What Are Federal Reserve Lending Facilities? How Will They Support the Economy during the Pandemic?

The Federal Reserve’s lending facilities are one of the many policy tools the central bank is using to stabilize the economy in response to the coronavirus (COVID-19) pandemic. Below is an overview of those facilities, as well as some other actions the Federal Reserve has taken to mitigate the pandemic’s economic impact.

How Does the Federal Reserve Typically Support the Economy?

In the past, the Federal Reserve has supported the economy through a variety of monetary policy tools such as the federal funds rate (the short-term interest rate at which commercial banks lend to one another overnight) or quantitative easing (the large-scale purchase of government securities or other financial instruments). However, the central bank already took those steps early in the pandemic — in mid-March, the Federal Reserve lowered the target for the federal funds rate to near zero and initiated quantitative easing in an effort to encourage lending and investment across the economy.

To augment those approaches, the Federal Reserve has developed additional methods to support the economy. When faced with the same challenge about 10 years ago during the Great Recession, the central bank established several lending programs to provide liquidity directly to borrowers and investors in key credit markets. To respond to the economic downturn caused by the COVID-19 pandemic, the Federal Reserve is reviving some of those programs and establishing new ones.

What Are the Federal Reserve Lending Facilities?

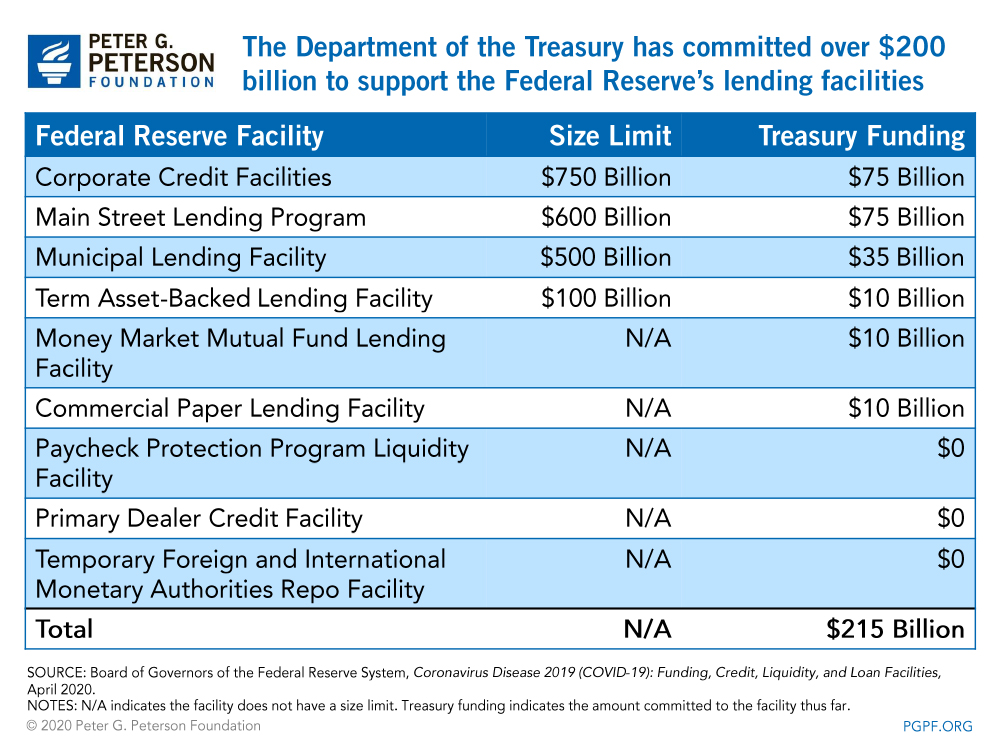

The Federal Reserve’s lending facilities provide loans, credit, and liquidity to various parts of the economy. In other words, those programs promote the smooth functioning of markets by providing access to credit for certain borrowers and lenders who need it. The Department of the Treasury is supporting many of those facilities by providing funds that were appropriated as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act to cover any potential losses the facilities may incur. The CARES Act authorized $454 billion for such purposes; to date, the Treasury has made $215 billion of that total available, but the Federal Reserve has not yet needed to draw on that funding.

Below is an overview of the Federal Reserve’s lending facilities, grouped by the key economic markets they are supporting.

Corporations, Small- and Mid-Sized Businesses, and Nonprofits

The COVID-19 pandemic is limiting economic activity and, as a result, straining the economic health of many businesses. Those businesses may need access to short-term financing to sustain their operations, maintain their payroll, and continue the financing of any existing debt. An important source of such funding for many companies is commercial paper, a $1 trillion market in which firms issue short-term debt to finance their day-to-day operations. Since investors have been reluctant to purchase that debt due to the economic uncertainty stemming from the pandemic, the Federal Reserve established the Commercial Paper Funding Facility. That facility allows the central bank to purchase commercial paper directly from issuers and therefore eliminates certain risks that issuers may not be able to repay investors. The Treasury committed $10 billion if support to the facility is needed.

The Federal Reserve established two other facilities to support the financial health of corporations. Through the Primary Market Corporate Credit Facility, the central bank can purchase a portion of certain loans or qualifying bonds from eligible corporations. Those corporations may defer interest and principal payments for the first six months to ensure sufficient cash is available to pay employees. Likewise, the Secondary Market Corporate Credit Facility facilitates the direct purchase of existing corporate bonds and certain exchange-traded funds. The combined size of those facilities is $750 billion and they are backed by $75 billion from the Treasury.

Small- and mid-sized businesses were hit particularly hard by the pandemic. To support such businesses, Congress and the president enacted the Paycheck Protection Program to provide loans, guaranteed by the Small Business Administration, to small businesses to maintain their payroll during the crisis. To support banks that processed such loans, the Federal Reserve created the Paycheck Protection Program Liquidity Facility (PPPLF); banks lending to small businesses under the PPP were able to borrow from the PPPLF to do so.

The Main Street Lending Program, which consists of several lending facilities, was created to enhance support to small- and mid-sized businesses. That program supports up to $600 billion worth of five-year loans to businesses that employ up to 15,000 workers or have up to $5 billion in annual revenues. In July, the Federal Reserve expanded the program to nonprofits with at least 10 employees and up to $3 billion in endowment (but less than 15,000 employees and $5 billion in annual revenues). To cover any potential losses from the program, the Treasury has committed $75 billion.

Governments and Households

The pandemic also strained the finances of many state and local governments as well as households across the United States. To facilitate and encourage lending to households, the Federal Reserve revived the Term Asset-Backed Securities Loan Facility (TALF), which was also part of their response to the 2007–2009 financial crisis. Through that facility, the central bank lends up to $100 billion worth of loans to holders of asset-backed securities — who must use new loans, such as student or auto loans, as collateral. To support state and local governments, the Municipal Liquidity Facility (MLF) was established; it will purchase up to $500 billion of short-term notes from those governments. The Treasury has committed $10 billion to support the TALF and $35 billion to support the MLF.

Providing Support and Stability to Financial Markets

The COVID-19 pandemic has also disrupted financial markets, leading to the re-institution of the Primary Dealer Credit Facility, a program aimed at keeping the credit markets functioning smoothly. That facility provides low-interest, collateralized loans to 24 large financial institutions, known as primary dealers, which are trading counterparties with the central bank and bid on Treasury securities; they therefore play a key role in securities markets.

To ensure that money market funds remain stable, the Federal Reserve also restored the Money Market Mutual Fund Liquidity Facility, which lends to banks and other depository institutions against collateral they buy from money market funds — funds that invest in short-term securities such as Treasury bills. Since many investors withdrew from those funds during the pandemic, the facility was established to help the funds meet demand for redemptions (requests from clients to sell such securities before their maturity dates, typically because they need cash immediately) and enhance the overall functioning of that market. The Treasury has committed $10 billion to the facility to cover any losses.

Finally, the Federal Reserve established the Temporary Foreign and International Monetary Authorities Repo Facility to help support the smooth functioning of financial markets, including the U.S. Treasury market. By allowing central banks and other international monetary authorities to exchange their U.S. Treasury securities held with the Federal Reserve for U.S. dollars, which can then be made available to institutions in their jurisdictions, the facility will provide an alternative source of U.S. dollars in the market.

Conclusion

The actions taken by the Federal Reserve have worked in conjunction with fiscal policy to respond to the economic slowdown caused by the COVID-19 pandemic. However, with the economy contracting at its worst quarterly rate in 70 years in the April-June quarter and claims for unemployment still at unprecedented levels, the country’s road to recovery may be long. Leaders will need to determine what monetary and fiscal policy actions are necessary to further support the nation’s economy to ensure a stronger future.

Image credit: Photo by Spencer Platt/Getty Images

Further Reading

How Did the One Big Beautiful Bill Act Affect Federal Spending?

Overall, the OBBBA adds significantly to the nation’s debt, but the act contains net spending cuts that lessen that impact.

What Is the Disaster Relief Fund?

Natural disasters are becoming increasingly frequent, endangering lives and extracting a significant fiscal and economic cost.

How Much Does the Government Spend on International Affairs?

Federal spending for international affairs, which supports American diplomacy and development aid, is a small portion of the U.S. budget.