What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Read MoreThe Federal Government Has Borrowed Trillions. Who Owns All that Debt?

Most federal debt is owed to domestic holders, but foreign ownership is much higher now than it was about 50 years ago.

Read MoreWhat Are Estate and Gift Taxes and How Do They Work?

Estate and gift taxes produce relatively lower revenue compared to other sources, but they generate a significant amount of attention, and even controversy.

Read MoreBudget Basics: What Is the Child Tax Credit?

The CTC provides assistance to families with children, and while it represents a relatively modest part of overall government spending, it is one of the largest tax expenditures.

Read MoreBudget Basics: Tax Expenditures

Tax expenditures can come in the form of exclusions, exemptions, deductions, and credits.

Read MoreWhat Are the Economic Costs of Child Poverty?

Child poverty is higher in the United States than in other wealthy countries. Studies show that it has quantifiable economic costs.

Read MoreWhat Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.

Read MoreInfographic: U.S. Healthcare Spending

Improving our healthcare system to deliver better quality care at lower cost is critically important to our nation’s long-term economic and fiscal well-being.

Read MoreHow Much Does the Government Spend on International Affairs?

Federal spending for international affairs, which supports American diplomacy and development aid, is a small portion of the U.S. budget.

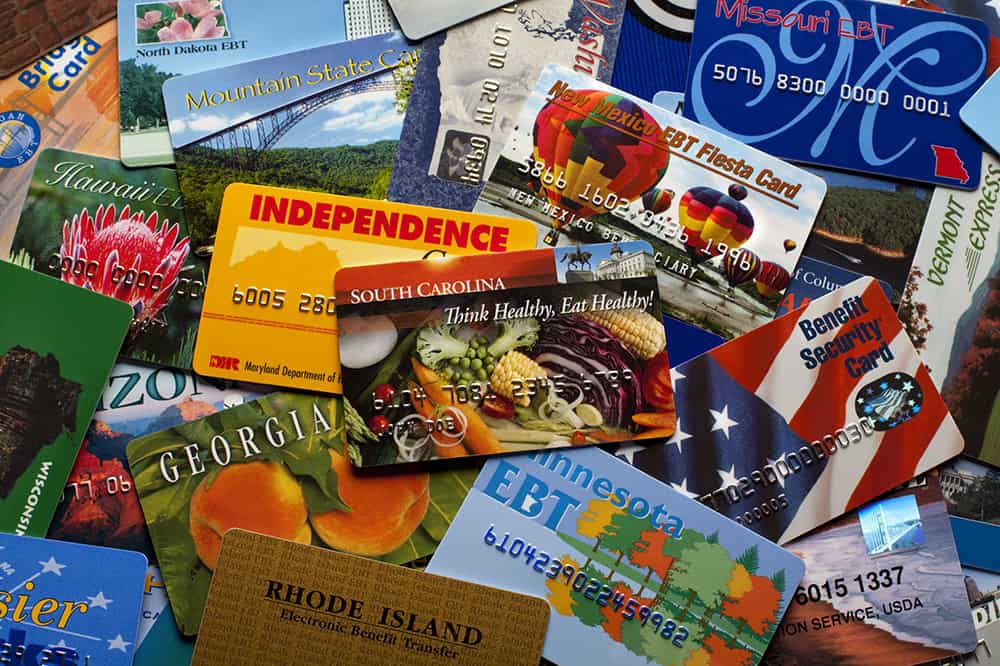

Read MoreWhat Is SNAP? An Overview of the Largest Federal Anti-Hunger Program

SNAP has a positive effect on poverty and food insecurity, with a relatively small effect on the federal budget.

Read More