Inflation — the rate of increase in prices over a given period of time — has been running unusually high over the past two years. Such rapid growth in prices can lead to a reduction in purchasing power, especially for low-income households, and have other negative effects on the economy.

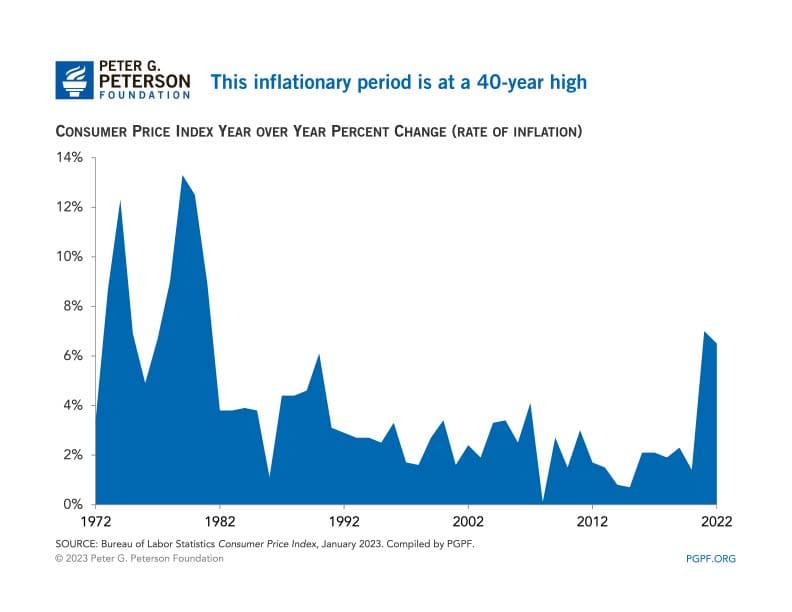

June 2022 saw the year-over-year Consumer Price index (CPI) hit 9.1 percent, the peak of this current inflationary period, and a four-decade high. Since then, the rate has receded, with the rate in January 2023 recorded at 6.4 percent year-over-year. While the decline is good news, that rate is still well above target set by policymakers. Monetary policy, which is set by the Federal Reserve, is the primary weapon against rising inflation — but can fiscal policy play a complementary role?

How Does Monetary Policy Fight Inflation?

Monetary policy is well equipped to combat inflation due to the Federal Reserve’s ability to adjust relatively quickly and its independence from short-term political pressures. To ease inflation, the Federal Reserve works to reduce the amount of money in the economy by raising the Federal Funds rate, which is the interest rate at which commercial banks lend to each other overnight. An increase in the Federal Funds rate ripples throughout debt markets, increasing the cost of borrowing, which encourages savings over investment and reduces demand for goods and services in the economy.

For most of the past 40 years, inflation has been well below the current level, typically hovering between 2 to 3 percent — and interest rates have generally remained relatively low. However, due to myriad factors, such as the pandemic, supply chain issues, and the amount of stimulus payments sent out by the government, inflation began to spike over a year ago. In response, the Fed has been rapidly raising the Federal Funds rate from near zero last February to a current range of 4.5 to 4.75 percent. That’s the highest rate since 2008, and it may continue to climb as the Fed continues its attempts to control inflation.

How Can Fiscal Policy Support Monetary Policy?

Fiscal policy can play a secondary, but important role in tamping down inflation by avoiding expansionary economic effects. The Committee for a Responsible Federal Budget (CRFB) has compiled a framework through which a set of disinflationary changes to revenues and spending could help ensure that “all federal actions are rowing in the same direction.”

Taxation

Increasing taxes, which reduce an individual’s spending power, can help ease inflation. As the St. Louis Fed notes, through taxation, “the government can have some influence over the total level of spending by consumers.”

One approach is to reduce take-home pay by limiting tax deductions or increasing the tax rate, and there are many options to do so. The abovementioned CRFB framework outlines a plan to generate $2.4 trillion in revenues over the next decade. For instance, a proposed deficit-reducing surtax on individuals and corporations, raising the effective tax rate, the capital gains tax rate, and the corporate tax rate, all would generate revenues and directly reduce buying power.

Moreover, the revenues generated from tax reforms would reduce the deficit, a potential factor in medium- to long-term inflationary pressures according to CRFB and 55 of the nation’s top economists and budget experts. On top of the proposals above, CRFB puts forth several other options such as: fully repealing the state and local tax deduction, improving tax compliance, and reforming the estate tax. Those proposals would incentivize saving, temper demand, boost supply, and reduce the deficit, thereby cooling inflation over the medium to long term.

Government Spending

In addition to using tax policy as a way to mitigate inflation, the government could also decrease spending. And as with revenue, there are myriad options to cut spending available to lawmakers.

CRFB cites reforms to Medicare, such as reducing provider payments, increasing premiums for high earners, and improving Medicare Advantage plans as ways to lower healthcare costs, potentially reducing inflation. CRFB also proposes limiting discretionary spending by restoring caps on defense and nondefense programs, which could reduce spending by $1.5 trillion over the next decade.

In addition, CRFB supports clean and affordable energy and infrastructure through regulatory reforms, infrastructure user fees, and phasing in a carbon tax. Furthermore, reforms to Social Security including increased revenues, cuts in benefits, and adjustments to the retirement age would improve the nation’s fiscal outlook and encourage long-term growth, according to CRFB.

Conclusion

Responsible fiscal policy can play an important complementary role to monetary policy in helping to moderate inflation. As the Fed continues to hike interest in the short term, there is a valuable opportunity for policymakers to deploy contractionary fiscal policy — with a host of spending and revenue options available, to bolster these efforts. Doing so would not only support the critical effort against high inflation, it would help stabilize our deficit and debt challenges over the longer term, which in turn leads to a stronger, more stable economic future.

Image credit: Photo by Getty Images

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.