CBO Report Should Motivate Lawmakers to Take Action on Debt

NEW YORK — Michael A. Peterson, Chairman and CEO of the Peter G. Peterson Foundation, commented today on the release of the 2018 Long-Term Budget Outlook by the nonpartisan Congressional Budget Office (CBO):

“Today’s report confirms that our nation’s fiscal outlook is on a dangerous and unsustainable path. With substantial imbalances between spending and revenues projected well into the future, we are on course to burden America’s children with trillions more in debt and hurt their economic opportunities. The debt outlook would be even more dire if lawmakers extend the tax cuts and higher spending levels that were enacted in recent months.

“CBO’s report is filled with sobering projections that should be an urgent wakeup call for the Administration and Congress. Annual budget deficits are on track to eclipse $1 trillion in just two years, and continue growing as far as the eye can see. Our overall debt will rise to 152% of GDP over the next three decades, nearly doubling today’s level and far surpassing the highest level in American history. As the nation continues to borrow and sink deeper in debt, interest has become the fastest growing category in the budget.

“This new report should motivate policymakers to pay for their priorities and act on the many available solutions to secure our collective future.”

In its new report, CBO projects:

- Debt is projected to climb from 78 percent of GDP at the end of 2018 to 152 percent at the end of 2048.

- The annual deficit is projected to grow from 3.9 percent of GDP in 2018 to 9.5 percent of GDP in 2048, or from $0.8 trillion to $6 trillion.

- Driven by Social Security and Medicare as well as by rising interest payments, spending as a share of GDP is projected to grow by 8.7 percentage points over 30 years, outstripping projected growth in revenues of 3.2 percentage points.

- Interest payments would be the third largest category of the budget by 2026 and would be tied with Social Security as the largest category by 2048.

Further Reading

Top 10 Reasons Why the National Debt Matters

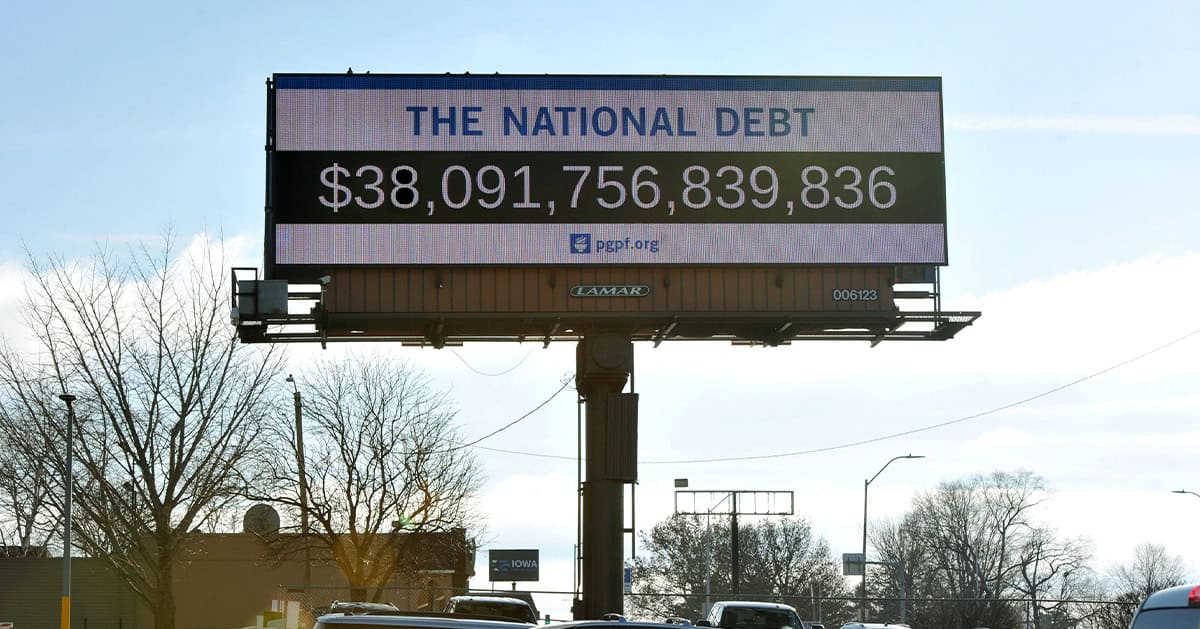

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

Lawmakers are Running Out of Time to Fix Social Security

Without reform, Social Security could be depleted as early as 2032, with automatic cuts for beneficiaries.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.