What Is Fiscal Policy? Interactive Teaching Tools

Many Americans, young and old, may be confused by the complex set of issues that comprise how the government raises revenues and allocates them.

Read MoreHow the Lack of Action on the Debt Ceiling Can Hurt the Economy

Even though the government has never defaulted, the continued pattern of brinksmanship has negative consequences for our economy.

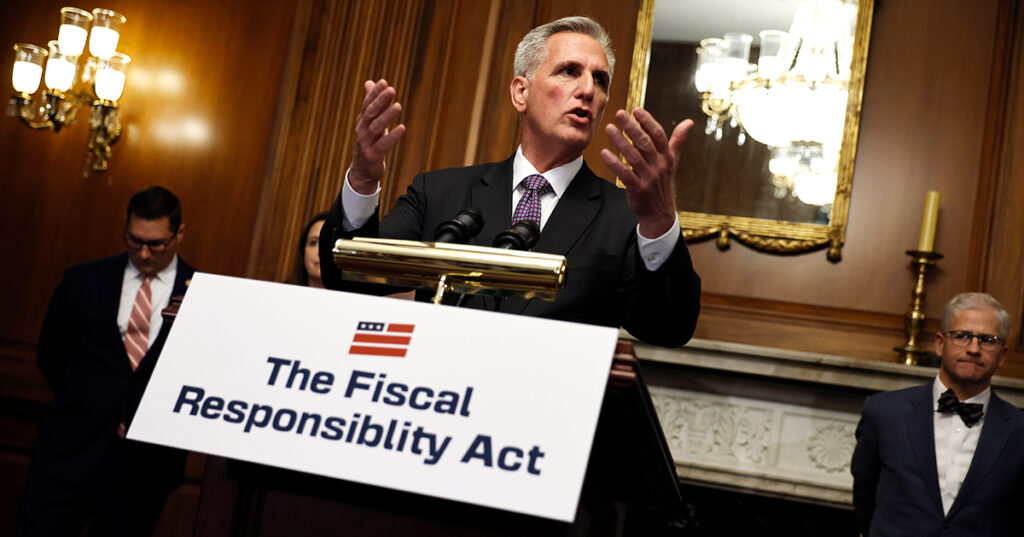

Read MoreHow Much Will the Debt Ceiling Deal Reduce Deficits?

According to CBO, provisions in the Fiscal Responsibility Act of 2023 will result in a $1.5 trillion decrease to the deficit over the next 10 years.

Read MoreWhat Are Caps on Discretionary Spending and Do They Work?

Let’s look at the trends in discretionary spending and how effective caps are in reducing the debt.

Read MoreHow Much COVID Funding Remains Unspent?

As part of a potential deal to raise the debt ceiling, policymakers are considering rescinding remaining funding for COVID-19 relief.

Read MoreBreaching the Debt Ceiling Could Make Federal Borrowing More Expensive

The recent volatility in interest rates shows that breaching the debt ceiling could make federal borrowing much more expensive.

Read MorePayroll Taxes: What Are They and What Do They Fund?

Most working Americans are subject to payroll taxes, which are usually deducted automatically from an employee’s paycheck. Employers are also often subject to these types of taxes.

Read MoreFive Different Ways of Raising Taxes on the Wealthiest Americans

Many options exist to reduce the imbalance between spending and revenues, including additional taxes on wealthier Americans.

Read MoreHealthcare Spending in the United States Remains High

Healthcare spending in the United States totaled 18.3 percent of gross domestic product (GDP) in 2021.

Read MoreAlmost 25% of Healthcare Spending is Considered Wasteful. Here’s Why.

The United States has one of the most expensive health systems in the world, hampering the country’s fiscal and economic well-being.

Read More