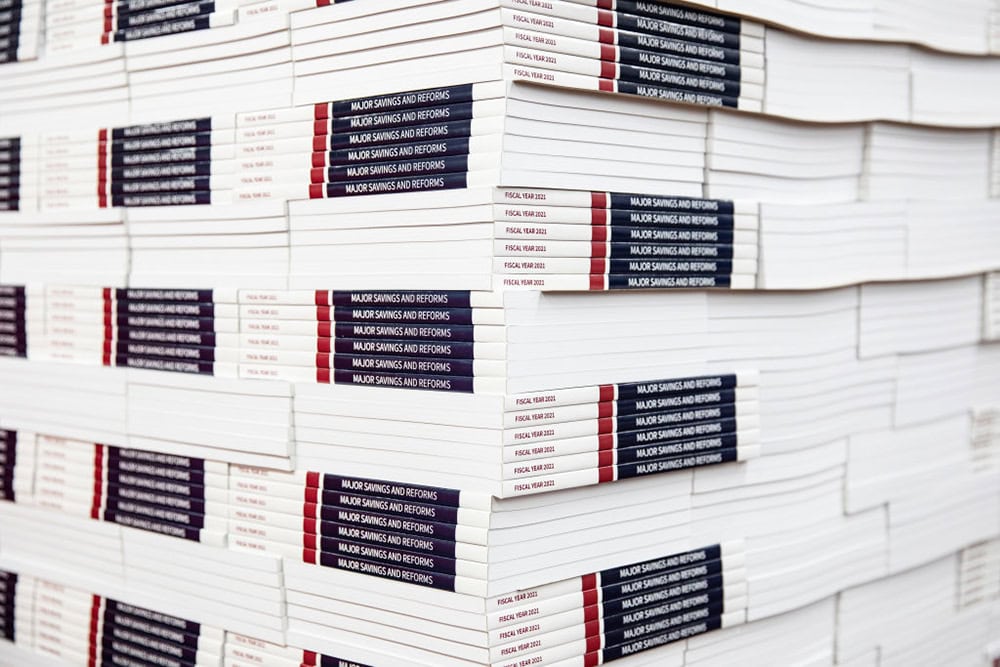

What Is a Continuing Resolution?

A continuing resolution is a temporary funding measure that Congress can use to fund the federal government for a limited amount of time.

Read MoreHealthcare Spending Will Be One-Fifth of the Economy Within a Decade

Healthcare spending in the United States is rising, with serious implications for the federal budget.

Read MoreQuiz: How Much Do You Know About the Federal Budget?

A strong fiscal outlook is an essential foundation for a growing, thriving economy. Take our quiz to see how much you really know about the federal budget.

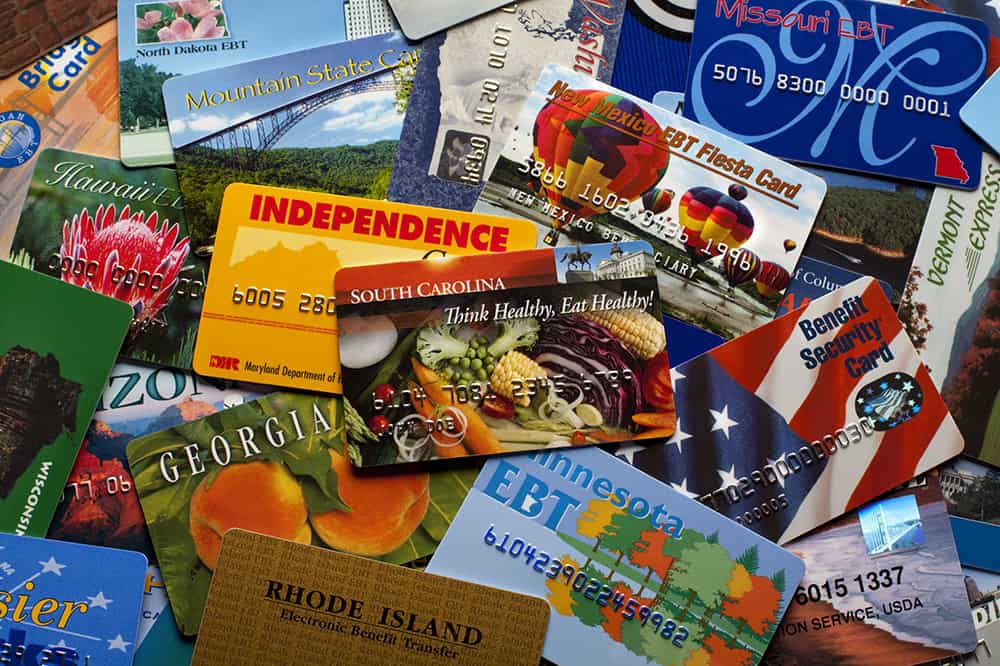

Read MoreWhat Is SNAP? An Overview of the Largest Federal Anti-Hunger Program

SNAP has a positive effect on poverty and food insecurity, with a relatively small effect on the federal budget.

Read MoreFour Reasons Why a Government Shutdown Is Harmful

It may be counterintuitive, but government shutdowns are expensive. They are also bad for the economy.

Read MoreShould We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

Read MoreNo Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Read MoreThree Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.

Read MoreTax Breaks on Retirement Savings: Who Benefits and How Much Do They Cost?

Tax breaks on retirement accounts support the economic security of older Americans. They also affect our fiscal outlook.

Read MoreHow Does the U.S. Healthcare System Compare to Other Countries?

Despite higher healthcare spending, America’s health outcomes are not any better than those in other developed countries.

Read More