To date, lawmakers have enacted four separate pieces of legislation in response to the coronavirus (COVID-19) pandemic. Overall, the cost of the legislation is estimated to total approximately $2.4 trillion, funding a range of programs intended to help support Americans and stave off the significant economic damage caused by the necessary response to the virus.

The last such legislation was passed in April — eight months ago — and a number of key coronavirus relief programs are set to expire soon, while funding for other programs has already been exhausted.

This week, lawmakers in the House and Senate, along with representatives from the administration, are considering another round of coronavirus relief legislation, including re-funding a number of earlier programs.

While there is no single ideal way to deal with such a complex policy challenge as the pandemic, we can glean insights about how our responses have been working. Our recent six-part series provides an in-depth examination of the effectiveness of various relief and stimulus programs. Below are two charts that provide topline insights on how some of the major programs impacted the economy.

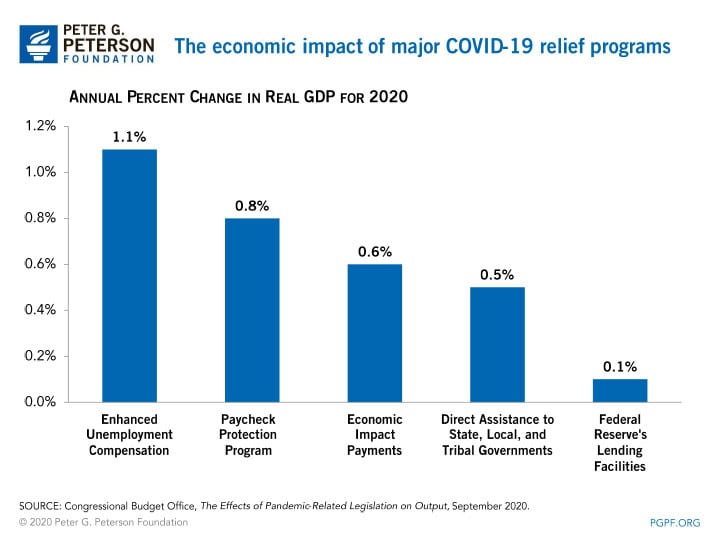

Which Major Coronavirus Relief Programs Boosted the Economy the Most in 2020?

The chart below compares major coronavirus relief programs, looking at how much they contributed to the economy in 2020, regardless of budgetary effect.

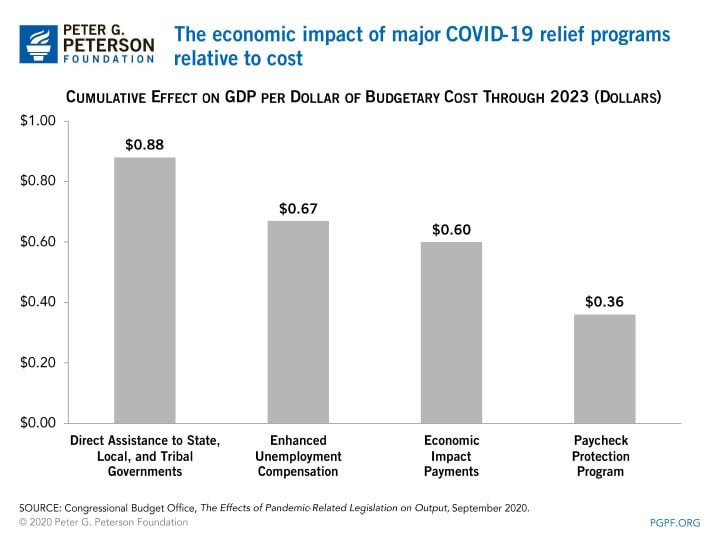

Which Major Coronavirus Relief Programs Provide the Most “Bang for the Buck”?

Perhaps a better way to assess these programs is to examine their effect on GDP relative to their cost. The below chart looks at major COVID-19 relief programs’ “bang for the buck” through 2023.

The estimates provided by the Congressional Budget Office evaluated some of the key relief programs enacted earlier this year. However, there are a number of additional details and insights for lawmakers to consider as they debate additional relief legislation. Moreover, lawmakers could structure those programs differently, and achieve different economic and budgetary impacts. To read more, below are links to our six-part deep dive into the economic response to the pandemic.

- How Did the Fiscal Response to the Coronavirus Help the Economy?

- What Role Did the U.S. Safety Net Play in the Response to the Coronavirus Pandemic?

- How Did Americans Spend Their Stimulus Checks and How Did It Affect the Economy?

- How Effective Has the Coronavirus Relief Fund Been in Helping State and Local Governments?

- How Did the Fiscal Response to Coronavirus Help Small Businesses?

- How Much Has Coronavirus Relief Helped Healthcare Providers?

Image credit: Photo by Spencer Platt/Getty Images

Further Reading

Lawmakers are Running Out of Time to Fix Social Security

Without reform, Social Security could be depleted as early as 2032, with automatic cuts for beneficiaries.

Budget Basics: How Does Social Security Work?

Social Security is the largest single program in the federal budget and typically makes up one-fifth of total federal spending.

How Did the One Big Beautiful Bill Act Affect Federal Spending?

Overall, the OBBBA adds significantly to the nation’s debt, but the act contains net spending cuts that lessen that impact.