In December 2017, the Tax Cuts and Jobs Act (TCJA) was signed into law. This major piece of tax legislation has significant implications for the federal budget, our economy, and every family and business in the country. While the bill has been in place for less than a year, we’ve already learned quite a bit about its effects. Let’s look at the top five takeaways of TCJA so far.

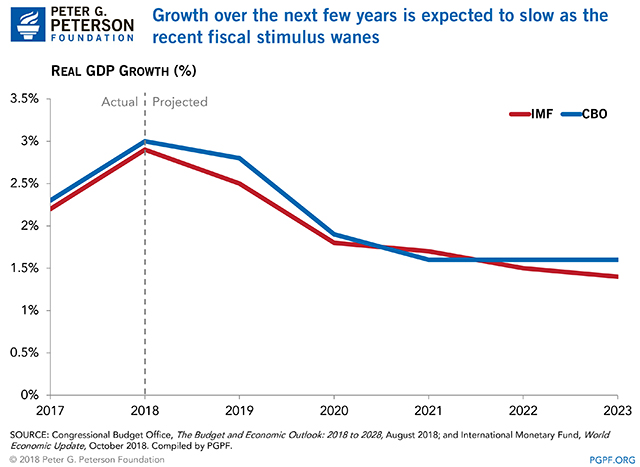

1. Economic growth has been strong . . . but it’s likely temporary. Although the economy has exhibited strong growth during the past few months, forecasters expect this growth to be temporary. Most economists believe that economic growth will diminish over the next couple of years as the stimulus provided by tax cuts and additional spending wanes.

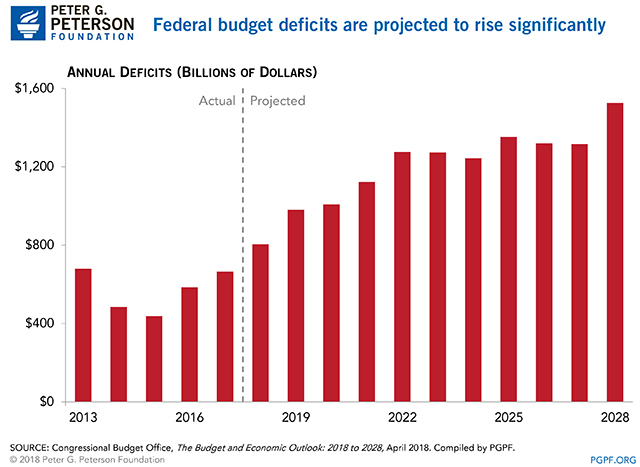

2. We’re back to trillion-dollar deficits. Despite the boost to short-term economic growth, the TCJA has accelerated the return to trillion-dollar deficits. Both the nonpartisan Congressional Budget Office (CBO) and the Trump Administration’s Office of Management and Budget (OMB) project a roughly $1 trillion budget deficit for the current year (fiscal year 2019), and the TCJA will contribute to growing deficits for years after that. In fact, without action, we are facing permanent deficits above $1 trillion.

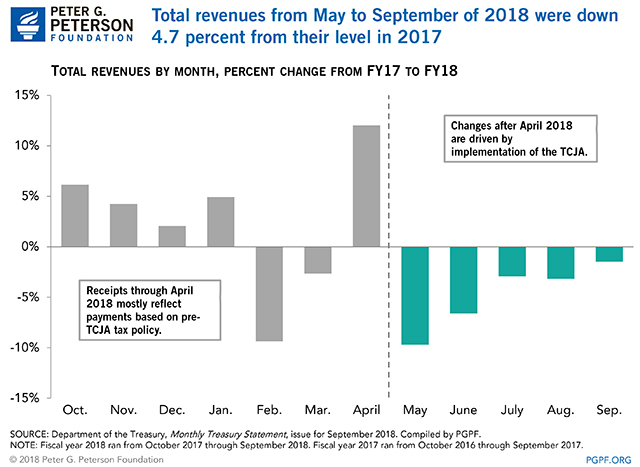

3. Revenue growth is weak. Deficits are so high because the TCJA reduced revenues significantly. During FY18, a period that saw rapid economic growth, total revenues increased by just 0.4 percent — unusually low during a period of economic expansion. And that meager growth was driven by increases in tax payments made in April, which were based on pre-TCJA tax law.

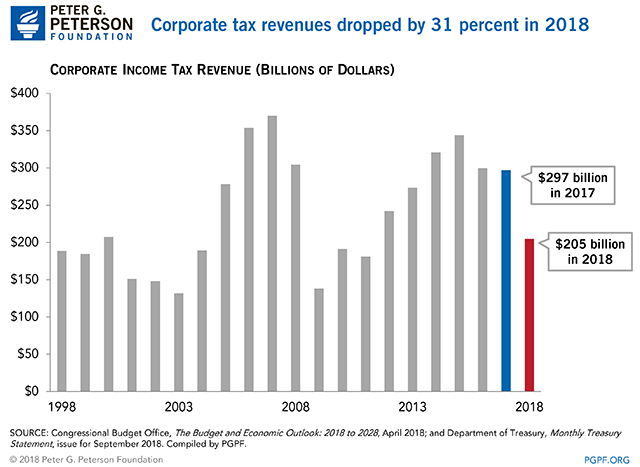

4. Corporate revenues, in particular, dropped. A key aspect of TCJA’s revenue-reducing effect is highlighted by corporate tax revenues for FY18. They dropped by 31 percent, the largest decrease ever during a period of economic growth, despite the fact that the TCJA was only in effect for three-quarters of the fiscal year.

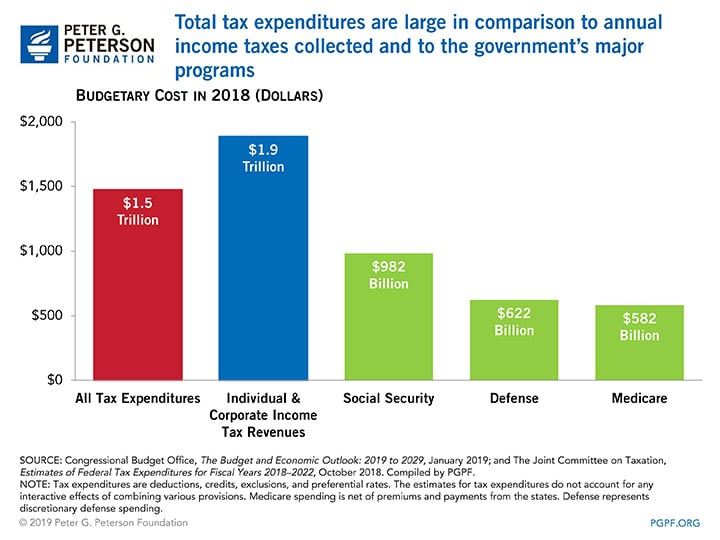

5. More tax breaks than before. The TCJA also fails on another key metric — simplifying the tax code. According to the Joint Committee on Taxation, there were a total of 216 tax breaks before the TCJA; now, after TCJA's implementation, there are 223.

Image credit: Photo by Getty Images

Further Reading

The United States Collects Less Tax Revenue Than Other G7 Countries

The U.S. collects less tax revenues compared with other G7 countries, and that lower level of revenues is a key driver of the national debt.

Energy Tax Policy Under the OBBBA

As part of the OBBBA, lawmakers rolled back existing energy tax incentives in order to partially offset the bill’s deficit impact.

The Six Largest Corporate Tax Expenditures

Relative to the size of the economy, the U.S. collects less revenues than many other advanced countries. Tax breaks are a contributing reason.