Leading Economists: The Economy Bounced Back Fast, But Major Questions Remain

Amid a complicated economic and fiscal environment, two top economists joined a panel discussion as part of the Peterson Foundation Economic Forum.

Read MoreThe Labor Market Recovery Continued in October

There were 531,000 jobs added in October. However, the unemployment rate remains high, especially for non-white workers.

Read MoreDelta Variant Slows Economy, But Output Still Better Than Pre-Pandemic Levels

The economy continued to grow in the third quarter of 2021, but at a slightly slower pace than previous quarters due to the delta variant of COVID-19.

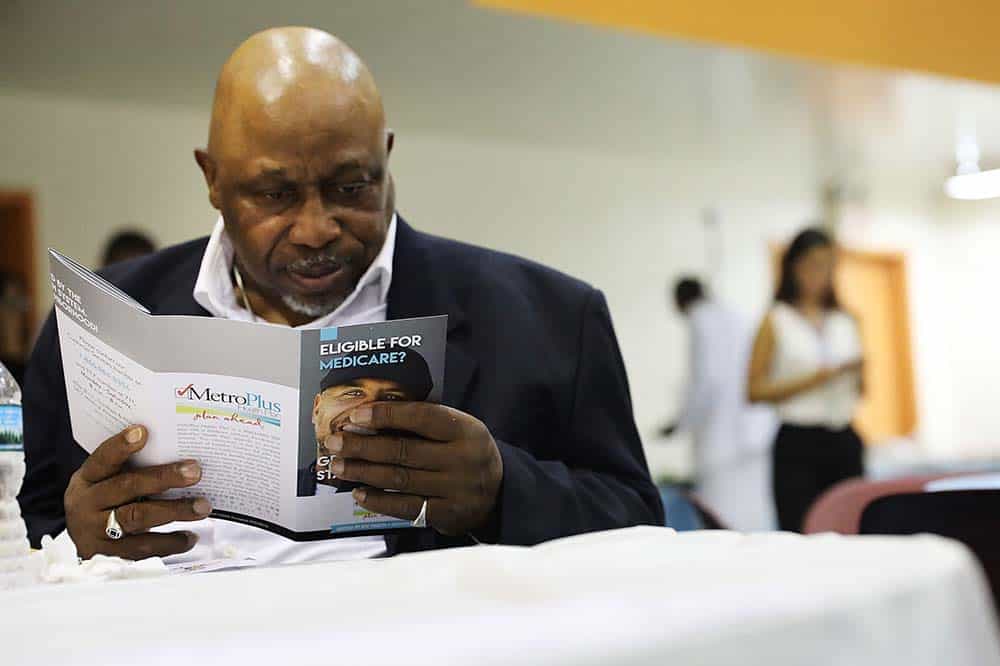

Read MoreCan the TRUST Act Help Fix the Social Security, Medicare, and Highway Trust Funds?

Several federal programs that are governed by trust funds are facing serious funding shortfalls.

Read MoreShould the Corporate Income Tax Rate be Raised?

The possibility of raising the corporate tax rate has spurred a debate about the optimal corporate income tax rate to balance revenue generation and U.S. competitiveness.

Read MoreWhat Is a Carbon Tax? How Would It Affect the Economy?

In light of the growing urgency of the climate crisis, many lawmakers, advocacy groups, and American citizens are calling for the government to undertake policies to more comprehensively address climate change.

Read MoreHere’s How Democrats Would Pay for Their New Spending Proposals

Democratic leaders revealed the details of how they plan to pay for, or offset, the approximately $3.5 trillion of spending in their reconciliation bill.

Read MoreHow Do We Tax Energy in the United States? How Does It Compare to Other Countries?

A key part of the Biden administration’s policy agenda in 2021 relates to our nation’s energy policy, and in particular, there have been important debates among policymakers about how we use the tax code to incentivize economically and environmentally beneficial behavior.

Read MoreWhat’s the Price Tag on Reconciliation — and Will It Be Paid For?

Components of a large legislative package — that could carry a price tag of as much as $3.5 trillion — is now being debated in the House of Representatives.

Read MoreWhat Economic Effects Can We Expect from the Bipartisan Infrastructure Bill?

Infrastructure investment has important impacts on the economy, and this piece examines the economic effects that could be expected from the bipartisan physical infrastructure plan.

Read More