On March 11, 2021, President Biden signed into law the American Rescue Plan, the most recent legislation designed to combat the economic fallout associated with the COVID-19 pandemic. One key component of the $1.9 trillion package is an estimated $362 billion in federal aid to state, local, territorial, and tribal governments to cover expenditures incurred due to the public health emergency. That allocation is more than twice the $150 billion allocated to such governments as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act of March 2020.

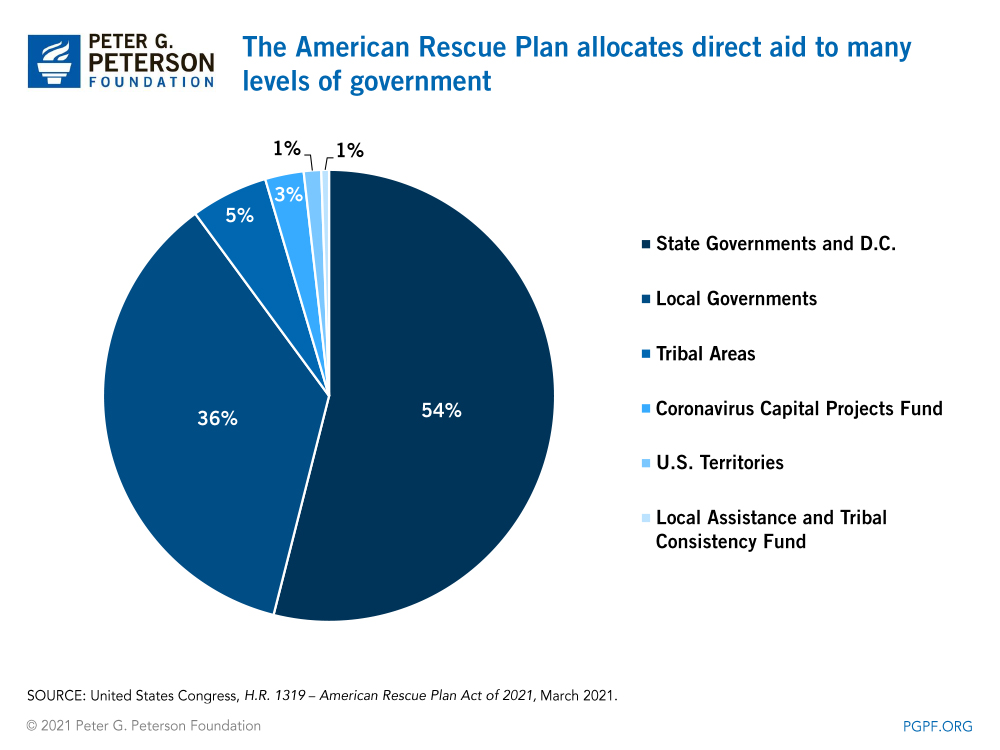

The $362 billion included in the American Rescue Plan is allocated to sub-federal governments in the following amounts:

- $195 billion to each of the 50 states and the District of Columbia. Of that amount, $169 billion will be distributed in proportion to the average estimated number of each state’s unemployed individuals between October and December 2020. In addition, $26 billion will be distributed equally to all 50 state governments and to the District of Columbia, guaranteeing a minimum payment of $500 million. See how much funding has gone to your state thus far, with our interactive map.

- $130 billion to cities, local governments, and counties. Of this amount, about $65 billion will go to larger counties, $46 billion will go to larger cities, and $19 billion will go to smaller cities and counties.

- $20 billion to governments in tribal areas. Of that amount, $1 billion will be distributed equally among the tribal governments, while the remaining $19 billion will be distributed in a manner to be determined by the Secretary of the Treasury.

- $10 billion to the Coronavirus Capital Projects Fund to help state, local, territorial, and tribal governments undertake critical capital projects necessary to enable work, education, and health monitoring amid the public health crisis.

- $4.5 billion to the territories of Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, and American Samoa. Half of that amount will be distributed equally among the territorial governments, while the other half will be distributed based on shares of the total population of all U.S. territories.

- $2 billion to the Local Assistance and Tribal Consistency Fund, providing eligible counties and tribal governments with extra funds to be used for any governmental purpose except lobbying. The allocated funds will remain available until September 30, 2023.

Funds allocated to state, local, tribal, and territorial governments through the American Rescue Plan may be used to cover costs associated with the economic impacts of the COVID-19 pandemic, to help pay for essential workers, to cover government services affected by a loss of revenue, and to invest in water, sewer, or broadband infrastructure. Additionally, local governments are permitted to transfer funds to qualifying private nonprofit organizations, public benefit corporations that work in transportation, or a special-purpose unit of state or local government. The legislation stipulates that state and local governments are not permitted to use funds to offset any reductions in tax revenues resulting from a change in law during the pandemic, nor can they use funds to make deposits into pension funds.

Funding provided for the purposes described above is available until December 31, 2024, but will likely be disbursed much earlier. The Congressional Budget Office estimates that $284 billion (78 percent) of the total allocation will be disbursed in 2021, $77 billion in 2022, and the final $1 billion in 2023.

Image credit: Photo by Spencer Platt/Getty Images

Further Reading

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Three Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.