National Commission on Fiscal Responsibility and Reform November 2010

The Co-Chairs of the President’s National Commission on Fiscal Responsibility and Reform, Erskine Bowles and Alan Simpson, released a draft of their recommendations for deficit reduction and debt stabilization on November 10, 2010. This “Chairmen’s Mark” represents the starting point for the 18-member Commission’s efforts to report out a final package of recommendations, which are due December 1.

The U.S. faces serious, long-term structural budget imbalances driven in part by escalating health care costs, increasing longevity, and large demographic shifts. At the same time, the country’s economy is still recovering from the effects of the financial crisis and the “Great Recession”. As the introduction of this draft argues, “The problem is real, the solution is painful, there’s no easy way out, everything must be on the table, and Washington must lead.”

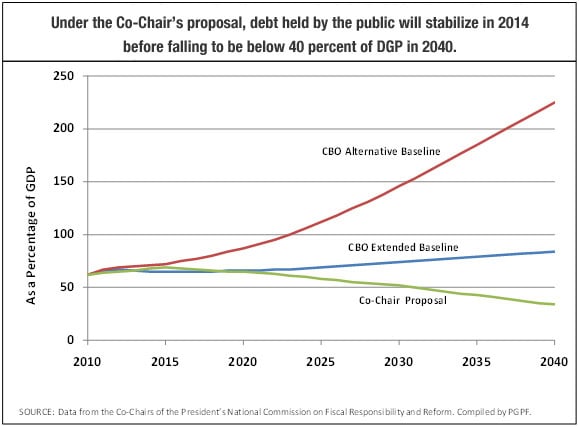

Absent reform, the U.S. will face an unprecedented level of debt of more than twice the size of the economy within 30 years. Our structural imbalances will threaten our standards of living, our ability to attract domestic investment, and our standing in the international community. The plan outlined in the co-chairmen’s draft is ambitious and comprehensive, and puts “everything on the table.” The plan’s recommendations are divided into two parts: those designed to achieve deficit reduction and stabilize the national debt at an affordable level; and those that will improve Social Security‘s financial condition. The deficit reduction section is split further into three parts: discretionary spending cuts (to both defense and non-defense discretionary spending); tax reform; and mandatory budget options (which address both health care and other mandatory spending). View the Co-Chairmen’s proposal here.

Some key highlights from the plan include:

- Achieves $4 Trillion in deficit deductions through 2020

- Reduces the Deficit to 2.2 percent of GDP by 2015

- Reduces tax rates and simplifies the tax code

- Caps revenue at 21 percent of GDP and reduces spending to 21 percent of GDP

- Stabilizes the debt in 2014, then reduces it to 60 percent of GDP by 2024

- Reduces the debt at 40 percent of GDP by 2037

- Stabilizes Social Security’s finances while preventing senior poverty, and distributing the burden of solving Social Security’s problems to those who have higher incomes

Further Reading

The Fed Held Its Target Range After Reducing the Short-Term Rate Three Meetings in a Row

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

How Does the United States’ Fiscal Position Compare to Other Countries’?

The United States is in a poor fiscal condition compared to the rest of the world, according to the OECD.

The United States Collects Less Tax Revenue Than Other G7 Countries

The U.S. collects less tax revenues compared with other G7 countries, and that lower level of revenues is a key driver of the national debt.