The national debt will continue to grow at an unsustainable pace, reaching nearly twice the size of the economy in 30 years, according to the annual Government Accountability Office (GAO) report on the long-term fiscal outlook. GAO’s projections are similar to the results reported by the Congressional Budget Office in March. Here are some other key takeaways from the GAO report.

1. COVID added to existing fiscal challenges. The COVID-19 pandemic has led to a considerable increase in spending — but our long-term debt was already on an unsustainable path. To combat the coronavirus (COVID-19) pandemic and its effects on the American people and economy, the federal government has enacted several large pieces of relief legislation. As a result, the deficit in 2020 tripled to $3.1 trillion from a little less than $1 trillion the year before. Relative to the size of the economy, debt held by the public grew from 79 percent of gross domestic product (GDP) in 2019 to 100 percent of GDP in 2020. However, according to GAO’s long-term projections, those large increases in short-term spending do not translate to a meaningful change in the long-term debt outlook, which was already on an unsustainable path before the pandemic hit. In last year’s report, GAO projected that debt would be about 184 percent of GDP in 2050; in this year’s report, they are projecting that the debt will be 185 percent by 2050, both according to baseline projections.

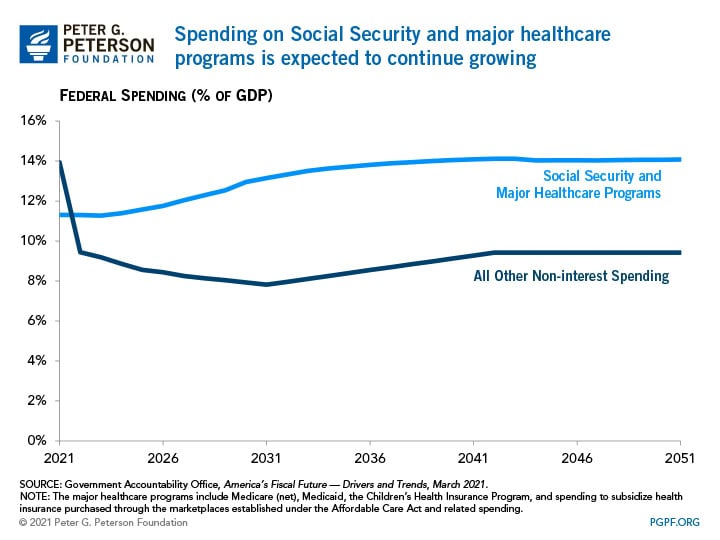

2. Demographics and healthcare costs are driving spending. The aging of the population will be a significant factor driving spending growth over the next 30 years. That aging is the result of baby boomers entering retirement years, combined with increases in longevity. Growing healthcare costs per enrollee also plays an important role in driving spending over the next three decades. As a result of those factors, GAO projects that spending on major healthcare programs — Medicare, Medicaid, the Children’s Health Insurance Program, and subsidies for health insurance purchased on the exchanges established by the Affordable Care Act — will grow from 5.9 percent of GDP in 2020 to 8.0 percent in 2050. Those factors will also drive Social Security spending, which is projected to grow from 5.2 percent of GDP to 6.1 percent over that period.

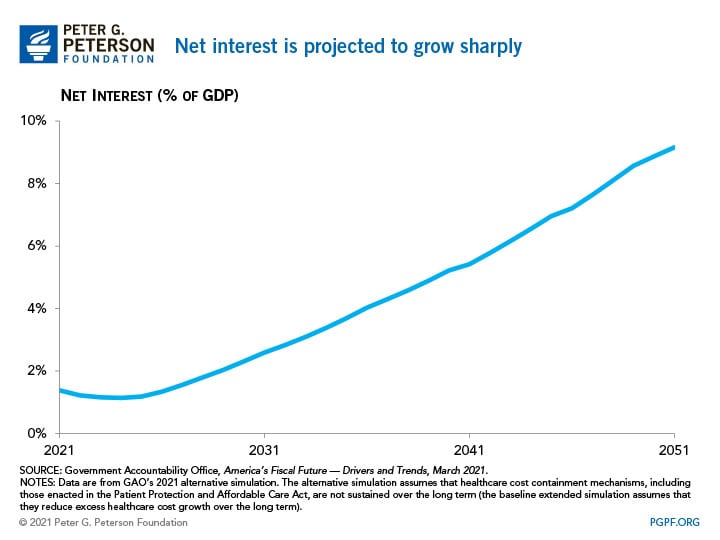

3. Interest is on the rise. GAO projects steep growth in interest costs on the national debt due to the growing size of the debt and an expectation of increasing interest rates. Spending on net interest fell from $375 billion in 2019 to $345 billion in 2020 even though total debt increased. However, under GAO’s alternative simulation, which generally reflects historical trends like the extension of tax provisions that are scheduled to expire, spending on net interest will eventually be the largest category of spending; by 2050, such spending would reach 8.9 percent of GDP. By 2033, net interest costs are expected to exceed $1 trillion annually.

In addition, GAO describes potential risks to the country’s future fiscal condition that were not included in their baseline estimate, including public health emergencies and climate change. Regarding the former, GAO noted that the COVID-19 pandemic showed the significant impact that a pandemic can have, and with respect to the latter, the report observed that 2020 was the sixth consecutive year where the United States had 10 or more weather and climate disaster events, each costing more than $1 billion in damages.

GAO’s report urges Congress to consider establishing a long-term plan for fiscal sustainability. They recommend that policymakers consider the full range of options for such a plan — spending cuts, revenue increases, and adjustments to tax expenditures, as well as narrowing the tax gap, addressing improper payments, and implementing program reforms. The report advises: “after the pandemic recedes and the economy substantially recovers, Congress and the administration should quickly pivot to developing an approach to place the government on a sustainable long-term fiscal path.”

Image credit: U.S. Government Accountability Office

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.