The Tax Cuts and Jobs Act (TCJA) was enacted in December 2017. Among its numerous provisions were a permanent reduction in the corporate tax rate and an individual income tax cut that is scheduled to expire at the end of 2025. Such fundamental changes to the tax code have substantial effects on the federal budget and economy. As more time passes since enactment, and as more data become available, economists continue to weigh in with analyses of the TCJA’s effects.

The following is a selection of key takeaways by economists that have provided commentary recently.

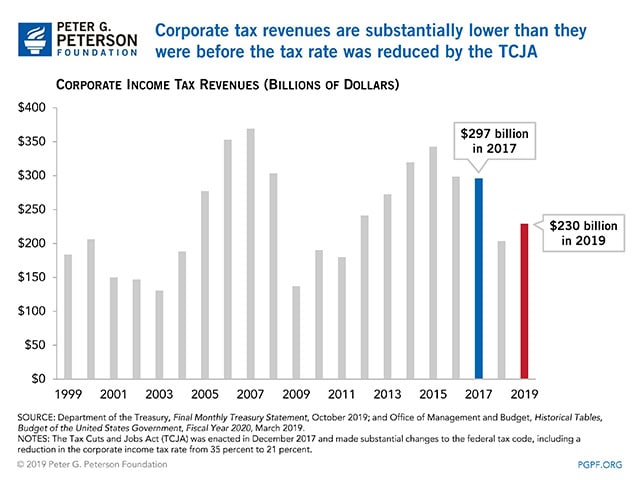

1. The TCJA has reduced corporate income tax revenues. The Congressional Research Service (CRS) highlights:

“Data from FY2018 suggest that the tax cut for corporations may have been larger than the $94 billion CBO projected in its April 2018 baseline. That baseline projected corporate revenues of $243 billion, but actual corporate revenues were $38 billion lower at $205 billion, 16% lower than projected.”

The Center for American Progress (CAP) noted:

“Since the law passed in December 2017, revenues from corporate taxes have fallen by more than 40 percent, contributing to the largest year-over-year drop in corporate tax revenue that we have seen outside of a recession.”

2. One of the main arguments in support of the TCJA was that it would increase business investment and, as a result, provide a boost to the economy. Economists do not agree on the economic effects of the TCJA.

Douglas Holtz-Eakin from the American Action Forum, when referencing quarterly annual growth rates from the beginning of 2016 to the second quarter of 2019, said:

“There is a discernible ramping up of the growth rate of investment following the fourth quarter of 2017 — although it has tailed off in early 2019. Indeed, the averages for the latter period are 3.4 (structures), 3.3 (equipment), and 4.3 (intellectual property) percentage points faster than in the first part of the window.”

Meanwhile, CAP said:

“In the year following the tax cut, business investment increased — but not by nearly as much as the tax cut proponents’ predictions would have implied. Furthermore, a study by the International Monetary Fund (IMF) concluded that the relatively healthy business investment in 2018 was driven by strong aggregate demand in the economy — not the supply-side factors that tax cut proponents used to justify the tax cut.”

CRS offered this view:

“Thus, while it is possible that the [TCJA] increased the investment due to supply-side effects, it would be premature to conclude that the higher rate of growth of nonresidential fixed investment was due to the tax changes.”

Finally, recent comments from Federal Reserve Chair Jerome Powell, made as the Federal Open Market Committee decided to cut interest rates for the third time in 2019, highlight the weakness of business investment:

“Although household spending has been rising at a strong pace, business fixed investment and exports remain weak.”

3. One of the objectives of the TCJA’s changes to the corporate income tax was to encourage U.S. firms to bring back cash that they were holding overseas. Economists also disagree about whether the TCJA encouraged such repatriations. According to Aparna Mathur from the American Enterprise Institute:

“Repatriations — when US corporations bring back and realize overseas profits in the US — are up. Repatriations saw a massive increase in the first quarter of 2018, and though the trend has slowed, repatriations are still well above their pre-TCJA levels.”

CRS was slightly more cautious about attributing increased repatriations to the TCJA:

“Investment from abroad occurs in a real sense only when the amount of imported goods exceeds the amount of U.S. exports . . . there was a small increase that amounted to 0.8% of private investment. This change is relatively small and is not out of line with historical fluctuations.”

4. Economists are warning of the negative effects that increased deficits stemming from the TCJA could have on the economy. Mathur wrote:

“The TCJA also added to fiscal deficits, which has implications for economic growth going forward.”

And Bill Gale of the Urban-Brookings Tax Policy Center added:

“By raising deficits, TCJA may make future policy makers more reluctant to engage in discretionary stimulus programs to boost an ailing economy.”

5. The effects of the TCJA have occurred simultaneously with changes to trade policy. Such changes can make it difficult to separate the individual effects of either component. According to the Congressional Budget Office:

“Detailed information from 2018 tax returns is expected to become available in late 2020. Assessing the tax act’s effects on receipts will not be possible even then, however, because it is not possible to disentangle changes in revenues caused by the tax act from changes driven by other factors, such as the effects of trade barriers that might have reduced economic growth and thus held down tax receipts.”

CAP notes:

“To be sure, President Trump’s erratic pronouncements on tariffs have clearly created considerable uncertainty for businesses, leading many to hold back on investments. At this point, it is not possible to disentangle the negative effects of Trump’s misbegotten trade war from his tax policies.”

Holtz-Eakin also discusses the confounding effect of trade policy when trying to analyze the TCJA:

“More recently, the TCJA’s impact has been intermixed with the negative fallout from misguided trade tactics and the administration’s ad hominem attacks on the Federal Reserve.”

6. There are a range of viewpoints on how the TCJA has affected family incomes. Mathur writes:

“Many analyses show that most families received a tax cut because of the TCJA. As per the Tax Policy Center’s estimations, the average household paid approximately $1,600 less in 2018 than they would have under prior law, with middle-income households receiving a $900 increase in after-tax income.”

CAP has an opposing viewpoint:

“Two years later, there is little indication that the tax cut is even beginning to trickle down in the ways its proponents claimed.”

And Gale’s analysis points out how the TCJA might affect family incomes as we move further into the future:

“Lower tax rates will create positive effects, but higher deficits will work in the opposite direction. The impact on gross national product (GNP), the income attained by Americans, will be even smaller because TCJA will lead to net capital inflows in the near term. Americans will have to be repay[ing] those inflows in future years, thus reducing their income (GNP) relative to Americans’ production (GDP).”

7. Finally, economists generally agree that while certain definitive trends are emerging, it is impossible to undertake a full accounting of the TCJA’s effects until more time has passed. According to CAP:

“While the effects of a very large tax overhaul will take years to fully develop and analyze, the evidence from the first two years suggests that corporate tax cuts are draining revenue from the U.S. Treasury while doing little that would ultimately benefit U.S. workers.”

Holtz-Eakin thinks more time is needed to assess the effects on long-term trends:

“It is going to take a minimum of five years before the data will allow a statistical decomposition that teases out the TCJA component. So, it is not yet clear how the United States will end up on balance, and whether the improved, albeit still imperfect, tax-based investment incentives have changed the long-run trends in investment, productivity, and growth.”

And Mathur writes:

“In short, teasing out the impacts of the largest tax overhaul the country has seen in decades on households and the economy will take time. So let’s be patient. It’s too early to give up on the Tax Cuts and Jobs Act.”

A full analysis of the effects of the TCJA will not be possible to complete for years to come, if ever. But for now, we can continue gathering information and build an understanding of the TCJA’s impacts on the economy and the federal budget.

In any scenario, it is clear that lawmakers need to address the nation's long-term fiscal condition and that the TCJA has made that task more difficult. The longer policymakers wait to address the country’s mounting debt, the worse the problem will get.

Photo by Chip Somodevilla/Getty Images

Further Reading

What Are Refundable Tax Credits?

The cost of refundable tax credits has grown over the past several years, with the number and budgetary impact of the credits increasing.

The Six Largest Corporate Tax Expenditures

Relative to the size of the economy, the U.S. collects less revenues than many other advanced countries. Tax breaks are a contributing reason.

Understanding the New Senior Deduction in the One Big Beautiful Bill Act

The senior deduction adds complexity to the tax code, and fewer than half of seniors will benefit from it.