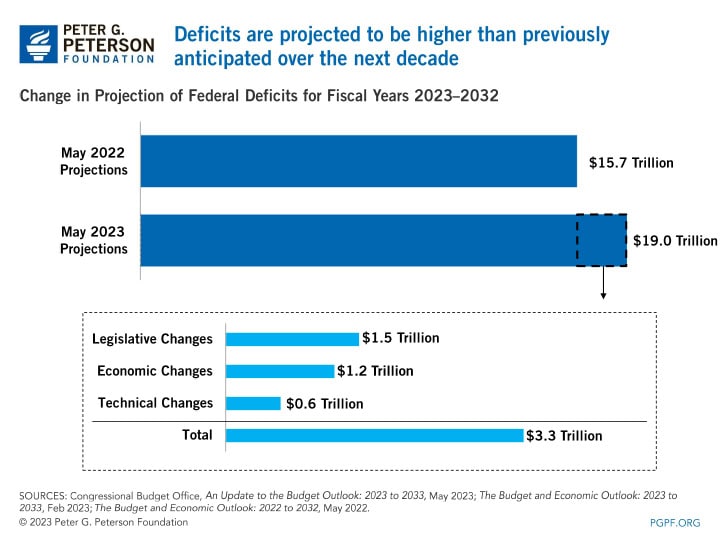

The country’s fiscal trajectory got notably worse over the past year, according to projections from the Congressional Budget Office (CBO) released in May. Federal deficits will total $19.0 trillion over the 2023–2032 period if no new legislation targeting spending or revenues is enacted — a $3.3 trillion increase from the agency’s projections made in May 2022. The stark changes in CBO’s baseline projections, which do not reflect the enactment of the Fiscal Responsibility Act of 2023, show a worsening of the country’s fiscal outlook resulting from legislation over the past year, a less-favorable economic outlook, and other factors.

Legislative Changes

Of the $3.3 trillion increase in the cumulative deficit over the 10-year period, nearly one-half ($1.5 trillion) was due to pieces of legislation that were enacted over the past year.

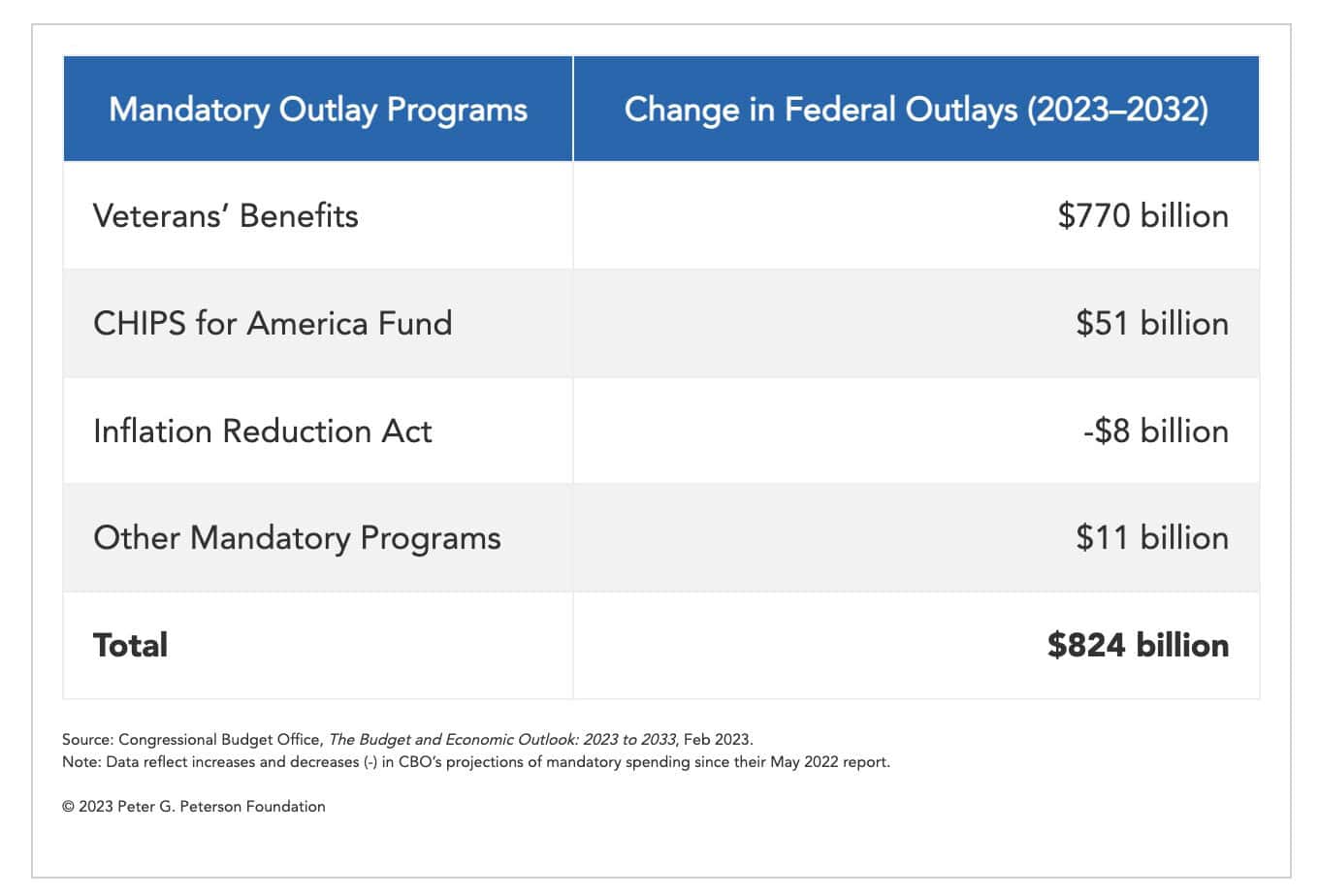

CBO’s projections for mandatory outlays over the 2023–2032 period increased by $824 billion due to legislative factors. Most of those changes are attributed to the Honoring our PACT Act, which increased spending for veterans’ benefits, and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act of 2022, which provided new funding to encourage research and manufacturing of semiconductors.

Projections for discretionary outlays over that period increased by $538 billion, largely due to increased appropriations for defense in 2023 under the Consolidated Appropriations Act; extrapolating that increase for future years results in higher projected spending during the 10-year period. Appropriations for regular non-defense programs were also higher, but certain spending under the Infrastructure Investment and Jobs Act is not extrapolated in CBO’s more-recent baseline, which offsets such increases.

Projections for revenues, meanwhile, increased by $84 billion primarily due to tax provisions in the Reconciliation Act such as a new minimum tax on certain corporations, a new excise tax on corporate stock repurchases, and a new excise tax on certain drug producers. Those new taxes are partially offset by the extension and modification of certain tax credits.

Additionally, the increase in deficits stemming from legislation will increase federal borrowing. As a result, CBO’s projections of net interest outlays increased by $185 billion due to legislative factors.

Economic Changes

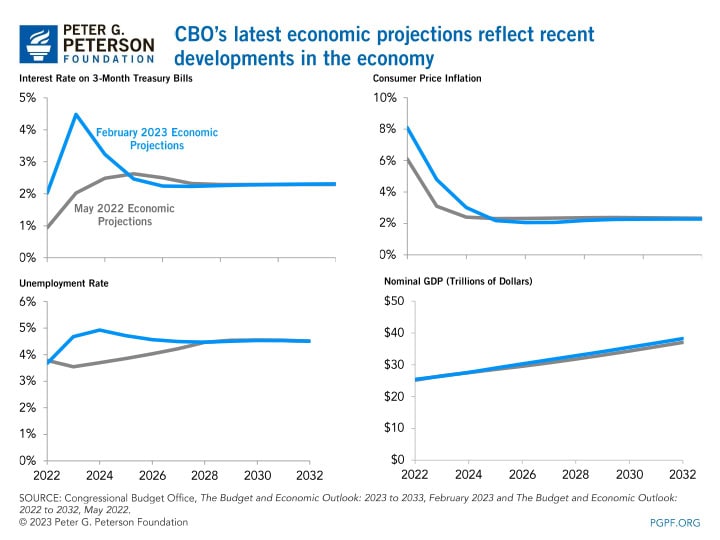

CBO’s baseline budget projections rely on a number of economic assumptions, such as for interest rates, inflation, the unemployment rate, and gross domestic product (GDP). Changes across those forecasts led to a $2.1 trillion net increase in outlays over the 2023 to 2032 period, most notably for interest payments ($1.2 trillion) and Social Security ($0.4 trillion). Higher projected expenses were partially offset by a $0.9 trillion increase in revenues — resulting in the cumulative 10-year deficit rising by $1.2 trillion due to economic factors.

Those revisions included:

- Short-term interest rates climbing faster than previously anticipated, which increased projections for net interest costs. In CBO’s May 2022 projections, the interest rate on 3-month Treasury bills was projected to climb from 0.9 percent in 2022 to 2.0 percent in 2023, and average 2.4 percent throughout the period; CBO now projects that rate to jump from 2.0 percent in 2022 to 4.5 percent in 2023, before falling to around 2.5 percent by 2025 and remaining slightly below that level throughout the rest of the decade.

- Higher levels of inflation, which drove increases in short-term interest rates as the Federal Reserve increased rates to tame rising prices. In 2022, CBO projected that inflation would average 6.1 percent in that year and eventually fall to 2.4 percent by 2024; however, price growth remained higher for longer than the agency anticipated, averaging 8.1 percent in 2022. CBO now projects that inflation will fall to 3.0 percent by 2024, before averaging 2.2 percent throughout the rest of the projection period. While higher levels of inflation increase costs for programs such as Social Security, it also increases revenues — resulting in a marginal net impact on the federal budget (excluding the effect on interest costs).

- A higher unemployment rate, which increased projected outlays for unemployment compensation. CBO projects unemployment to climb from 3.7 percent in 2022 to 4.9 percent in 2024, before averaging around 4.5 percent throughout the next few years. Those projections contrast with the agency’s 2022 forecast, which saw unemployment dipping to 3.5 percent in 2023, before gradually rising to around 4.5 percent in later years.

- A moderate uptick in economic growth, which partially increased projections for tax receipts (much of that increase was due to higher inflation). The economy grew faster than the agency projected in 2022, and CBO’s projections now reflect moderately stronger growth in nominal GDP over the next decade.

Technical Changes

Technical changes, resulting from factors such as revisions to CBO’s population projections, new data from federal agencies, and changes in federal programming that impact revenues and spending, led to an increase in projected deficits of $605 billion between 2023 and 2032.

CBO’s projections of mandatory outlays grew by $441 billion over the upcoming decade for technical reasons. That higher spending was spread across many programs, such as student loans, Social Security, and SNAP, but was partially offset by lower spending on programs such as Medicare and Medicaid. Projections for discretionary spending, meanwhile, fell by $179 billion due to technical revisions.

CBO’s projections of federal revenues fell by $36 billion over that period.

Net interest outlays, meanwhile, rose by $307 billion over the 10-year period. That increase in outlays was partially due to reductions in interest earned by the Treasury from various financing accounts that record the collections and disbursements of federal loan programs, changes in the mix of securities issued by the Treasury, and the incorporation of actual rates paid on recently issued Treasury securities. In addition, the cost of servicing the debt would be higher, stemming from increased deficits associated with technical revisions.

Conclusion

CBO’s projection of rising deficits highlights the nation’s unsustainable fiscal outlook. While the recent deterioration of the nation’s fiscal situation is mostly due to legislative and economic factors, the underlying concern about the fiscal trajectory stems from a structural mismatch between spending and revenues. However, it’s not too late for lawmakers to correct course. Putting our nation on a sustainable fiscal path now will create a positive environment for growth, opportunity, and prosperity for future generations.

Image credit: Photo by Anna Moneymaker/Staff/Getty Images

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.