The United States’ tax code is long, confusing and complex — and that means that the amount and type of taxes owed can vary widely across individual taxpayers.

Two key aspects of our tax code that affect what you pay are tax rates and tax breaks.

Marginal tax rates are based on your income level. Our federal tax system is generally progressive, meaning that as your income rises, you fall in to a higher tax bracket, and are subject to a higher tax rate.

Tax expenditures, or tax breaks, are exemptions from tax for certain activities, the costs of which can be ‘exempted’ from total taxable income. Higher income Americans benefit disproportionately from tax breaks, which totaled $1.7 trillion in 2024.

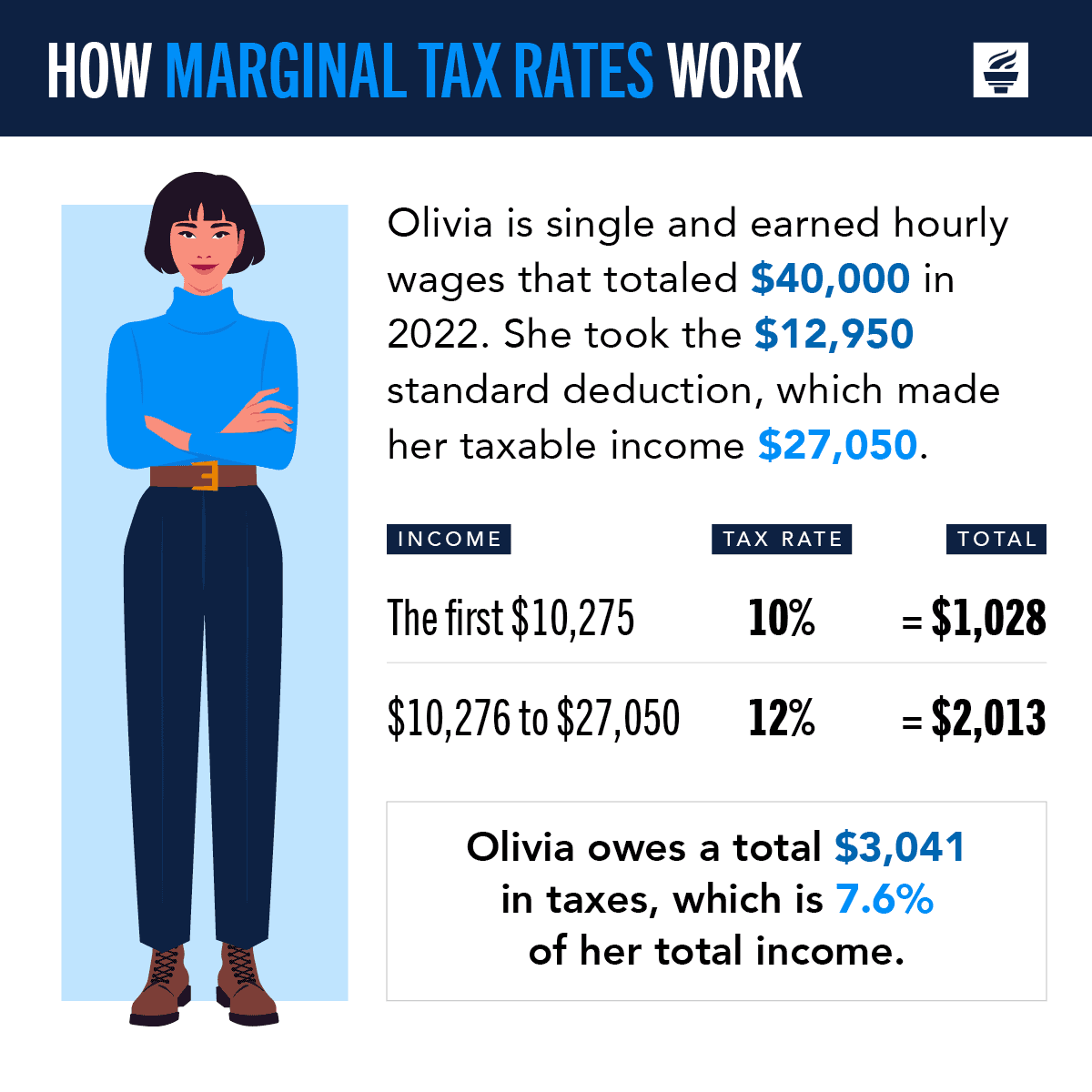

Let’s look at a few examples of how individual Americans’ tax burdens differ based on their tax rates and tax breaks.

Scenario 1: Single employee making $50,000

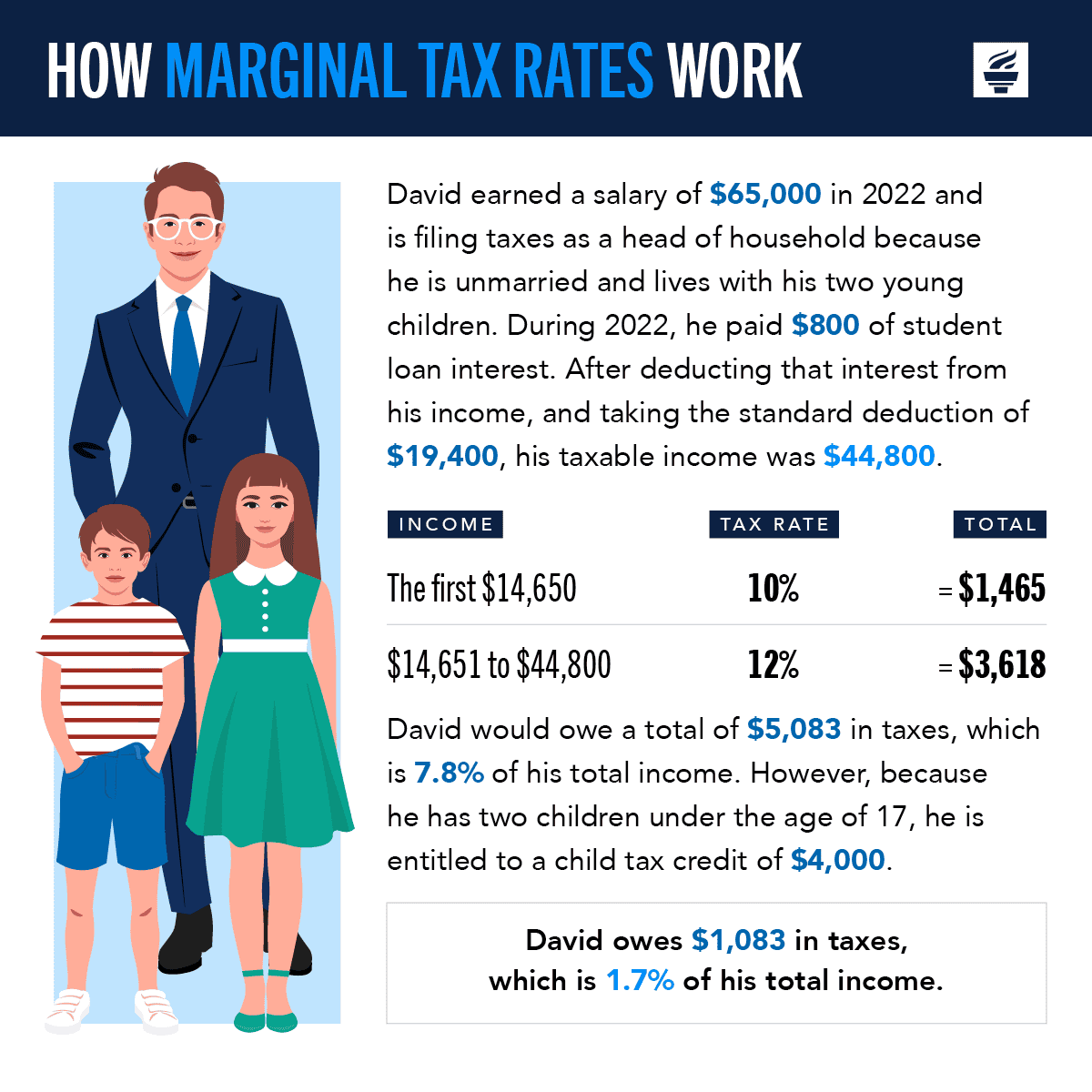

Scenario 2: Higher earning individual receiving the child tax credit

In the next example, David earns significantly more than Olivia, but he pays a lower percentage of his income, largely because he receives the child tax credit (a popular tax break).

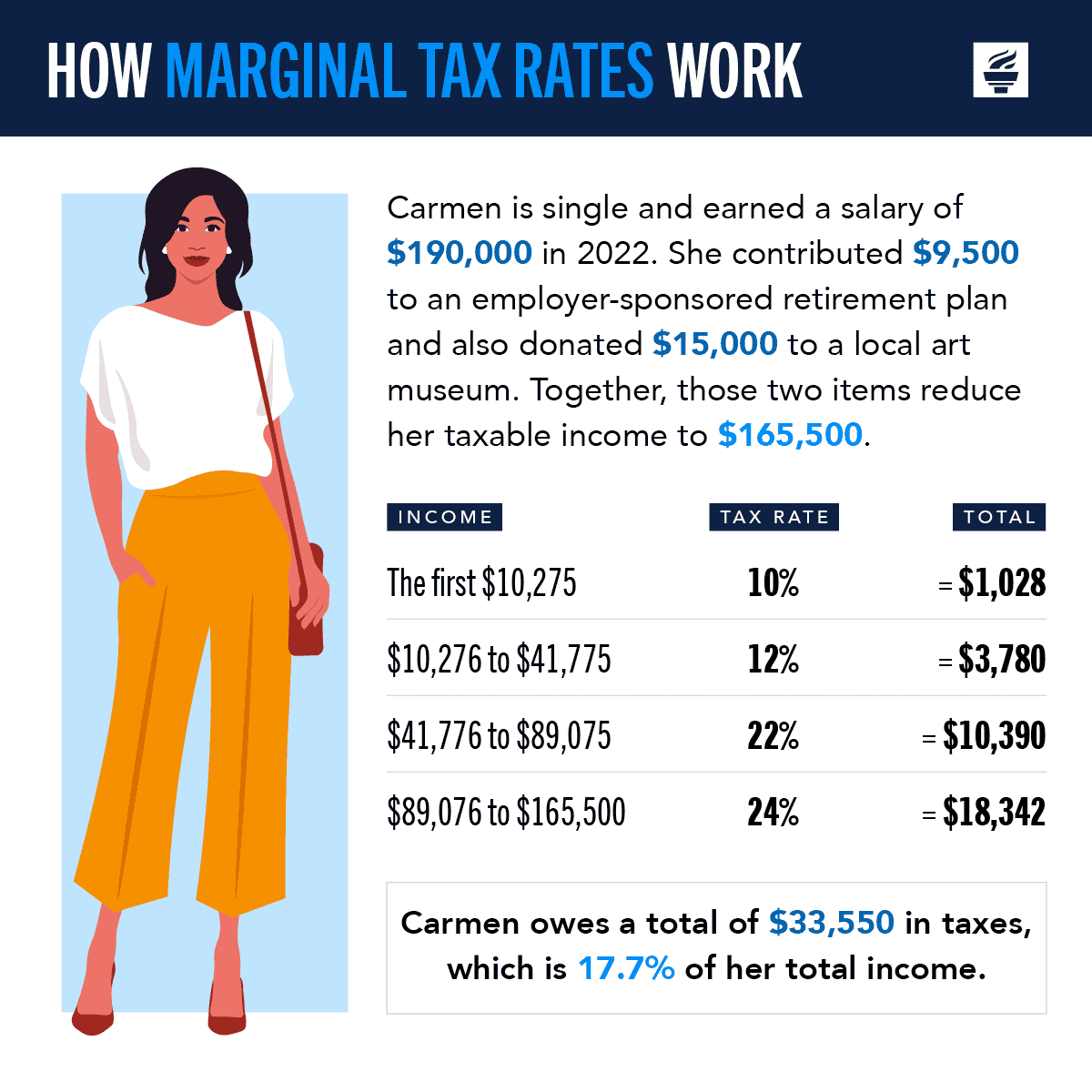

Scenario 3: Leveraging 401(k), IRA, and Charitable Deduction Tax Breaks

In the scenario below, Carmen reduced her taxable income in two ways.

The first was by making contributions to an employer-sponsored retirement plan, such as a 401(k) or IRA. Tax breaks for retirement savings are one of the largest individual tax expenditures — in 2024 they reduced tax revenues by $395 billion.

The second way that Carmen reduced her taxable income was by making a charitable contribution. Charitable contributions are an itemized deduction. Taxpayers can either itemize their deductions by listing them on their tax returns or claim the standard deduction and reduce the burden of record keeping associated with itemizing deductions. In 2025, the standard deduction for single taxpayers is $15,750; married couples filing jointly are entitled to a $31,500 standard deduction. When itemized deductions total more than the standard deduction allowance, taxpayers usually choose to itemize deductions. For itemizers, charitable contributions deductions will reduce their taxes due.

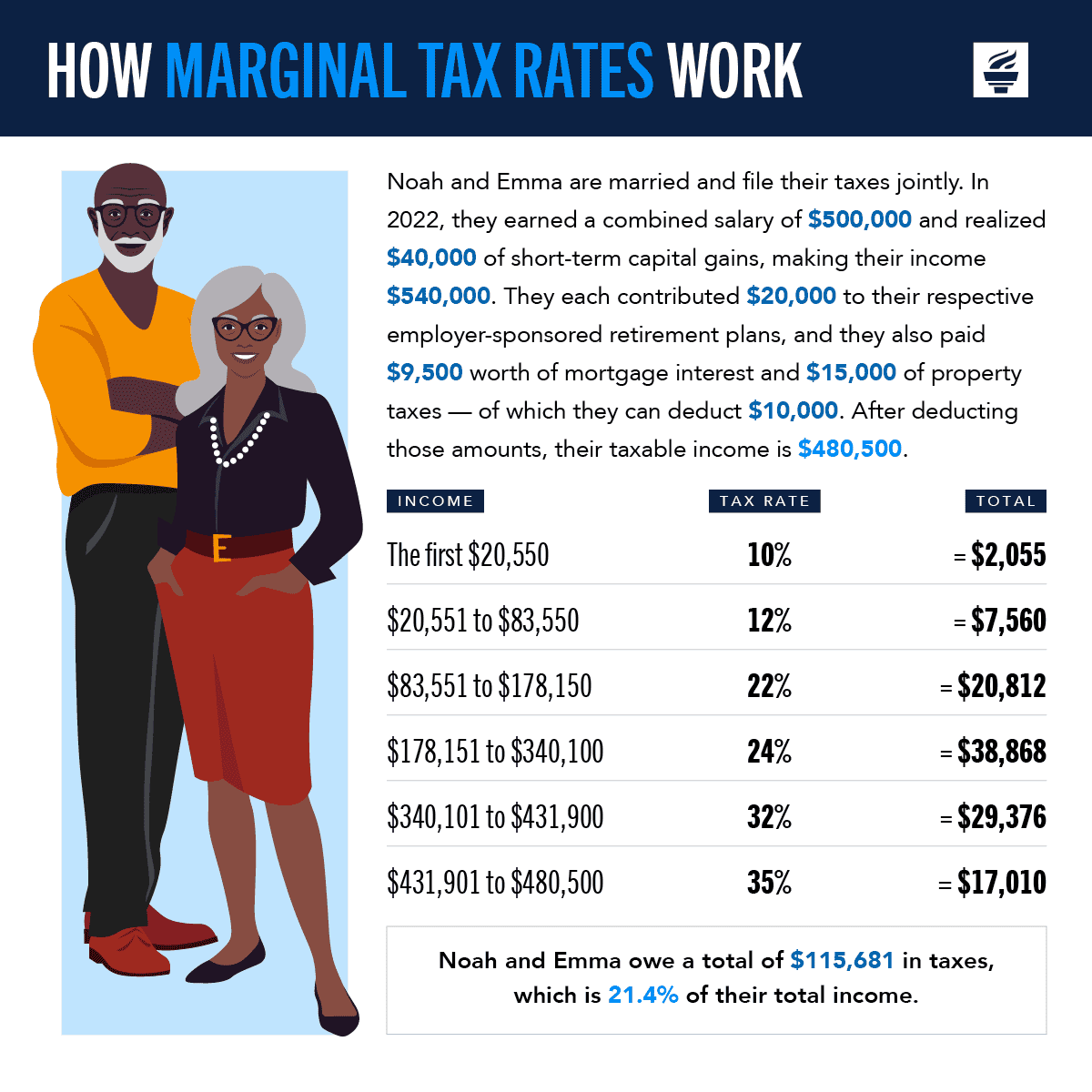

Scenario 4: Leveraging mortgage interest and SALT tax breaks

Noah and Emma are in the top 5 percent of income earners in the United States, and they took advantage of the mortgage interest and state and local tax (SALT) deductions — both of which tend to enefit high-income earners more than lower-income groups.

The Case for Simplifying the Tax Code

As the scenarios above illustrate, our tax system can be complex. On the one hand, higher income leads to higher income tax rates. On the other, there are many ways to reduce one’s tax burden, as we see in the above examples like charitable giving, home ownership, and saving for retirement.

Many economists agree that reforming the tax code would increase compliance and tax collections , while making the code simpler and more fair.

Further Reading

What Are Refundable Tax Credits?

The cost of refundable tax credits has grown over the past several years, with the number and budgetary impact of the credits increasing.

Understanding the New Senior Deduction in the One Big Beautiful Bill Act

The senior deduction adds complexity to the tax code, and fewer than half of seniors will benefit from it.

What Are Estate and Gift Taxes and How Do They Work?

Estate and gift taxes produce relatively lower revenue compared to other sources, but they generate a significant amount of attention, and even controversy.