How Effective Has the Coronavirus Relief Fund Been in Helping State and Local Governments?

The coronavirus (COVID-19) pandemic has imposed an enormous fiscal strain on state, local, tribal, and territorial governments. To help those governments combat the public health and economic crisis, federal policymakers allocated $150 billion to the Coronavirus Relief Fund. In this blog, the fourth in our series on the effectiveness of the nation’s fiscal response to the COVID-19 pandemic, we evaluate the degree to which federal funding assistance from the Coronavirus Relief Fund has helped other levels of government.

How Much of the Coronavirus Relief Fund has been Disbursed and Spent?

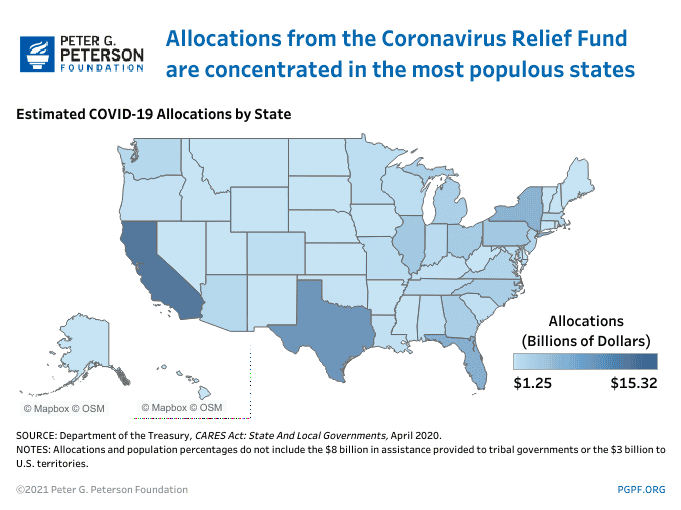

As of October 14, 2020, the Treasury had disbursed nearly all ($149.5 billion) of the available resources in the Coronavirus Relief Fund. Of the total available, $139 billion was allocated to state and local governments based on their population (with smaller states receiving a minimum of $1.25 billion), $8 billion to tribal areas, and $3 billion to U.S. territories.

The National Association of State Budget Officers reported that as of June 30, states and territories had allocated 75 percent of their Coronavirus Relief Fund payments. State and local governments have until December 30, 2020, to spend their allocations from the fund.

Without Federal Funding, State Shortfalls Would Have Been Far Worse Due to COVID-19

The Coronavirus Relief Fund is providing much-needed financial aid to state and local governments working to combat the virus. The National Conference of State Legislators shows that states have used (or plan to use) their Coronavirus Relief Fund payments on healthcare costs, small business relief, unemployment compensation, workforce development, technology, and support to local governments. Because most states have balanced budget requirements, meaning that any decrease in tax revenues (or unforeseen increase in spending) must be offset by tax increases or spending cuts, federal aid provides a crucial lifeline to state and local governments.

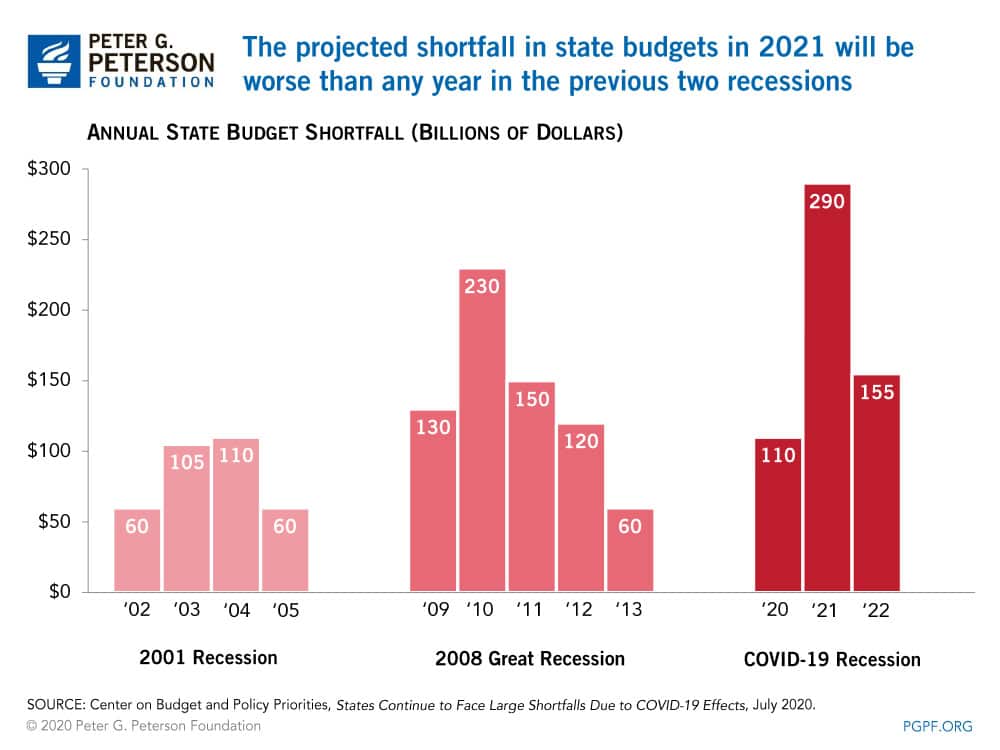

Despite the speed and size of this initial tranche of federal funding, there remain deep, ongoing budget holes at the state and local level due to the enormity of the public health crisis. The Center on Budget and Policy Priorities projects that states will face a cumulative budget shortfall of $555 billion between 2020 and 2022 as a result of pandemic-related spending and revenue losses. To put that number in perspective, the $150 billion provided through the Coronavirus Relief Fund would only cover about a quarter of that total shortage, which doesn’t even account for the shortfalls faced by local governments, tribal areas, and territories. The projected shortfall for states in fiscal year 2021 alone would be far worse than any year during either of the last two recessions.

Additionally, governments are constrained in how they can spend the money from the fund. While the money can be used for expenditures incurred due to the pandemic, it cannot be used to directly cover revenue shortfalls. Some observers argue that such a prohibition is impractical, particularly for states that have faced fewer COVID-19 cases but have lost substantial revenues because of economic shutdowns. That said, the Congressional Research Service notes that fund payments can indirectly assist with revenue shortfalls in cases where new pandemic-related expenses cause an increase in the deficit. States also have some flexibility to direct the money towards payroll expenses to essential public workers, such as state and local employees, which can help keep workers on the payroll and avoid furloughs.

It seems clear that the Coronavirus Relief Fund has helped states deal with some immediate budget problems; however many still remain. With a continued high incidence of COVID-19 in the United States, the strain on state and local budgets could prolong the recession and thereby inflict further harm on families and communities. Many analysts therefore argue that additional federal assistance will be needed to ensure the solvency of state budgets and to meet the health needs of the nation’s citizens.

What Effect Has the Coronavirus Relief Fund Had on the National Economy?

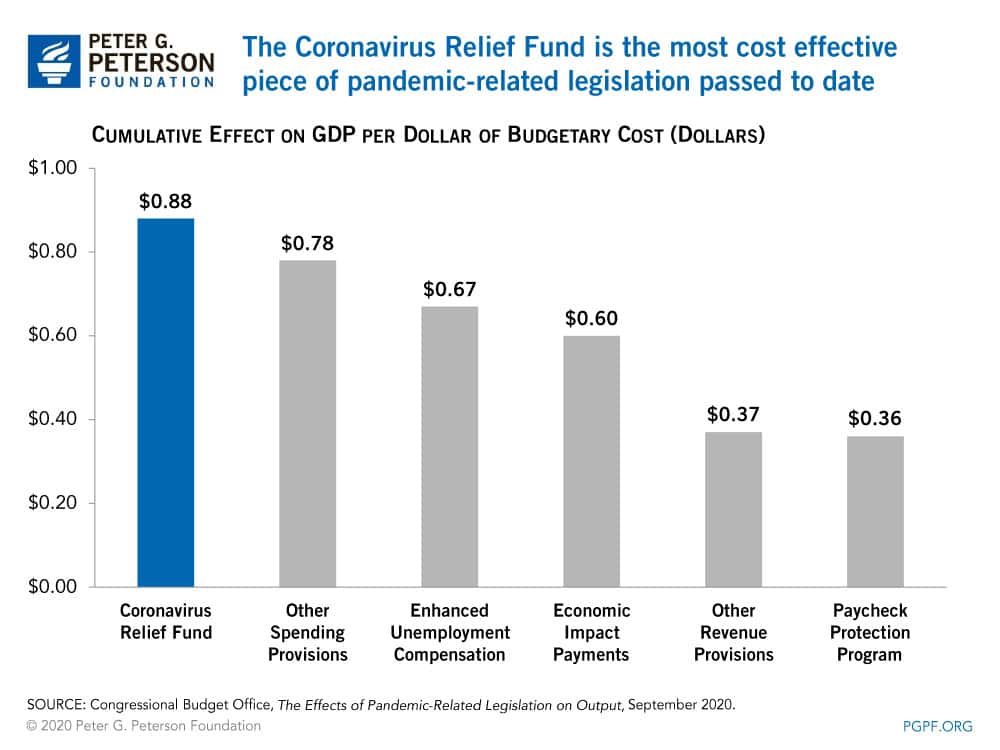

The Coronavirus Relief Fund is expected to provide a modest boost to the economy at a relatively low cost. Such assistance to state and local governments will add a total of $150 billion to the federal deficit, and the Congressional Budget Office (CBO) estimates that it will increase real (inflation-adjusted) gross domestic product (GDP) by $132 billion, or 0.7 percent, through 2023. Overall, the program would boost the economy by 88 cents for every dollar of budgetary cost, which CBO estimates is the highest amount among all of the other major provisions enacted in response to the pandemic. An analysis by the Brookings Institution found that an additional $400 billion of direct federal aid to state and local governments would have a positive effect on real GDP growth over the next three years, though not as large an effect as other policies such as additional unemployment insurance.

Assistance to state, local, tribal, and territorial governments from the Coronavirus Relief Fund has been one of the most cost-effective components of the federal government’s response to the pandemic and has helped those governments combat the health effects and economic fallout associated with the coronavirus pandemic. However, even after the $150 billion from the Coronavirus Relief Fund is fully spent by recipients, state and local budget shortfalls are likely to persist. As the global health crisis continues, more aid to states and localities will likely be necessary if they are to avoid raising taxes or making cuts to critical programs; the absence of such aid could further weaken the economy and affect the livelihoods of many Americans.

Image credit: Photo by Jamie Squire/Getty Images

Further Reading

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Three Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.