The Congressional Budget Office (CBO) released a new report this week on the Budget and Economic Outlook. CBO reports that the fiscal outlook is dramatically worse than it was last year, primarily due to the fiscally irresponsible tax legislation and budget deal that were recently enacted.

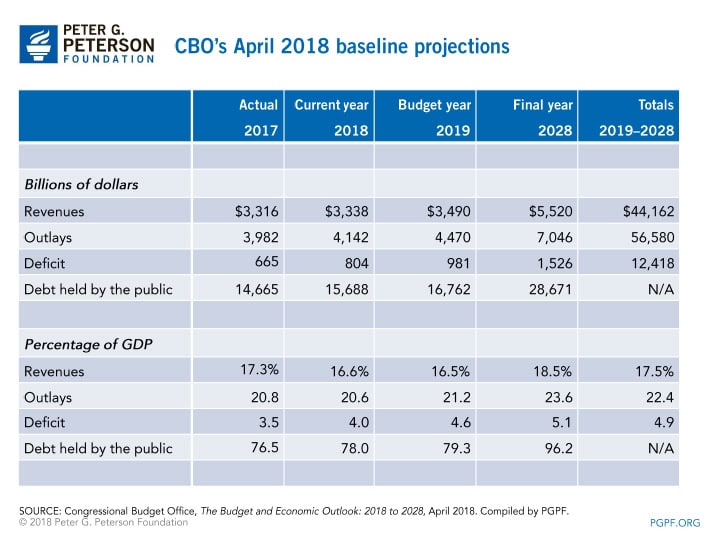

CBO projects that, on our current path, the deficit will reach nearly $1 trillion next year and will total $12.4 trillion over the ten-year period from 2019–2028. Such deficits stem from a structural mismatch between revenues and spending, which grows steadily over time.

In the new report, CBO projects that:

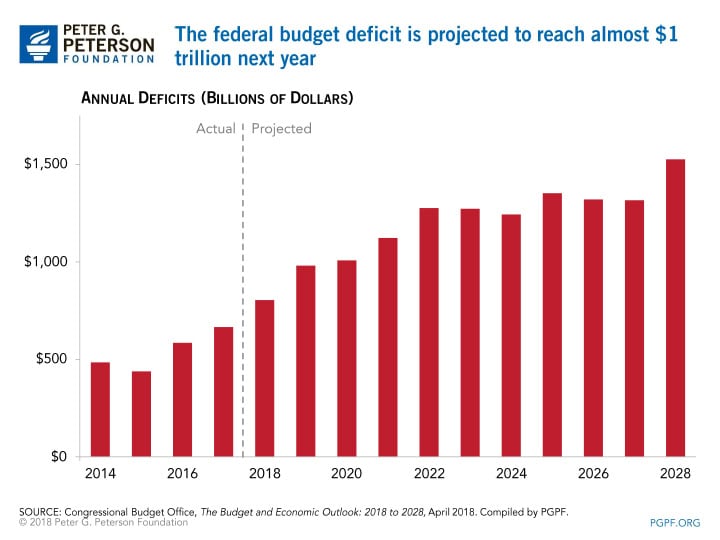

- The budget deficit will total $804 billion this year—$139 billion higher than it was in 2017. Deficits will then grow to nearly $1 trillion in 2019, and will remain greater than $1 trillion for the remaining years of the 10-year budget window.

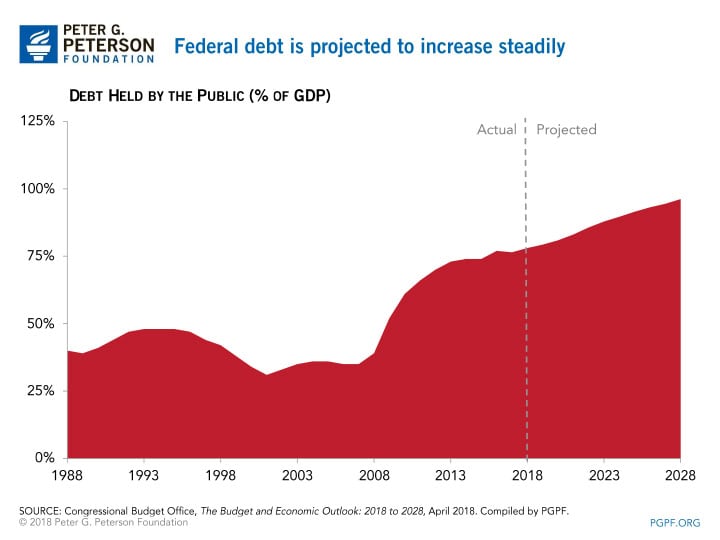

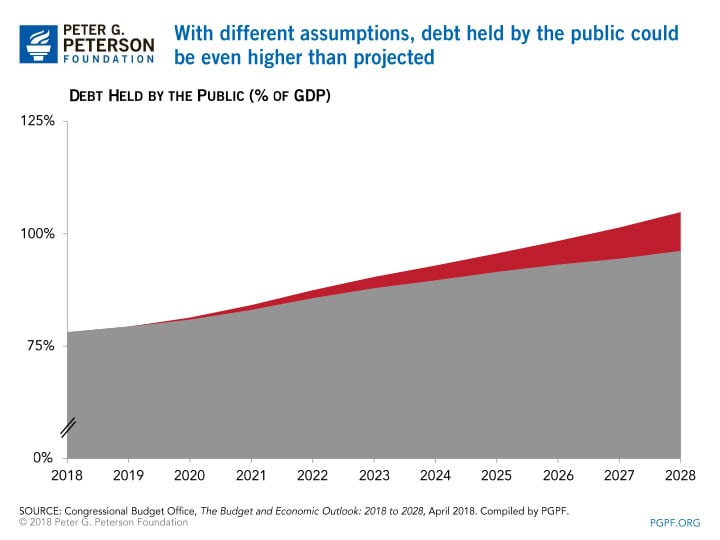

- Under current law, debt held by the public is projected to reach 96 percent of gross domestic product (GDP) by 2028—nearly the size of our entire economy.

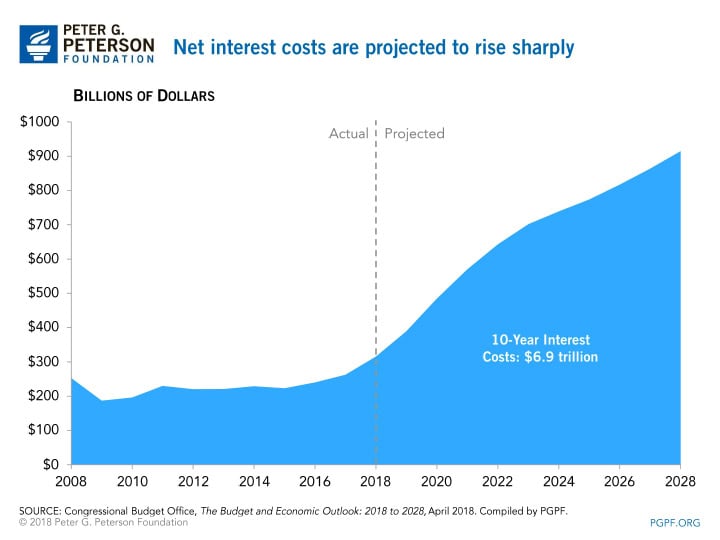

- Interest costs on the debt will nearly triple by 2028. In 2028, CBO projects interest costs will reach $915 billion—which, for comparison, is more than twice the amount of revenues collected from corporate income taxes. Between 2019 and 2028, net interest will total nearly $7 trillion.

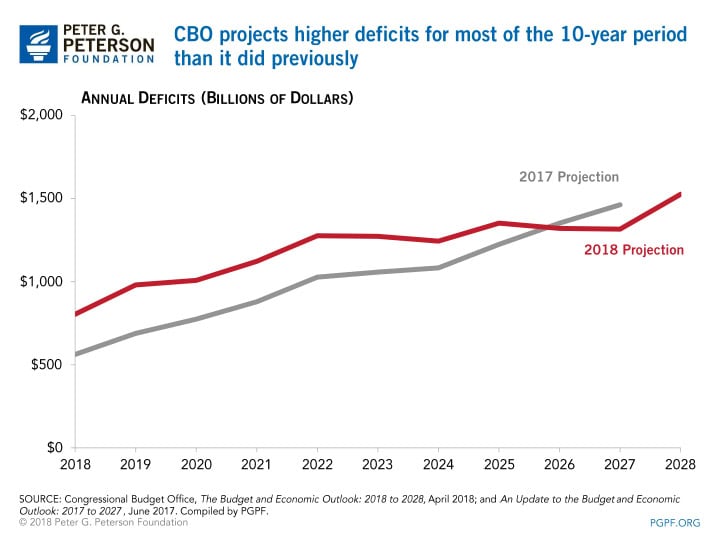

Those projections describe a markedly worse fiscal condition than outlined in CBO’s previous report, which was released in June 2017. At the end of 2017, Congress and the President enacted the Tax Cuts and Jobs Act, which will significantly reduce revenues. Then, in early 2018, legislation was enacted that will increase discretionary spending. As a consequence, the budget outlook has changed dramatically for the worse:

- The deficit for 2018 is now anticipated to be $242 billion higher than projected in June 2017. Most of the increase in this year’s deficit projection stems from legislative actions.

- Between 2018 and 2027 (the 10-year period used in CBO’s June 2017 report), CBO estimates that revenues will be more than $1 trillion lower and outlays will be $574 billion higher than previously projected.

- As a result, CBO now projects a cumulative deficit over the 2018–2027 period that is $1.6 trillion larger than projected last June under the current law baseline.

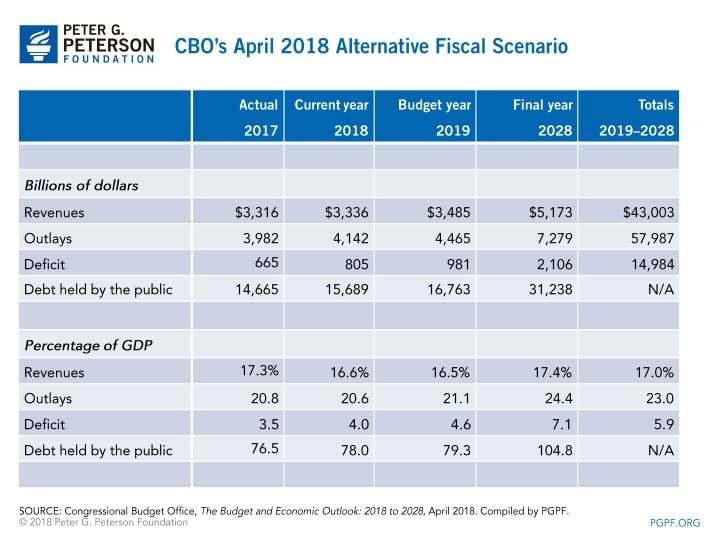

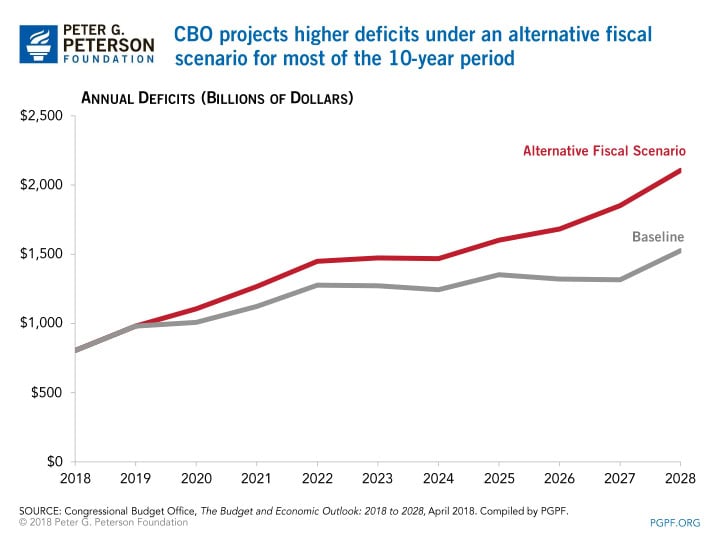

CBO’s current law baseline, however, does not account for possible future legislation to continue current policies, which could have material effects on the budget. Such legislation might include extending expiring tax provisions and maintaining current appropriation levels (rather than letting them revert to levels set by law and well below the current limits). Incorporating such policies in its Alternative Fiscal Scenario, CBO estimates that the cumulative deficit over the next decade would be $2.6 trillion above the baseline projections.

The federal deficit will grow significantly over the next ten years

CBO projects that the budget deficit will climb from $804 billion in 2018 to $1.5 trillion in 2028, resulting in a cumulative 10-year deficit of $12 trillion. The overall trend in the deficit is unmistakable—it almost doubles over the next decade.

Federal debt will reach historically high levels

CBO projects that federal debt will reach 96 percent of GDP in 2028, which is historically very high. Since 1940, debt as a percentage of GDP has only exceeded that amount at the end of and immediately after World War II. However, unlike that period and other instances of high debt levels, the budget outlook today is not being driven by temporary factors. The trajectory is much more worrisome because projections show sustained increases in deficits and debt fueled by ongoing structural factors such as the retirement of the baby boom generation, increases in health care costs, and higher interest spending—with an inadequate intake of revenues to cover such commitments.

Interest costs: The fastest growing part of the budget

As debt accumulates and interest rates increase, net interest costs are projected to nearly triple over the next decade, increasing from $316 billion in 2018 to $915 billion in 2028. Increased interest costs will crowd out important private and public investments in our future that fuel economic growth, such as infrastructure, R&D, and education.

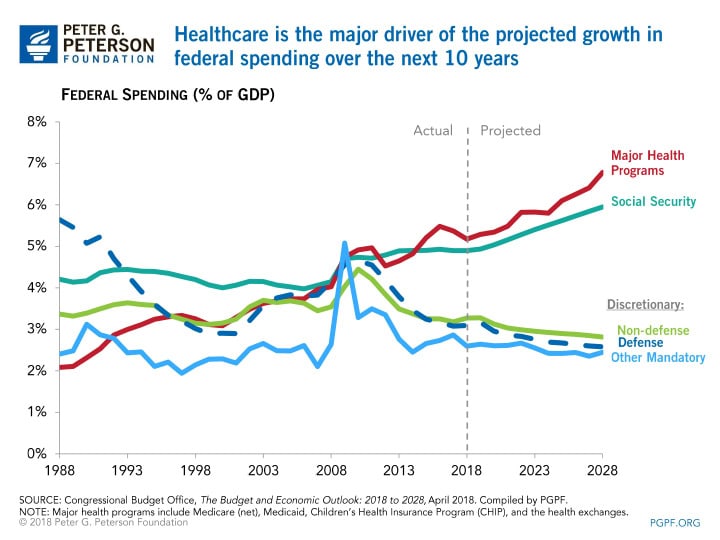

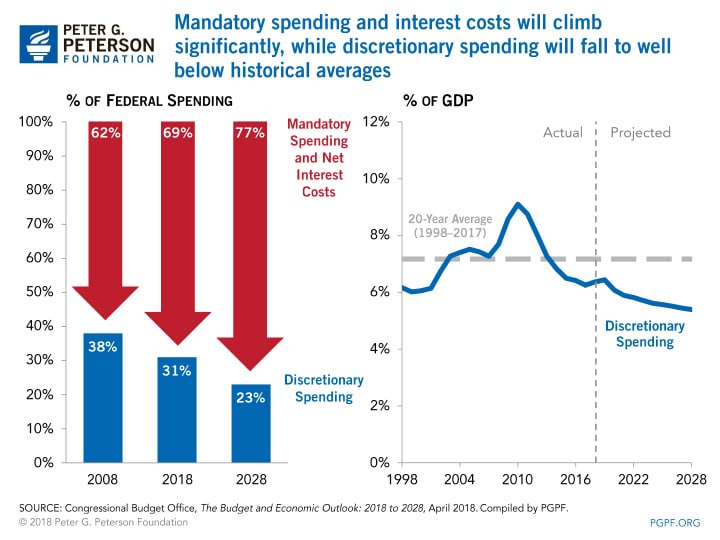

Spending is projected to increase for mandatory programs — the key driver of our growing debt — and slow for discretionary programs

Mandatory spending (excluding net interest) is projected to increase from $2.5 trillion in 2018 to $4.5 trillion in 2028, driven by increases in the two areas:

- Major Health Care Programs: CBO projects that net spending on the major health care programs will climb from 5.3 percent of GDP in 2018 to 6.6 percent in 2028, driven largely by growth in Medicare spending.

- Social Security: Spending on Social Security, currently the largest federal program, will rise from 4.9 percent of GDP in 2018 to 6.0 percent in 2028, primarily as a result of the retirement of the large baby boom generation.

In 2018 and 2019, federal outlays for discretionary programs will increase due to emergency funding provided over the past few months related to natural disasters as well as the increase in the caps of $296 billion provided for those two years in the Bipartisan Budget Act of 2018. In 2020, however, the caps on discretionary spending are assumed to decrease by 10 percent each under current law. Therefore, in CBO’s baseline, combined spending for defense and non-defense purposes would decline relative to the size of the economy— from 6.4 percent of GDP in 2018 to 5.4 percent in 2028. That level of discretionary spending would be historically low — 25 percent below its average over the past 20 years of 7.2 percent of GDP.

The budget outlook has changed significantly over the past year

For the 2018–2027 period, CBO estimates that the cumulative deficit in the baseline will be $1.6 trillion larger than estimated last year. Projected revenues will be lower by $1.0 trillion, while outlays will be higher by $0.5 trillion.

The baseline projection might be too optimistic

CBO’s baseline projections are constructed under the assumption that current laws will generally remain unchanged. However, some elements of that baseline contain projections that don’t conform to what many observers would consider current policy. For example:

- The Bipartisan Budget Act of 2018 increased caps on discretionary spending for 2018 and 2019, but not for the following 2 years; CBO’s baseline incorporates the large drop in the caps for 2020 and 2021.

- Many of the provisions in the 2017 tax act will expire at the end of 2025, and a number of pre-existing tax provisions are set to terminate between 2020 and 2028. In the baseline, CBO assumes that those provisions will not be renewed.

- A number of taxes established by the Affordable Care Act have been delayed. CBO’s baseline assumes that they will go into effect when the delay ends.

- Lawmakers have provided $102 billion in 2018 funding for emergencies. That funding is much higher than it has been historically, but baseline rules direct CBO to assume that it will continue.

Under CBO’s Alternative Fiscal Scenario, which adjusts those factors, deficits would be $2.6 trillion higher than reported in the baseline.

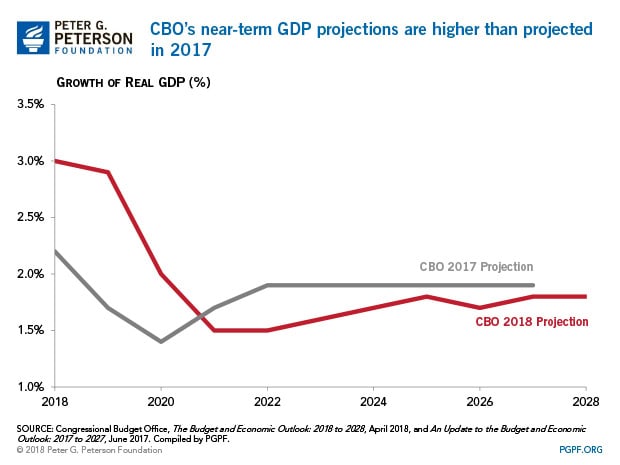

This year’s economic outlook is stronger

Economic forecasts have strengthened since last year. In CBO’s view, The Tax Cuts and Jobs Act has changed incentives to work, save, and invest, which will raise real GDP in the short term; in addition, higher appropriations will also help to boost near-term economic growth. Over the longer term, however, growth will be tempered by greater levels of debt, higher projected interest rates, slightly higher inflation, and lower growth in federal spending.

CBO notes that while economic projections are inherently uncertain, the current projections are particularly so. The effects of recent changes in fiscal policy—particularly from the Tax Cuts and Jobs Act—may not be clear for quite a while. In addition, the path of GDP and other economic measures could vary from CBO’s projections. For example, businesses could respond more robustly to the anticipated increase in demand and push GDP growth higher than estimated; conversely, the tight labor market may not generate the increase in wages that CBO incorporates, and therefore restrict economic growth.

The time for policy makers to act is now

Recent legislation on the budget has been fiscally irresponsible and debt is on a path to nearly equal the size of the economy just 10 years from now. CBO warns that if such a path of debt is followed, it “would have serious negative consequences for the budget and the nation.” They offer four concerns on page 6 of the report:

- Federal spending on interest payments would increase substantially, especially because interest rates are projected to rise over the next few years.

- Because federal borrowing reduces total saving in the economy over time, the nation’s capital stock would ultimately be smaller, and productivity and total wages would be lower.

- Lawmakers would have less flexibility to use tax and spending policies to respond to unexpected challenges.

- The likelihood of a fiscal crisis in the United States would increase. There would be a greater risk that investors would become unwilling to finance the government’s borrowing unless they were compensated with very high interest rates; if that happened, interest rates on federal debt would rise suddenly and sharply.

However, we have the ability to reform our budget to achieve the opposite result. By getting our fiscal house in order we can create the conditions that encourage economic growth, enhance business and consumer confidence, and build a prosperous future. Lawmakers have made our fiscal condition significantly worse in recent months, and should correct those failures by enacting sensible reforms that put our nation on a sustainable fiscal path.

Photo by Alex Wong/Getty Images

Further Reading

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.