Healthcare Costs for Americans Projected to Grow at an Alarmingly High Rate

Overall healthcare costs — including all private and public spending — are anticipated to rise by an average of 5.5 percent per year over the next decade.

Read MoreTrustees Warn: Social Security’s Total Costs Next Year to Exceed Income for First Time Since 1982

The report anticipates that in 2020 — for the first time since 1982 — the program’s total costs will exceed its total income.

Read MoreTrustees Report: Funding Challenges Threaten Medicare’s Future

Medicare spending equaled 2.9 percent of GDP in 2018, but is expected to rise to 5.5 percent of GDP by 2043.

Read MoreEconomic Growth in Early 2019 Was Stronger than Expected

Growth over the next few years is expected to slow as the recent fiscal stimulus wanes.

Read MorePresident’s Budget Relies on Optimistic Economic Projections and Unlikely Spending Cuts

The president’s budget misses an opportunity to address the structural causes of our debt and relies instead on overly optimistic economic assumptions.

Read MoreThe President’s Budget Reduces Debt a Little, but Only if Growth Is Rosier Than Projected

The budget would achieve some deficit reduction on paper under the administration’s calculations, but it fails to address the key drivers of our debt.

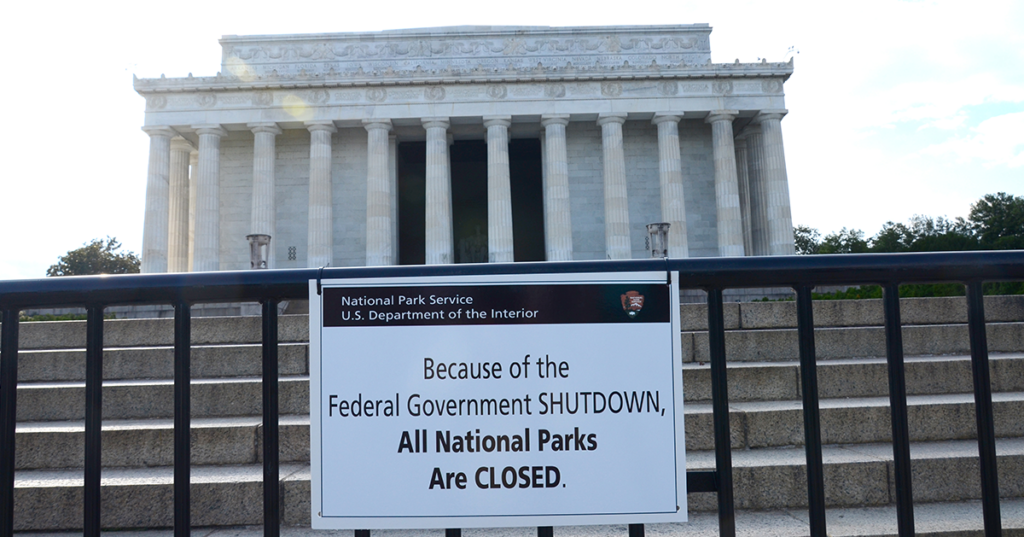

Read MoreHere Are Some Ways the Shutdown Is Hurting Americans and the Economy

Since the shutdown began, about 800,000 federal employees have been furloughed or are working without pay.

Read MoreThe House Is Returning to PAYGO

Budget process rules like PAYGO help ensure that fiscal considerations are an important part of policymaking.

Read MoreCan a New Congress — and a Divided Government — Make Progress on Fiscal Challenges?

A divided government means there is both a requirement and a valuable opportunity for lawmakers to work together on fiscal solutions.

Read MoreRising Interest Rates Will Affect Everything from Mortgages to National Debt

Although a return to a normalized interest environment is a good sign for the strength of the economy, rate increases will make it more expensive to borrow.

Read More