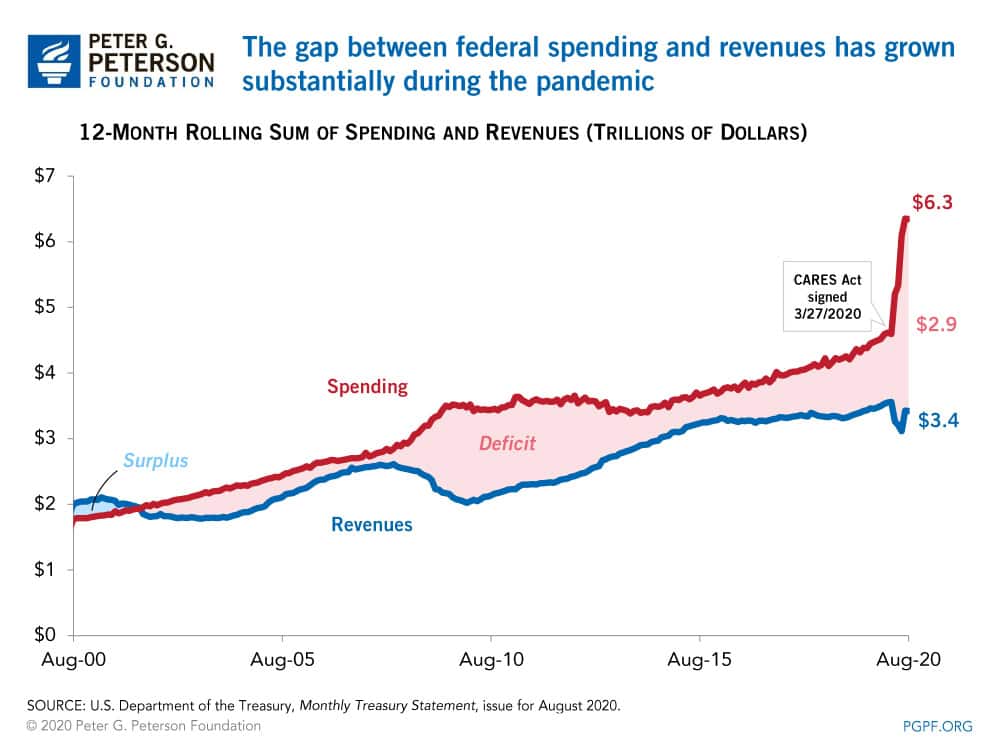

The economic disruption caused by the coronavirus (COVID-19) pandemic and the federal government’s response to it has widened the gap between spending and revenues in the budget. The growth in spending has been driven by legislative actions, particularly provisions in the Coronavirus Aid, Relief, and Economic Security (CARES) Act such as Economic Impact Payments, the Paycheck Protection Program, and additional unemployment compensation.

Provisions in the CARES Act and the Families First Coronavirus Response Act also diminished revenues sharply by deferring some payroll taxes, creating tax credits for employers to retain workers and provide sick leave, and allowing greater use of losses to offset taxable income. The recent uptick in revenues mostly reflects activity that would have occurred earlier in the year if the Administration had not postponed the tax-filing deadline.

An Unsustainable Fiscal Future

The rapid increase in the gap between revenues and spending is not surprising given the devastating effects of the pandemic and the necessary fiscal response. However, the underlying structural gap is an issue that lawmakers will need to consider once the crisis has abated.

Learn more about the fiscal challenges that the U.S. was facing before the pandemic.

Image credit: Chip Somodevilla/Getty Images

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.