Democratic leaders this week for the first time revealed specific details for how they intend to pay for, or offset, the approximately $3.5 trillion of spending in their reconciliation bill. On Monday, the House Ways and Means committee released a set of proposed tax increases that would largely offset the bill’s cost. Read more for the specific changes to the tax code that have been proposed — and how it all adds up.

What Is Reconciliation? And How Do Lawmakers Plan To Pay For It?

A bill considered under the reconciliation process enjoys special rules that allow for expedited consideration in the Senate; specifically, it cannot be filibustered, and only needs 50 votes instead of the usual 60 to move forward.

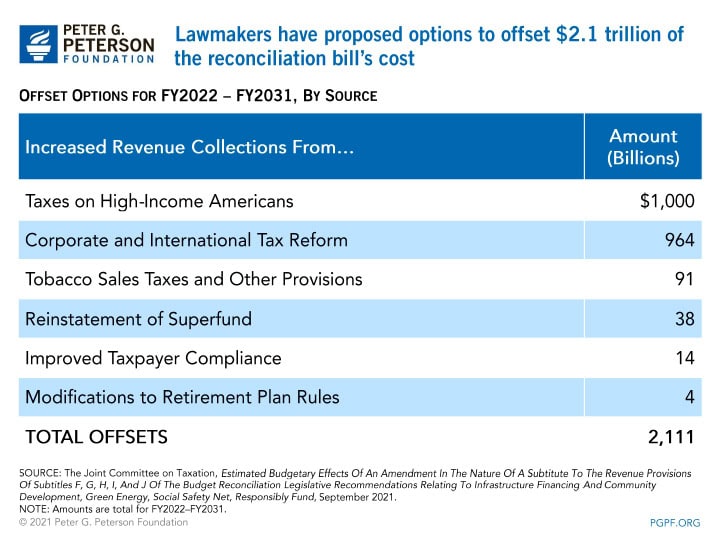

To their credit, leaders in the House and Senate, as well as the White House, have pledged to fully offset the cost of their reconciliation bill. While details will continue to evolve as the package advances, the Ways and Means committee has put forward a set of options that would provide about $2.1 trillion in offsets, according to the Joint Committee on Taxation — largely by raising taxes on high-income Americans and on corporations. The table below summarizes the effects of those revenue provisions.

Individual Income Taxes ($1 Trillion)

- Raise the top individual income tax rate from 37.0 percent to 39.6 percent

- Increase the top tax rate on capital gains from 20.0 percent to 25.0 percent and lower the income thresholds to which it applies

- Impose a 3.0 percent surtax on individuals with adjusted gross income above $5 million

- Reduce the estate tax exemption credit

- Limit the 20.0 percent deduction for pass-through businesses with incomes over $400,000 and impose a 3.8 percent investment income tax

Corporate Income Tax ($964 Billion)

- Raise the top corporate tax rate from 21.0 percent to 26.5 percent for those earning more than $5 million annually (other tax rates would apply to smaller corporations)

- Set a 16.5 percent minimum tax on global income, up from 10.5 percent

- Reduce certain tax expenditures, including incentives for maintaining intellectual property in the U.S. and subsidies for the depreciation of physical assets in foreign countries

Other Sources ($147 Billion)

Other revenues would stem from taxes on tobacco products like e-cigarettes, limiting contributions to IRAs with large balances, and certain other proposals.

All told, the revenue provisions specified by the Ways and Means Committee would offset $2.1 trillion, or roughly two-thirds, of the bill’s costs between 2022 and 2031. In addition, proposals to close the tax gap and other tax-related provisions would also increase revenues. Furthermore, some sources indicate that reform related to prescription drug prices would generate an estimated savings of $700 billion over the next decade. Moreover, lawmakers claim that resulting economic growth from the policies under consideration would save another $600 billion over 10 years. Official cost estimates should soon provide a clearer picture of the total net budgetary effect of the legislation.

Uncertain Weeks Ahead

As the bill advances and its details evolve, there will no doubt be changes to this developing legislation. Lawmakers should remain committed to including credible options to offset the full cost of the package.

Looking ahead and beyond this bill, lawmakers will need to go beyond simply paying for new spending, and look to address our structural fiscal imbalance, as we are already on a path that projects our nation’s debt to its highest level ever recorded.

Image credit: Anna Moneymaker/Getty Images

Further Reading

The One Big Beautiful Bill Act Is the Most Expensive Reconciliation Package in Recent History

This week, lawmakers in Congress approved reconciliation legislation that will add trillions of dollars to America’s already unsustainable fiscal trajectory

Lifting the Debt Ceiling Has Been Paired with Budget Reform in the Past

Earlier this year, the United States once again hit its debt ceiling, which is currently capped at $36.1 trillion.

Even with Economic Growth Factored in, OBBBA Would Increase Deficits

The small, positive fiscal impact from slightly higher economic growth is projected to be more than offset by increased federal interest costs.