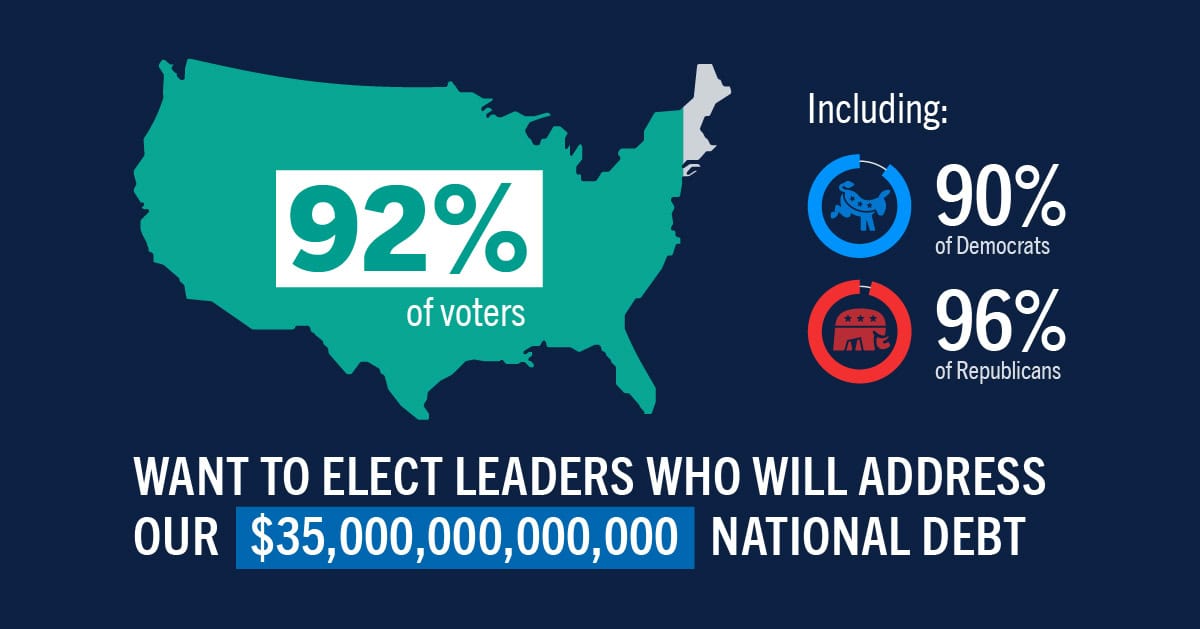

The lawmakers we choose this November will face critical fiscal and economic decisions in the next two, four, and six years.

Starting in 2025, the president and Congress will confront a series of urgent deadlines and decision points. The choices our leaders make will determine how much families and businesses pay in taxes, whether or not there are automatic cuts to Social Security and Medicare, the affordability of healthcare under the ACA, and what to do about the debt ceiling. Undoubtedly, 2024 is a Fiscal Election.

Want to share this image on your site? Copy and paste the embed code below:

<img src="http://www.pgpf.org/sites/default/files/Infographic-The-2024-Fiscal-Election.jpg" width="620" alt="The Fiscal Election">

<a href="https://www.pgpf.org/infographic/the-fiscal-election-whats-at-stake-in-this-election">

</a><p><strong>The Fiscal Election</strong>, courtesy of <a href="https://www.pgpf.org/infographic/the-fiscal-election-whats-at-stake-in-this-election">Peter G. Peterson Foundation</a></p>Feel free to share this infographic on Twitter.

Tweet: The lawmakers we choose this November will face critical fiscal and economic decisions.

Further Reading

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.